USDA Projects Lower Farm Incomes in 2024

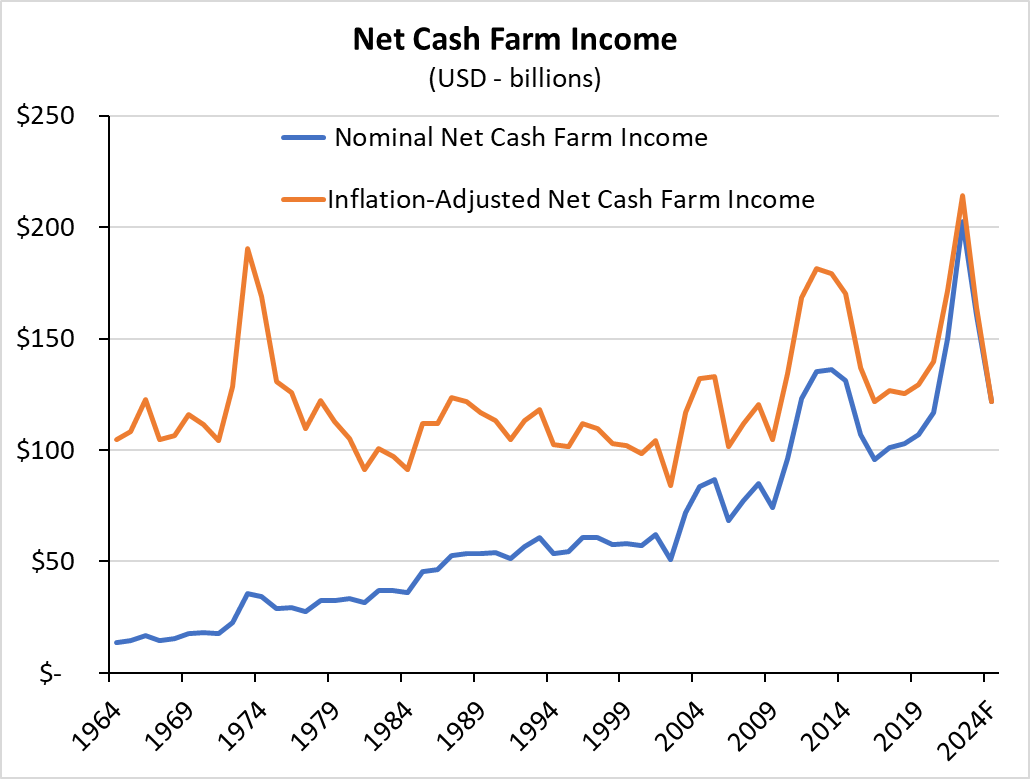

The USDA provided its initial forecast for 2024 farm incomes in early February, projecting that sector margins will decline for the second year. Net cash farm income (NCFI) is forecast to drop to $122 billion in 2024, a decline of 24% from last year and 40% lower than the record level reached in 2022. This largely reflects the broad decline in agricultural commodity prices over the past 18 months. However, it’s worth highlighting that the projected decline may not fully encapsulate the farm income story for 2024.

Rebound in Global Inventories Weighing on Revenues

A key factor in declining NCFI has been lower commodity prices. For example, corn and soybean futures prices are approximately 47% and 32% lower, respectively, than their 2022 peaks. The decline in commodity prices has been broad, with wheat, cotton, and other major commodities also seeing a pullback. As a result, agricultural revenues are projected to drop 4% in 2024 after declining 5% last year. The last time NCFI dropped two consecutive years was between 2018 and 2020. The decline then was at much lower levels, though, and due partially to COVID-19-related impacts.

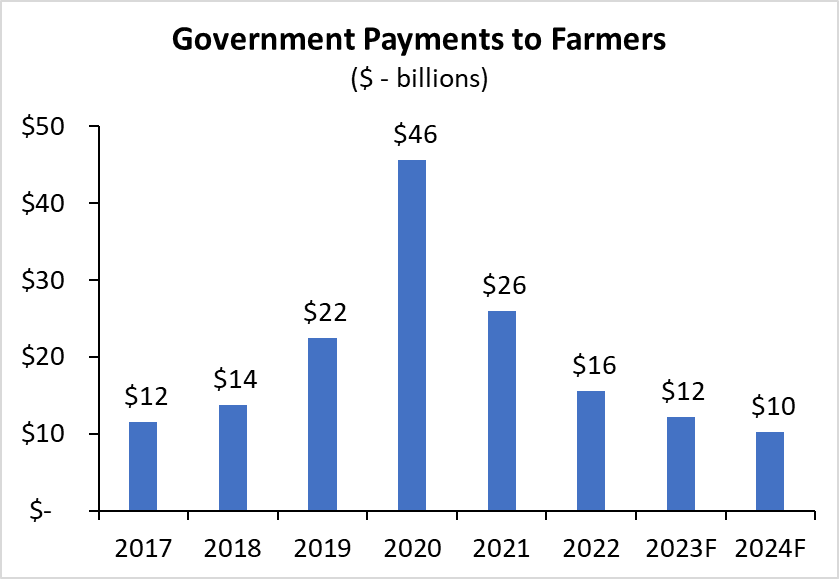

Another contributor to the decline in farm revenues is the continued pullback in government payments. Government payments to farmers are forecast to be $10 billion in 2024, down 16% relative to last year. Government payments to farmers totaled as much as $71 billion in agricultural revenue between 2020 and 2021, largely attributable to programs intended to offset the impact of COVID-19-related disruptions. Farm profitability changed significantly, though, and payments are now forecast to remain below the long-term average this year. Even within the expected $10 billion in government payments this year, over 40% are related to conservation programs, which occur regardless of the ag economic landscape. One potential silver lining to lower government payments is that it may help alleviate concerns from some lawmakers about recent elevated government support for the farm economy as Congress looks to pass a new Farm Bill.

