Crop Exports Down but Not Out

Competing Headlines in the Corn Market

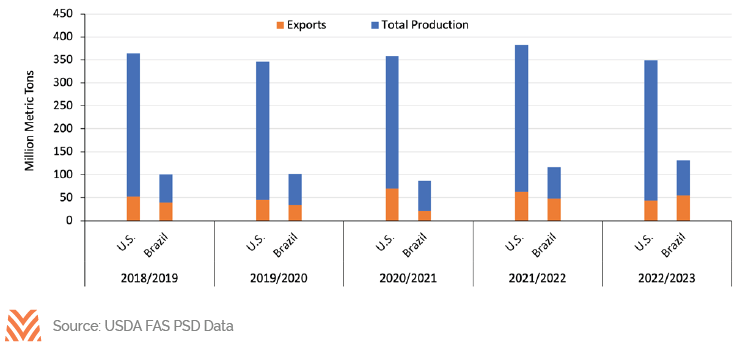

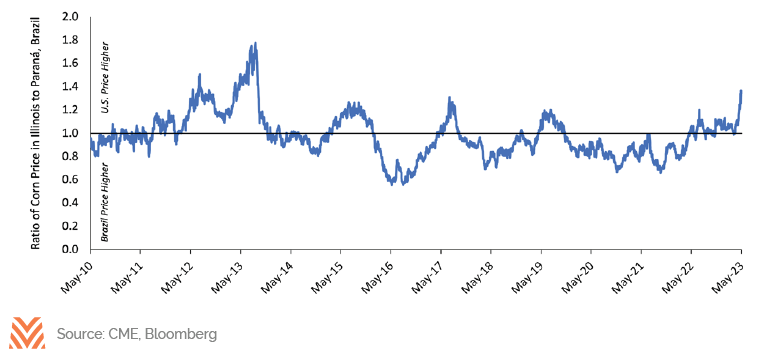

The rebound in global inventories has proven a headwind for corn prices this year. After reaching their tightest level in a decade, global corn inventories are projected to jump 6% year over year in 2023, largely attributable to a surge in South America’s production. Specifically, total Brazilian production is projected to increase by 14% annually as the harvest of the second corn crop nears completion. And while the U.S. continues to produce a far greater amount of corn, Brazil is soon expected to surpass the U.S. as the largest corn-exporting nation. Ample supply is not the only factor boosting demand for Brazilian corn, though. The price differential has also motivated countries to shift corn purchases to Brazil. The ratio between corn prices in the U.S. and Brazil increased rapidly over the past year, partially due to a strong U.S. dollar.

Increased export competition has not been the only headwind for U.S. corn prices this summer. Planted corn acreage also spiked in the U.S. this year and is expected to boost production significantly relative to last year. According to USDA projections released in June, U.S. corn acreage reached 94.1 million acres this year, the third highest level since 1944. The corn futures market did not expect such a large increase in planted acreage, which put immediate downward pressure on prices. However, greater planted acres relative to the March projection reflect favorable spring weather and relatively high prices during planting compared to soybeans.

Despite the expected large corn crops in Brazil and the U.S., drought remains a significant price wildcard. Drought conditions across the central U.S. growing regions were the most severe since 2012 through mid-August. The drought a decade ago led to a sharp decline in production and fueled a surge in commodity prices and farm incomes for the following two years.

However, as of summer 2023, a complete repeat of 2012 is not expected. Adequate soil moisture leading into the growing season and sporadic summer rainfall provided a solid foundation to start the year. Plant genetics, including drought tolerance, have also greatly improved over the last decade. However, 15% of the U.S. corn crop was rated poor to very poor through mid-July. Since 2000, this proportion is second only to 2012, when 30% of the crop was rated this poorly. At a minimum, the possibility that drought could severely impact crop yields helped boost prices this summer and allowed farmers to hedge their crops at favorable margins.

Diverging Export Paths: Cotton, Sorghum, and Soybeans

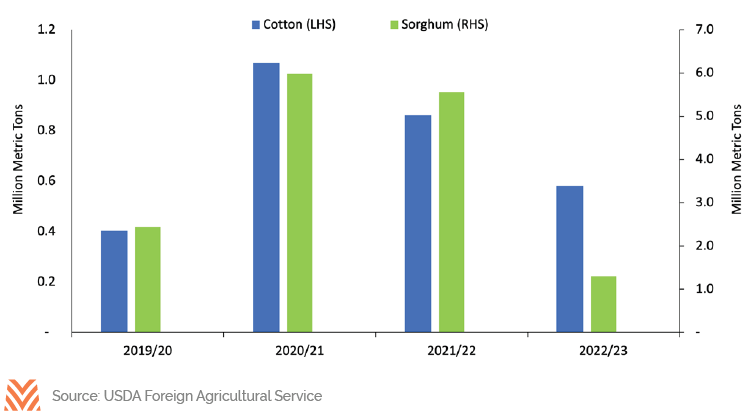

A pullback in export demand has also dented prices for other annual crops, such as cotton and sorghum. Most cotton and sorghum production is exported for clothes production and as feedstock, respectively. Both crops benefitted significantly from robust Chinese export demand in 2020 and 2021 that lifted prices to near or above previous record levels. More recently, though, export volumes to China have cooled. Through May, marketing year shipments of cotton and sorghum to China were 32% and 76% lower annually, respectively. Reduced production partially explains the drop. Cotton and sorghum producers faced severe drought conditions last year, weighing on yields and total output. Still, forward sales for cotton and sorghum to be harvested this year have been tepid, and prices have responded.

Despite the slowdown in China’s demand for some U.S. annual crops, soybean shipments remain robust. Soybean exports to China increased 12% through May and were exceptionally large this spring. Much of the strength in soybean demand has been attributable to the recovery in China’s domestic swine herd. China’s domestic pork production increased by 16% in 2022, boosting the demand for feed. The USDA projects that China will hold soybean imports relatively stable in 2023. This could reduce demand for U.S. exports if China sources soybeans from competing exporters such as Brazil. Still, the robust pace of U.S. exports this spring and reduced planted acreage could support prices into the fall.

Value Add Products Boost Long-term Outlook

Acknowledging the short-term fluctuations in export demand and the resulting impact on prices, the long-term outlook for U.S. annual crop growers is positive. Exports of raw commodities such as wheat and corn have fluctuated, especially as they have faced increased competition from foreign producers. However, the total volume of annual crops exported has increased significantly over time after accounting for value-add products. Livestock, for example, consume a significant proportion of the annual crops grown in the U.S. annually. Exports of livestock products have nearly doubled over the past two decades, indirectly contributing to greater export demand for U.S. annual crops. Similarly, exports of processed annual crops, including ethanol, soymeal, and distillers’ grains, have all risen substantially. In total, annual crop exports have increased significantly more than raw export volumes suggest.

Conclusion

Robust annual crop exports lifted commodity prices and farm incomes to historic levels in 2022. Some tailwinds have shifted to headwinds as export demand slows and competition in global markets increases. Still, the long-term outlook remains positive as rising global incomes and greater demand for protein lead to higher direct and indirect demand for U.S. annual crops. In the meantime, U.S. crop farmers are projected to realize substantial farm incomes again in 2023, albeit marginally lower than last year.