Tree Nut Exports Threatened by Slower Emerging Market Growth

Over the last year, tree nuts have benefitted from rising global demand for almonds, pistachios, and other consumer-oriented goods. This is critical for tree nuts, as U.S. production of nuts like almonds has quadrupled between 2000 and 2021. While wealthy regions like the European Union are the largest export destination for tree nuts, this growth-oriented industry is reliant on growth in emerging markets to keep up with production increases. Export volumes of edible tree nuts to advanced economies more than doubled over the last two decades. Over the same period, exports to emerging economies increased by more than eight times.

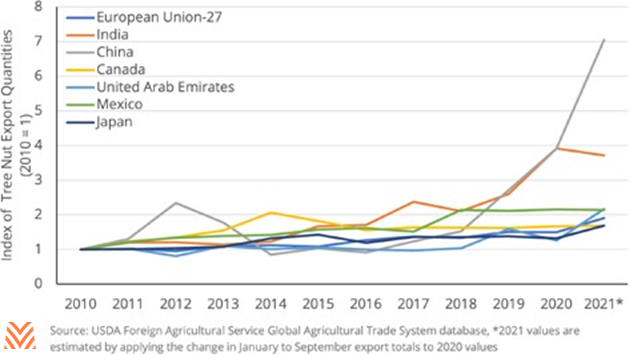

Emerging economies are essential to meet the additional production that has been put into almonds, pistachios, and other tree nuts. While the European Union remains the single largest U.S. market for tree nuts, India and China are on pace to eclipse it within a decade. And while India and China are the largest markets, many other emerging markets will contribute to this growth; countries like Mexico and the Philippines have more than doubled their imports of American tree nuts over the last decade. The figure below shows the growth in total tree nut exports for America’s largest nut export markets.

The challenge for nut producers is that a slowdown in emerging economy growth is a very real threat over the near term. In the latest set of global forecasts from the International Monetary Fund, the group noticed that the current recovery was very different from those of earlier recessions. Many emerging economies saw limited impacts from the 2007 financial crisis, and GDP growth in these countries remained well above advanced economies. But the 2020 recession differs, because many emerging economies are tourism-dependent or commodity exporters. These economies saw immediate impacts from the global shutdown, but also have seen lagging impacts due to slow vaccination rollouts.

The first reason the new IMF projections could signal trouble for tree nuts is due to income impacts in these emerging markets. In 2015, the USDA’s Economic Research Service found that many emerging markets spent 30% or more of household income on food, compared to less than 10% in the United States. Income declines in these less-advanced economies will directly impact the ability for individuals in those markets to purchase consumer-oriented goods.

Second, slower growth in emerging economies can influence exchange rates. During the financial crisis, the lack of impacts to emerging economies led to negligible differences in how the U.S. dollar fluctuated against emerging and advanced economies. While the recession of 2020 initially strengthened the dollar against most currencies, the trend has diverged. The dollar remains stronger against a basket of emerging economy currencies but is weaker against advanced economies. The reduction in purchasing power of consumers in emerging economies will compound the impacts of lower income growth.

Many other factors contributed to the record-breaking year tree nut producers saw for exports in 2020 and 2021. Strong almond production led to a glut of supply that allowed prices to decline to attractive levels for international buyers. Global shutdowns led to less spending on services and more spending on goods, including consumer-oriented commodities. But the slowdown in emerging market growth is a considerable risk to tree nuts. Core markets like the European Union may prevent total global declines in nut consumption, but producers must be aware of where the next billion pounds of additional production will go.