Hero or Zero: U.S. Prospects for Ag Trade With India

Simply put, India’s population and its economy are growing. According to data from the World Bank, India’s population topped 1.4 billion to end 2022, surpassing China for the first time to become the most populous country in the world. India’s Gross Domestic Product (GDP), a measure of a country’s total economic output, grew at a pace of 7% in 2022, capping a decade of more than 6% growth per year. While the Indian economy is approximately one-eighth the size of the U.S. economy, its economic growth has outpaced both the U.S. and China in recent years as it has become the fifth-largest economy in the world. India’s GDP per capita, a relative measure of national income and wealth, remains low compared to developed economies, but that, too, is increasing. Indian GDP per capita has had positive growth every year since 1991, with the exception of 2020 due to the COVID-19 pandemic.

Researchers, policymakers, and food producers view strong growth in India as an opportunity to expand agricultural trade with the country. However, India presents a complex tapestry of cultural and economic conditions that muddy the waters of market potential. In this article, we contextualize the Indian agricultural landscape, break down the composition of agricultural trade in India, and highlight some of the headwinds and tailwinds that could influence the future of U.S. ag trade with India.

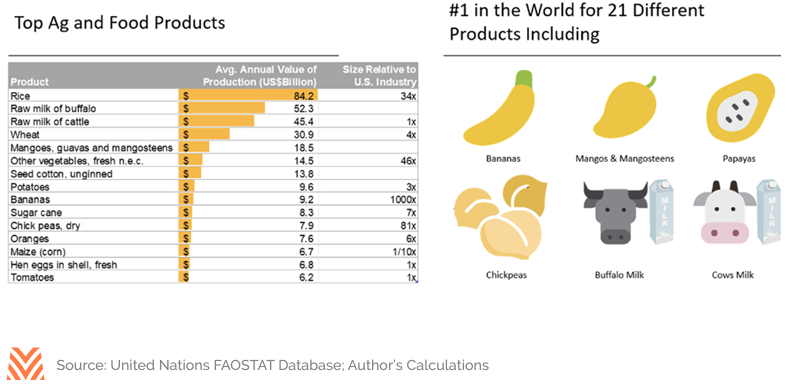

A Profile of Indian Ag Production

A growing population and economy also have a growing appetite and, accordingly, agriculture is a major industry in India. According to data from the World Bank and the United Nations, agriculture, forestry, and fishing added $562 billion to the Indian economy in 2022, making it the second-largest agricultural producer behind China and more than two times the size of the U.S. ag sector. Agriculture represents roughly 17% of India’s GDP, significantly higher than China’s 7% or the U.S.’s 1%. Rice is the top product grown in India, with over $84 billion in annual production value. However, India’s dairy industry is also massive, with more than $90 billion annually in buffalo and cow’s milk production. That is more than double the size of the U.S. dairy industry output. India’s wheat production is also sizable at roughly four times the size of U.S. annual production. According to data from the United Nations, India ranks number one in the world in agricultural value for 21 different crops and ag products, most notably bananas, chickpeas, milk, mangos, and papayas. India has a growing population, and policymakers intend to maintain a high level of food self-sufficiency through agricultural industry support and restrictions on agricultural imports.

