The U.S. – China Agricultural Trade Relationship

In early 2021, China demonstrated why it is one of the United States’ most unique agricultural trading partners. Corn production in both Brazil and Ukraine was faltering on dry conditions, and prices were rising. China had historically produced a large amount of the corn it consumed and imported only a small amount from Ukraine as necessary. In late 2020, a poor domestic crop and untenable pork prices for Chinese consumers led to a decision to purchase a massive quantity of feed at any cost. In the last week of January 2021, Chinese companies committed to buy almost 10% of the United States’ entire new corn crop, in the single largest one-week sale of corn in U.S. history.

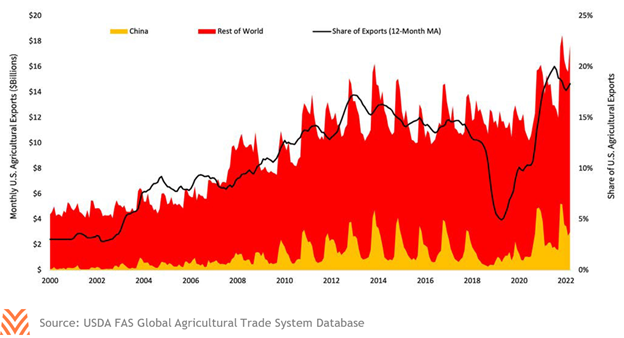

Unlike those of many other trading partners, China’s purchases are often highly concentrated. The historic January 2021 purchase was driven by a single company, known as the Chinese National Cereals, Oils, and Foodstuffs Corporation (COFCO). Like many major Chinese agricultural companies, COFCO is a state-owned enterprise, with dual commercial and national security objectives. Chinese agricultural purchases are large and are typically performed by state-owned enterprises like COFCO. This means that decisions often have as much to do with national policy objectives as they do with market forces. The potential for sudden shifts was shown in 2018, when trade conflicts led to Chinese purchases falling from approximately 15% of all U.S. agricultural exports to merely 5%.

While the U.S.–China trade relationship improved over the following years, Chinese thought leaders acknowledge two key problems with their agricultural consumption. First, China’s large population means that it is difficult to produce enough food domestically to feed its population, especially to produce those feeds used for protein production. Second, Chinese agricultural imports are highly concentrated. Many goods are imported from just one or two countries, making it difficult to replace those imports in the event of a disruption such as the 2018 trade conflict. Specifically, China imports almost a third of its agricultural products from North America and, in an era of rising tensions with the United States, that reliance is perceived by some in Beijing as a potential risk.

This is in part why China often talks about food through a national and food security lens. China’s most recent 5-year plan, which was enacted in 2021, includes aims to “promote the diversification of import sources, and cultivate large international grain merchants.” Their 2022 Agricultural Outlook Conference was titled “promoting stable supply,” with aims to grow 88% of all grain consumed in China by 2031. While these goals do not expressly mention the United States, their apparent goal is to reduce China’s reliance on U.S. commodities should the need arise.

Domestic Growth

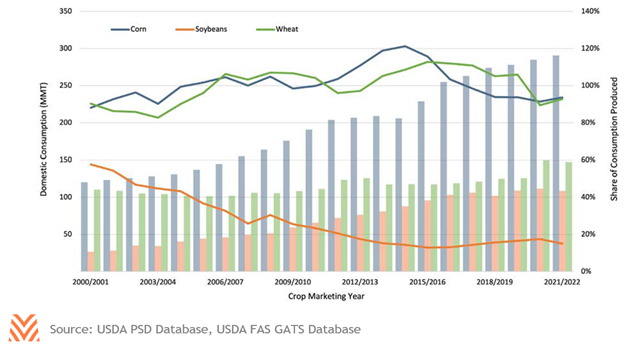

China’s goal to grow most of its own grain is challenged by the rapid improvement in living conditions in the country. While China has almost tripled the amount of corn it grows domestically since 2000 (due largely to increased acreage), domestic consumption has risen almost as much. This is driven by large increases in domestic meat consumption: per-capita pork, beef, and poultry consumption in China had all risen at least 50% between the start of the African Swine Fever outbreak in 2018 and 2000. However, Chinese per-capita consumption is already approaching nearby nations with much higher per-capita GDPs like South Korea. This suggests that Chinese demand for proteins could slow, something that would help China reach its goal of fulfilling its own feed needs.

However, China may struggle to grow additional feed even if protein consumption growth slows. China has only 75% of the arable land that the United States does, yet has a population almost four times larger. This has been exacerbated by decades of internal migration and urbanization that have led to a large amount of farmland being converted to nonagricultural purposes: One study from 2021 found that the total amount of farmland in China declined 6% between 2009 and 2019. Chinese production has also been hampered by persistently slow yield growth.

There have been many hypotheses why Chinese yield growth has lagged other nations; slow approval processes for genetically modified seed, soil erosion, fertilizer use restrictions, poor domestic seed availability, and other institutional and environmental factors are all possible culprits. What remains true is that more than a decade after corn yields became a top concern for the Ministry of Agriculture, yield growth has slowed even further. The combination of both declining acres and slow yield growth means that China may have extreme difficulty meeting its production goals even if protein consumption slows in the coming years.

Diversification of Imports

China’s other aim is to reshape global patterns of trade to influence how agricultural products flow. The largest of these is the Belt and Road Initiative, which aims to create a series of land and maritime transit routes between China and the European, African, and Asian continents. Members of the Chinese Ministry of Commerce have indicated that these investments are designed specifically to counter established trade routes with North America. This is evidenced by the relatively low share of foreign direct investment in North American agricultural investment: while China imported almost a third of its agricultural products from the U.S. in 2014, outward investment in North America represented just 2% of China’s total agricultural investments.

China’s efforts have seen mixed results. On the negative side, many investments fail to produce the designed returns and are abandoned: Heavy financial and technological investment in countries like Cambodia do not appear to have materially influenced Cambodian agricultural production or exports to China. And the purchase of Smithfield Foods in the U.S. did not lead to a greater amount of pork being exported to China within the first years after its purchase. Yet other areas have seen success; Chinese investments in Brazil have coincided with declining transportation costs between Mato Grosso and Shanghai. This led to a historic change in 2021, when it became cheaper to ship soybeans from Brazil to China than from the U.S. However, as Chinese incomes rise and China imports more consumer-oriented goods like dairy and tree nuts, it has found itself importing even more goods from the U.S. and its allies.

Even if Beijing’s preference is to reduce its reliance on American agricultural products, that doesn’t mean the inevitable end of U.S.–China agricultural trade. Between the 1950s and 1980s, Japan exhibited many of the same characteristics of modern China: investment in foreign agribusiness, attempts to diversify agricultural imports, acquisition of U.S. farmland, and other similar features. However, the U.S.–Japanese agricultural relationship remained strong. Japan imported its second-highest value of U.S. agricultural products in 2021 since the USDA began collecting that data in 1996. The rise of great power competition may strain the U.S.–China trade relationship, but not every path ends in a fracturing of this important outlet for American farmers and ranchers.