Two Sides of the Fruit and Vegetable Coin

Produce Import Ascension

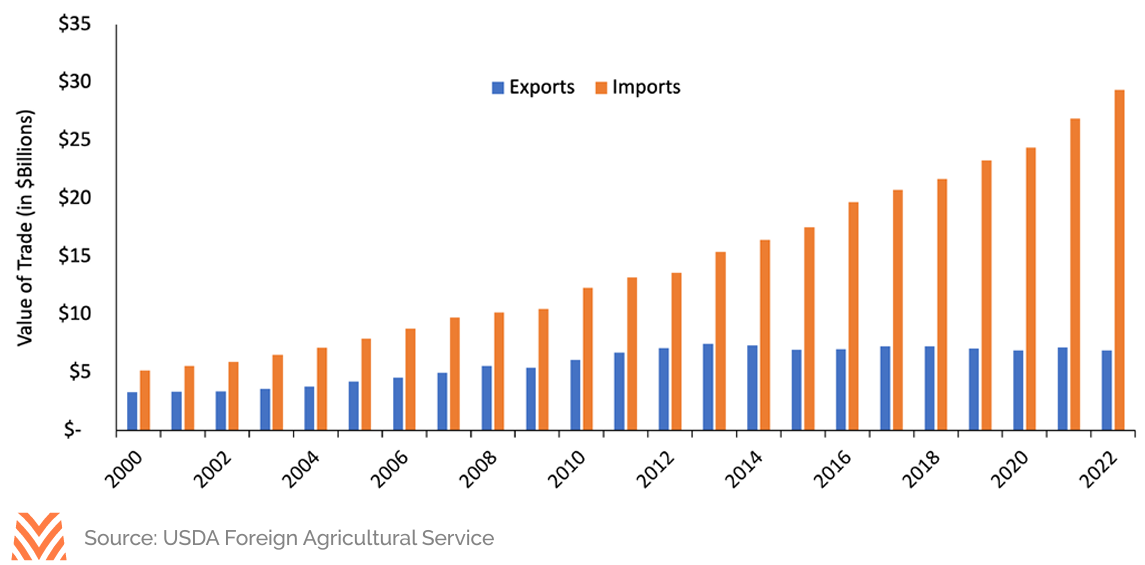

The U.S. agricultural sector ran a trade surplus for over 60 years leading up to 2020. Over that period, an expanding global middle class lifted demand for annual crops, livestock products, and many other U.S. agricultural products. Yet while U.S. agricultural exports continue to trend higher, imports have also grown substantially. Among the categories, imports of fresh fruits and vegetables have increased the fastest. The growth has been motivated by a combination of consumer preferences for greater fresh produce availability and lower production costs in other countries. Currency fluctuations also play a role as the sharp appreciation of the U.S. dollar from 2020 to 2022 made imports relatively more affordable. All in, the resulting difference between imports and exports has expanded rapidly over the past 20 years. Yet, while exports of fresh fruits and vegetables have grown slower than imports, foreign markets remain a critical source of demand for many U.S. produce growers.

Production Cost Differences Challenge Domestic Growers

The growth of fresh fruit and vegetable imports has varied across crops. Some produce imports reflect crops that are not well suited to be commercially produced in the U.S. For example, a small number of acres of bananas and avocados are grown today in a few southern states.