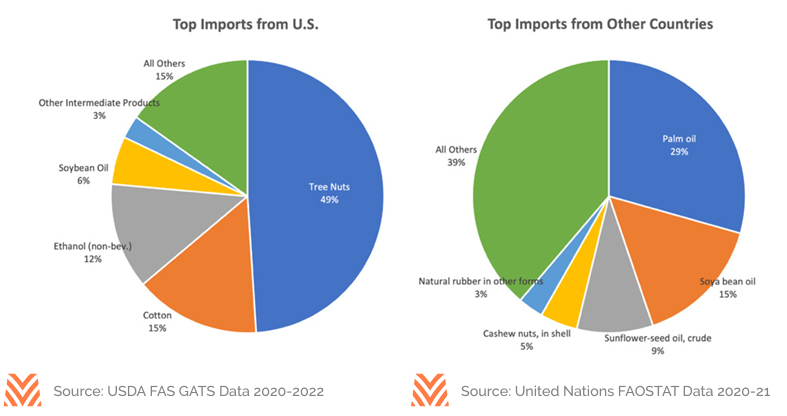

India’s Imports

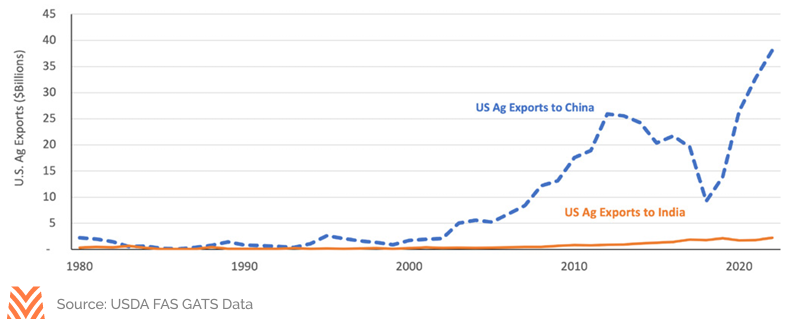

Food production in India is robust, but the country does import a limited amount of food and agricultural products from around the world. Since 2020, India has averaged more than $40 billion in agricultural imports per year. In 2022, the U.S. exported more than $2.2 billion in agricultural products to India. Approximately half of the value of food and agricultural imports into India are in the form of vegetable oils (palm, soybean, and sunflower oil represented a combined 53% of average imports in 2020 and 2021). India buys a small amount of soybean oil from the U.S., but its primary import from U.S. farms is almonds. In 2022, the U.S. exported nearly $900 million in almonds to India, up 14% from 2021 and more than triple the value sold ten years earlier in 2012. While imports are an important part of India’s food diversity, growth in overall agricultural trade activity between the U.S. and India has been relatively small over the last 20 years. Between 2002 and 2022, the U.S. increased the value of agricultural exports by a massive $140 billion, only 1% of which came from growth in trade with India. For comparison, agricultural trade with China generated an increase of $36 billion in value, representing nearly 26% of the increase over that period. India has maintained a policy goal of food production self-sufficiency for approximately 50 years. According to data compiled by The Economist, India maintains the fifth highest agricultural import tariff percentage in the world at 34% in 2022 (compared to a global average of 15%, 14% in China, and 5% in the U.S.) as a means of protectionism. Indeed, India has been challenged multiple times by the World Trade Organization in the last decade for violating agricultural subsidy and tariff rule limits.

Will They, or Won’t They?

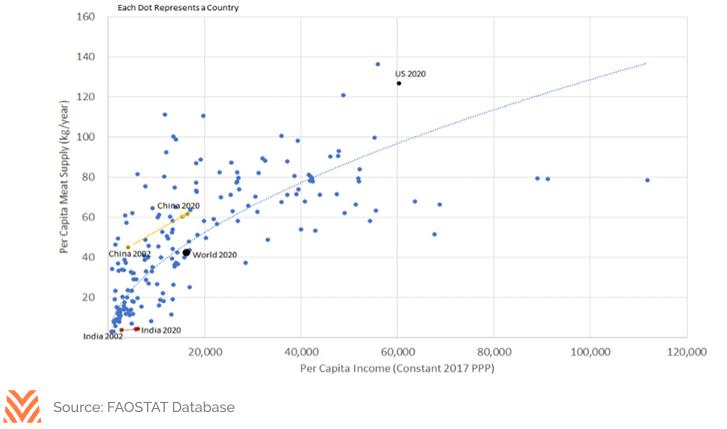

On the surface, India appears like a phenomenal growth opportunity for U.S. agricultural producers. Historically, higher incomes can lead to increases in protein consumption as well as higher-value food products like packaged goods, fresh fruits, and an increased variety of vegetables during all seasons. China is often cited as an example of this dietary evolution because income per capita increased by 300% between 2002 to 2022. U.S. farmers benefitted greatly from this. From 2002 to 2022, over 75% of the growth in U.S. ag exports to China was in the form of either livestock products and proteins or bulk commodities like soybeans and corn used to produce feed for the growing protein industries in China.

Digging a little deeper, there are some potential limitations to replicating the success of U.S. ag exports to China with India. One important difference between the countries is their cultural stance towards meat. According to a 2021 Pew Research Center study, 81% of Indian adults limit meat consumption in some fashion, and 39% describe themselves as vegetarian. In many ways, the societal attitude towards meat consumption reflects religions practiced in India that have dietary laws or restrictions. According to the 2011 Census of India, nearly 80% of Indians practice Hinduism, in which cows are traditionally viewed as sacred animals.

Even if India reduced trade barriers towards meat imports, the strong relationship between food and religion in India makes comparisons to other countries’ income and protein consumption inappropriate. Examining global income and consumption data from the last two decades shows a $1,000 increase in per capita income generated a one-kilogram per capita increase in meat consumption. However, in India, real incomes increased by 126% from 2002 to 2020, while per capita meat consumption only increased by 13%. For comparison, China’s income increased by 300% during that period while its meat consumption increased by 37%. This suggests U.S. protein producers should not expect a surge in export demand from India, even if trade barriers are reduced.

India also has economic and policy conditions that could limit trade opportunities with U.S. ag producers. Although overall economic activity is increasing, per capita incomes lag other developing countries like Brazil, Russia, China, and South Africa (fellow BRICS members), as well as regional groups like East Asia and the Pacific. The growing income inequality in India has resulted in more than 60% of the population living below the poverty line. The Economist ranked India 68th in the world in food security in 2022, roughly unchanged from their ranking in 2012. The relatively high level of agricultural import tariffs presents another barrier to U.S. markets, increasing the price of U.S. food and agricultural products relative to local producers.

While cultural and economic conditions make short-term inroads to India a challenge, there are many tailwinds for longer-term agricultural trade prospects. Agricultural production in India is already incredibly resource-intensive, making the next bushel of grain or gallon of milk that much harder to produce. India may have to look to foreign markets to keep the affordability of food products manageable for their growing population. Policies around self-sufficiency are unlikely to change overnight, but as India’s economy grows, so too can ag imports in relation to GDP. Trade tensions with India have thawed in recent months, and India has eliminated some of their retaliatory tariffs against U.S. produce (see related article on the “Two Sides of the Fruit and Vegetable Coin”). Further progress on reducing import barriers will no doubt remain a priority as the U.S. agricultural sector looks to diversify export markets.

It may be unrealistic to expect a shift in consumer preferences toward animal proteins in India, but U.S. producers can still grow and market the products that sell well in India. Vegetable oils, tree nuts, dairy products, and other higher-value consumer goods that do not involve animal proteins are all exported to India today, albeit in modest quantities relative to the size of the population. If the U.S. can slightly modify its ag exporting playbook, India shows tremendous promise as a growth market for many agricultural products in the years to come.