Acknowledging the broad pullback in revenues, agricultural sector revenues are still forecast to remain elevated in 2024 relative to historical averages. The projection for $485 billion in sector revenue would be in the top twentieth percentile for revenues after adjusting for inflation. Prices for many agricultural commodities have trended lower over the previous two years after reaching historical highs. However, overall price levels remain higher than historical averages, and the elevated revenues may help offset the impact of rising expenses.

A Surprise Finding: 2024 Expenses Projected to Increase

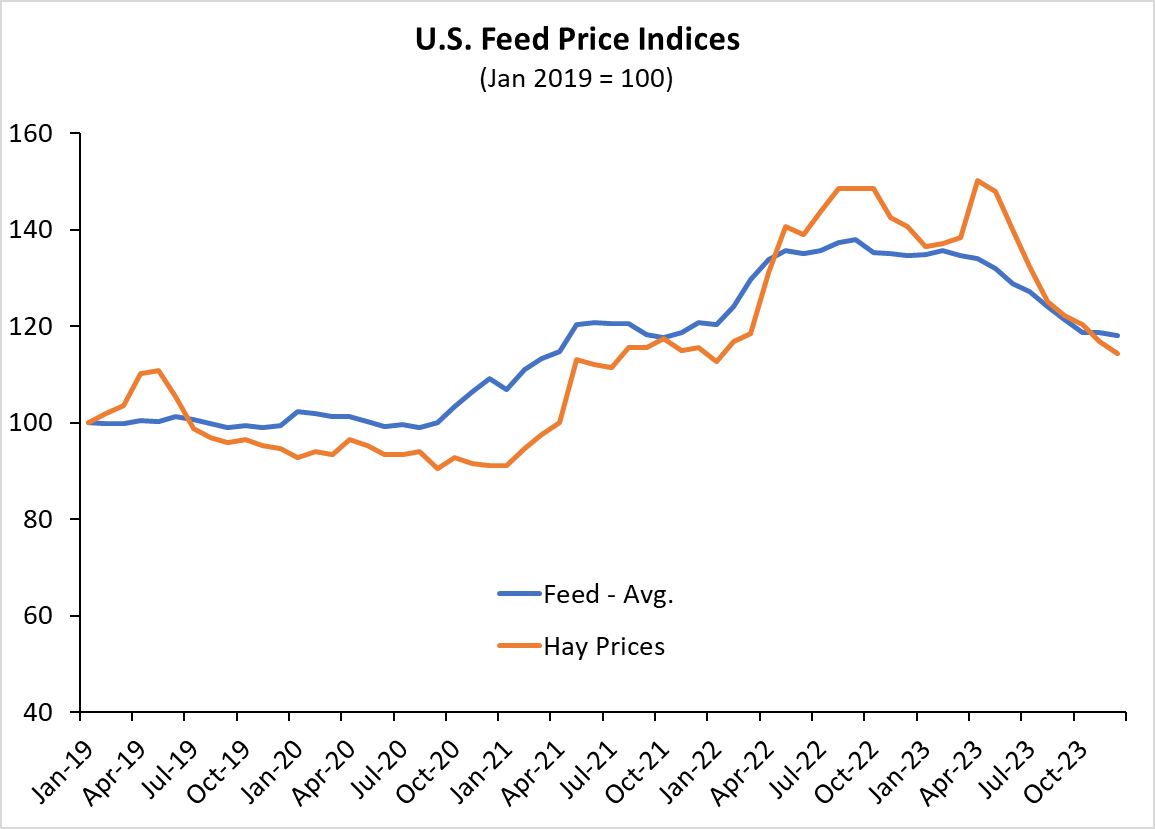

Perhaps the most interesting component of declining NCFI, though, was the projected increase in farm expenses, as they typically move in parallel. Total cash expenses are forecast to increase by nearly 4% in 2024. While not an exorbitant increase, it becomes noteworthy when examining individual components. Feed costs, for example, are forecast to increase by 1% this year compared to last year. This runs counter to the broad decline in corn, soybean, and wheat prices. Furthermore, the national average hay price continues to trend lower, and in December, it was 24% below the April 2023 peak. Fertilizer costs are also forecast to increase by 4% in 2024, despite entering the year approximately 18% lower than last January 2023.

While not guaranteed, the USDA’s February farm income forecast tends to be conservative relative to the eventual value. There is a chance that future estimates of 2024 farm incomes will show lower expenses than the February forecast, which could boost the overall NCFI value.

Farm Profitability Outlook Varies by Commodity

The outlook for lower farm incomes in 2024 does not apply uniformly to all producers. While many producers could see significantly tighter margins, others may benefit from stronger prices or lower costs. Hog and poultry producer revenues, for example, are forecast to increase by 1% and 2%, respectively, in 2024. While not record-breaking, higher revenues should help both sectors after being buffeted by high feed costs and challenging margins in 2023. Fruit and tree nut revenues are also forecast to increase by 3% this year. Almond and walnut prices have been relatively weak in recent years due to tepid export demand. However, export demand has increased over the past six months and helped lift prices for both commodities.

Conclusion

Those involved in the agricultural sector are no strangers to cycles. Just as rising commodity prices fueled a surge in farm incomes in the past few years, a rapid turnaround in global agricultural inventories is now putting downward pressure on farm incomes today. At face value, the USDA’s February forecast shows a relatively large decline this year. However, context is needed and the USDA is likely to revise from this initial projection in future updates.