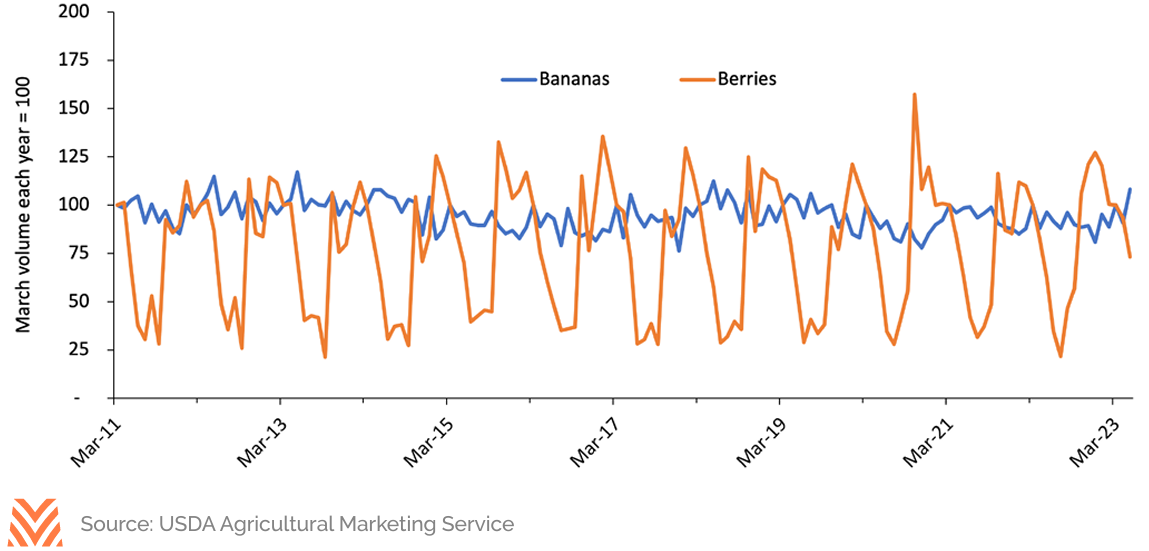

However, these crops are vastly more productive when grown in optimal climates such as Mexico, Guatemala, and elsewhere. As a result, banana import volumes are relatively steady throughout the year. Conversely, some commodities are imported in significant volumes from South America during the Northern Hemisphere winter. For other agricultural commodities, greater import volumes reflect the cost of production difference between producers in the U.S. and elsewhere.

Differences in labor costs have contributed to a shift in where U.S. groceries originate. Tomatoes are one of the most labor-intensive crops grown in America. For comparison, harvesting one acre of tomatoes may require upwards of 20 person-hours. For almonds or corn, harvesting one acre might take 1 hour or 5 minutes, respectively. Mechanized corn harvesters and almond shakers are clearly to credit for the difference. Still, the magnitude of the difference in labor requirements has spurred a shift in tomato production to areas with lower wages. As recently as the 1990s, U.S. tomato growers supplied over 80% of domestic consumption. Today, nearly three-quarters of tomatoes consumed in the U.S. originate in Mexico. A prevailing reason for the shift has been cheaper labor costs in Mexico. The average monthly salary for agricultural workers in Mexico was approximately $180 in Q1 2023. This was over ten times less than the minimum monthly salary of $1,901 for H2A workers.

