The Return of Inflation?

In November 2021, Farmer Mac and the American Bankers Association asked over 500 agricultural lenders about their top concerns for producers. This year, in a seismic shift, lenders overwhelmingly listed their biggest concern as something they had hardly mentioned in prior surveys: inflation.

Since the early 1990s, core personal consumption expenditure (PCE) inflation has been very near the Federal Reserve’s target of 2% annual growth. The recent return of higher inflation thus adds uncertainty that many lenders have had no experience with during their careers. However, the farm sector has a strong memory of the potential risks that inflation presents to borrowers. Rising inflation can harm profitability by increasing input costs or can lead to untenable rate increases for highly-leveraged producers with variable rate loans.

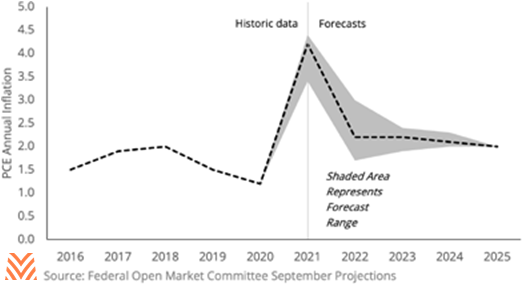

The good news is that despite recent sharp increases, current forecasts indicate that there are only modest changes in long-run inflation expectations. The figure below shows the September projections from the Federal Open Market Committee (FOMC), with median expectations of 2.2 core PCE inflation by 2022. This was echoed in the November Survey of Professional Forecasters, who forecast that PCE inflation would rise to 4.1% in 2021 before falling to levels just above 2% in 2022. Many economists believe that specific supply shortages, like the used cars shortage, led to transitory inflation that will not lead to significant increases in long-run inflation. That said, items like food are forecast to experience a longer period of price growth. Given the uncertain nature of future inflation, lenders and borrowers should be aware of the risks of an inflationary environment.

Input Costs

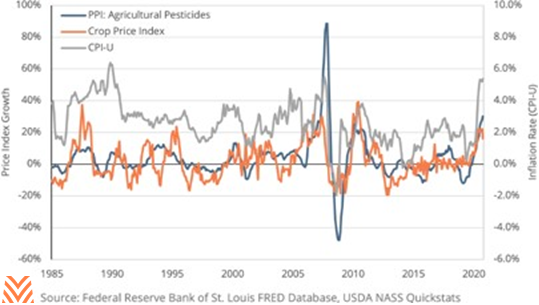

One of the potential impacts of a high-inflation environment could be on production expenses. In December, the USDA forecast that total production expenses will increase almost 9% in 2021. This is due in part to producers taking advantage of high market prices. However, increases in costs like fuels, labor, and fertilizer are all in some way related to the inflationary environment. The important thing to understand is where cost increases are coming from. Economists from the University of Illinois have found that fertilizer costs are more tied to the price of corn than to the inflation rate. Similarly, feed costs are a function of market prices, and are less tied to inflation. But labor and fuel costs are directly related to inflationary pressures, meaning that inflationary pressures may persist even if the farm economy is not strong. This means that high-labor commodities, like dairy, could feel inflationary pressures even as low-labor ones, like wheat, feel negligible pressure.

Land Valuation

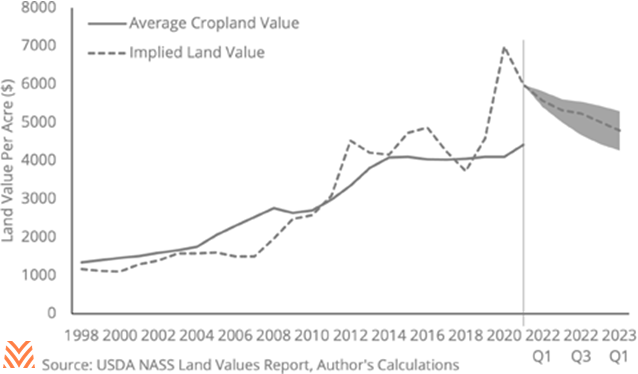

In addition to its impacts on variable rate payments, inflation also can harm assets by lowering the implied value of farmland. Current projections are that inflation expectations will lead to increases in the federal funds rate between 2023 and 2024. These increases are forecast to mirror the rate increases of the period between 2015 and 2018, with rates rising to between 2% and 2.5% by the end of 2024. Such a rising rate environment could impact producers through its impact on the capitalization rate for farmland. One theory of agricultural land values suggests that the implied value of farmland is roughly the cash rental rate divided by the capitalization rate.

The capitalization rate can be thought of as the risk-free interest rate (usually the 10-year Treasury yield) plus a portion of the additional returns to riskier assets minus the growth in farmland returns. The figure below shows what this implied valuation for cropland is given a range of forecasts from the Survey of Professional Forecasters for the risk-free rate, assuming constant returns to risky assets, and using futures for cash grains to predict growth in cash rents. This model suggests that increases in treasuries alone have the possibility to put downward pressure on cropland values by 2023.

While this model suggests that land values are influenced by monetary policy, recent literature has attempted to quantify how decisions by the FOMC impact farmers and ranchers. Researchers from Iowa State University’s Center for Agricultural and Rural Development recently reviewed the relationship between monetary policy changes and land values in the Corn Belt and Great Plains. They found that rate increases can lead to long-lasting impacts to land values, with residual impacts up to 18 years after the increase. For states around the Great Lakes and the Great Plains, they estimate that rate increases between 2015 and 2018 led to land values that were 2.5% lower in 2020 than they would have been without changes in monetary policy. As the FOMC expects future rate increases to mirror the 2015 to 2018 period, this model suggests that land values may see similar impacts in 2024 and on.

Commodity Prices

The silver lining for producers is that modest inflation may carry some benefits. In periods of inflation, storable commodities may serve as a hedge, meaning that increases in expectation for long-run inflation could raise the demand for real commodity prices. Research has specifically found links between some cash grain prices, market volatility, and food price inflation. In the U.S., food price inflation is not likely to change overall consumption. As of 2020, Americans spent just 8.6% of their disposable income on food, down from almost 20% back in 1960.

Modest inflation can also benefit producers by influencing exchange rates. If inflation in the U.S. exceeds that of other counties, then that will put downward pressure on the U.S. dollar relative to other currencies. As a weak dollar makes U.S. agricultural exports more competitive in the global marketplace, farmers and ranchers could benefit from the modest price pressures.

The net effect of inflationary pressures is likely to be negative for producers, but the impacts may be less severe than some lenders fear. There is currently no indication that inflation will reach the levels seen during the agricultural crisis of the 1980s. Many agricultural input costs are tied more to commodity prices than they are to inflation. Inflation could lead to downward pressure on land values, but near-term forecasts do not suggest that recent price increases are unwarranted. Finally, producers might even benefit from modest food price inflation. Inflation is not yet a cause for true concern, but lenders and producers should be aware of its impacts should inflation continue to climb.