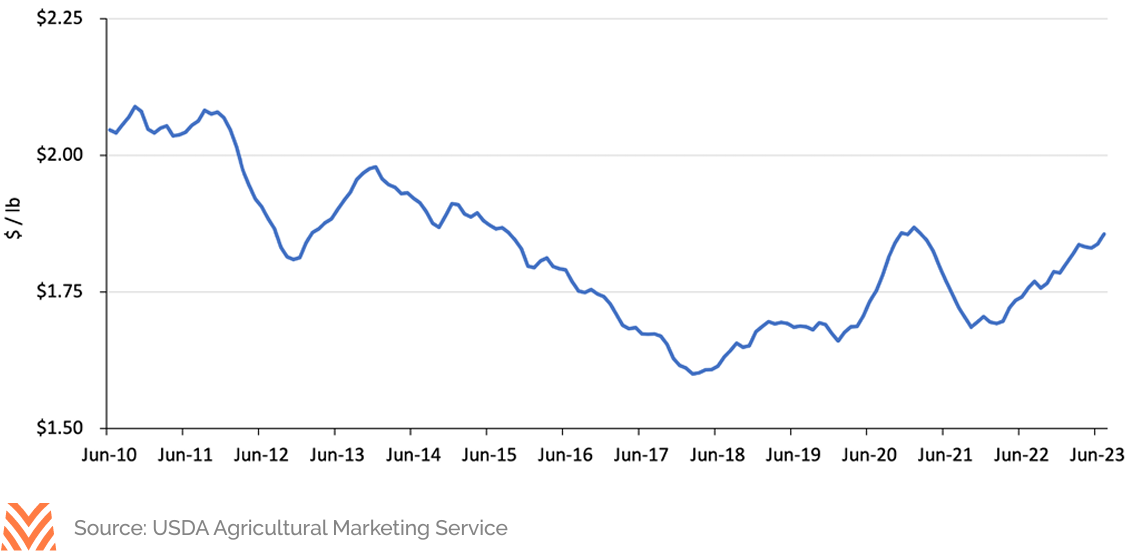

The U.S. and Mexico have adopted measures to address concerns regarding the labor cost difference between the two countries. One mechanism was adopting a reference price in the 1996 Tomato Suspension Agreement. Reference prices act as a floor on Mexican tomato prices if they are exported to the U.S. and have been updated occasionally to better reflect market conditions. Higher reference prices enacted over time, including in 2019, have helped relieve pressure on domestic tomato prices. The trailing average tomato price dropped as much as 23% between 2010 and 2017 but has since started trending higher. Higher prices have helped domestic growers, but challenges remain. Production costs for many U.S. growers have increased faster than tomato prices in recent years, putting additional pressure on margins.

Winter Imports as a Complement

Not all imports can be viewed through a lens of competition between foreign and domestic growers. For some fresh fruits and vegetables, imports have helped spur demand. For example, imports of blueberries from South America have skyrocketed over the last decade. Producers in Chile, Peru, and elsewhere have boosted production to ship primarily to the U.S. during the non-primary growing season in the Northern Hemisphere. Relative to imports of bananas, shipments of blueberries are much more volatile, spiking in winter before trailing off in the spring and summer. Consumers have greatly welcomed the increased availability of high-quality blueberries throughout the year. U.S. blueberry consumption approached one billion pounds in 2021, nearly nine times the volume consumed per capita in 2000. A greater ability to buy fresh products year-round likely played a role in shifting consumer preferences in favor of blueberries.

Domestic production and imports have both increased to supply the rising demand. U.S. blueberry production increased 23% from 2011 to 2021. While the increase is sizeable, imports have grown faster, surpassing domestic blueberry production by 2015. Even with the import surge, blueberry prices have remained remarkably robust. Farmgate blueberry prices increased the last four years and were 10% higher last year than the long-term average. The story is similar for raspberries. Greater domestic production has been more than offset by the 563% increase in raspberry imports since 2011. At the same time, farmgate raspberry prices have remained elevated after setting a new record in 2021.

Greater availability throughout the year is only one factor behind the increase in domestic consumption. The stability of retail prices has also increased as a result of imports. Historically, retail berry prices were significantly higher at the beginning and tail-end of the growing season in the Northern Hemisphere. Overlapping production with the Southern Hemisphere during these periods has reduced price volatility, and the final marketing year average prices have increased over time due to strong retail demand. Looking ahead, blueberry and raspberry growers can find confidence in the long-term shift of consumer preferences. Fresh fruit consumption increased by 9% per capita over the last decade and continues to trend higher.

Second Bite at the Export Apple

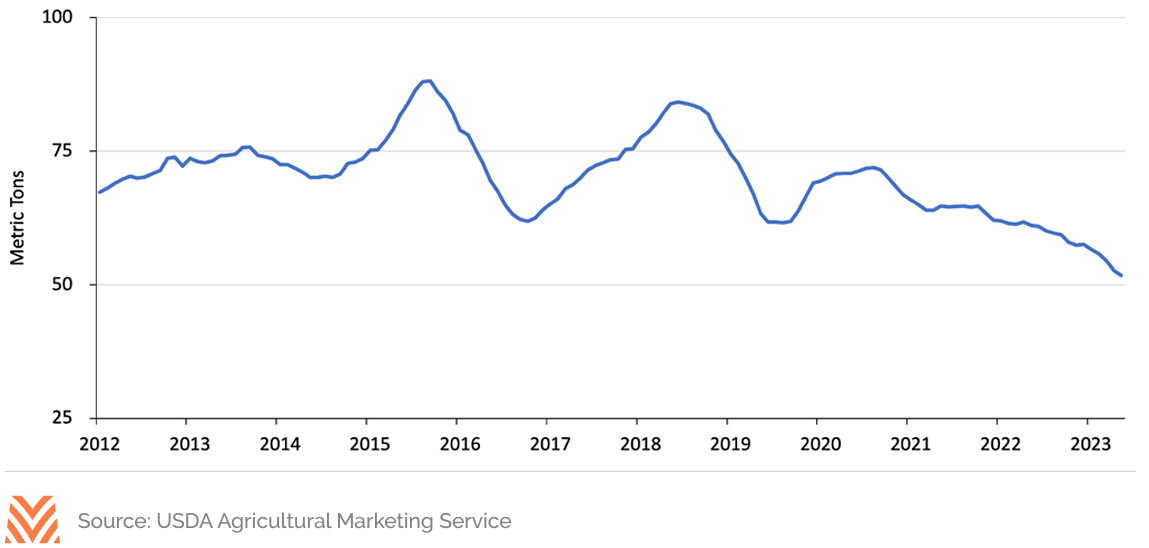

Trade flows go both ways, and many U.S. fruits and vegetables are exported in significantly higher quantities than they are imported. Apples are a prime example and may see a sizeable lift in export demand this year due to recent market developments. The U.S. exported 1.5 billion pounds of apples in 2022, or approximately 15% of total production. While significant, last year marked the fourth straight year of declining apple exports, which had previously peaked above 2.1 billion pounds. Several factors were behind the decline. One of the largest was India’s placement of retaliatory tariffs on U.S. apples in response to U.S. trade restrictions. The impact of the tariffs was immense. India had grown into the second-largest market for U.S. apple exports, importing 324 million pounds in 2018. By 2022, that volume declined 97% to under 9 million pounds, due mainly to retaliatory tariffs.

The outlook for apple exports has dramatically improved following India’s repeal of retaliatory tariffs. In June 2023, India agreed to lift retaliatory tariffs on numerous U.S. crops, including apples. The move was a significant positive breakthrough for apple growers. Export volumes to India will likely take time to return to pre-2019 levels. Still, additional demand from India will likely boost demand for U.S. apples and provide a lift to prices. Initial estimates suggest the 2023 apple crop will be the smallest since the 2012 growing season. The smaller crop and greater export demand may cause apple prices to continue their ascent and lift producer revenues.

Trade frictions may have disrupted U.S. apple shipments over the past several years, but exports remain a significant growth opportunity. Over the past decade, one positive development has been the continued introduction of newer, better-tasting apple varieties. Unlike some agricultural commodities, apple characteristics and quality can vary significantly across different varieties. Historically, apples bred for durability during transportation often sacrificed on taste and other traits. An emphasis on addressing this discrepancy has resulted in numerous new varieties of apples introduced since 2010 that boast excellent taste traits while retaining a reasonable amount of transportation hardiness. The shift has reinvigorated domestic apple consumption, and consumers abroad may also develop a taste for these new apple varieties. An additional plus for U.S. growers is that the genetics behind these newer apple varieties are often protected, potentially limiting their replication abroad.

Conclusion

While fresh fruit and vegetable exports are projected to see a pullback in 2023, imports are expected to continue their growth trajectory. The growth of these imports has led to significant challenges for some domestic growers while creating opportunities for others. Overall, farmers that embrace and adapt to shifts in where produce is grown could be more likely to thrive in the long term.