The Global Economic Recovery and Impacts to U.S. Agriculture

As more and more countries start to suppress the COVID-19 pandemic and begin an economic reset, impacts to U.S. agriculture will be wide and varied.

Demand for U.S. food and fiber is driven in large part by economic development; as per capita incomes rise, so does the demand for high-value products like animal proteins, fruits, nuts, and other processed consumer goods. Meanwhile, the development of protein markets in foreign countries drives the demand for U.S. grains, oilseeds, and other feeds.

A widespread global economic recovery would be a growth driver for American farmers, as evidenced by the global economic rebound in 2010 that drove up U.S. ag exports by 20% by 2011. Conversely, a slow or uneven global recovery could disadvantage some producers, depending on where the recovery stumbles and what U.S. products that country consumes. Meanwhile, since competition is an important driver for U.S. producers, one of the biggest variables of how the recovery will impact them will depend on how well producers in other countries fare. The trajectories of both COVID-19 and economic recoveries in other countries could advantage or disadvantage U.S. producers in the near term.

Demand

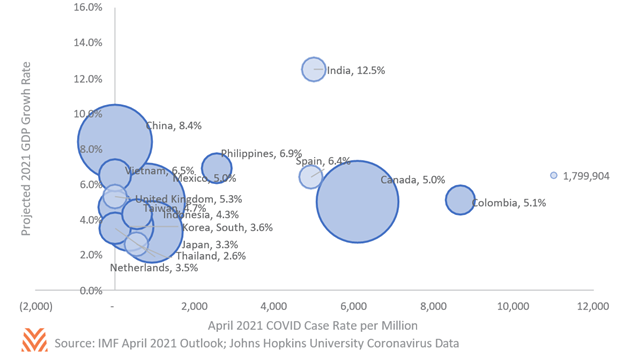

The export demand story has mainly been positive in 2021. Five of the top six export destinations are experiencing double-digit or higher growth rates in ag exports in the first three months of 2021 compared to the same period in 2020. China is leading the pack, with an impressive 164% increase in the value of exports in 2021. Other Asian nations, like Japan, South Korea, and Vietnam, are also experiencing a large jump in demand for U.S. food and fiber. As the figure below demonstrates, these countries tend to have low or virtually no current COVID-19 circulation and also have a healthy economic outlook from the International Monetary Fund (IMF). Mexico is the fifth importer experiencing a sizable demand expansion, and they too are experiencing relatively low COVID-19 circulation in early 2021. Much of the demand growth has centered around bulk commodities like corn and soybeans, but there have been some increases in consumer-oriented and intermediate goods. Higher prices are a big component of the growth, but the quantity of these exports is also up double-digits in most cases.

While the outlook for most of our top export destinations is positive, some are still facing challenges. Canada, a perennial top-three consumer of U.S. ag exports, experienced a surge in COVID-19 cases in April 2021. The outbreak is keeping commerce muted and reducing the outlook for economic growth in 2021. Exports to Canada are up only 5% in 2021, with sizable drops in fresh vegetables, beverages, and tree nuts dragging down sales. India also had a large spike in COVID-19 cases, hospitalizations, and deaths in the early months of 2021. India is routinely a top importer of U.S. almonds and fresh fruit, but export values are down 32% and 77% in 2021, respectively. Vaccination rates in Canada and Spain picked up considerably in April and May 2021, but India and Colombia still lag and may continue to see health and economic stress into the second half of 2021.

Foreign Competition

While U.S. agriculture depends on foreign markets to drive demand for food and fiber, they also compete for that demand with other, foreign producers.

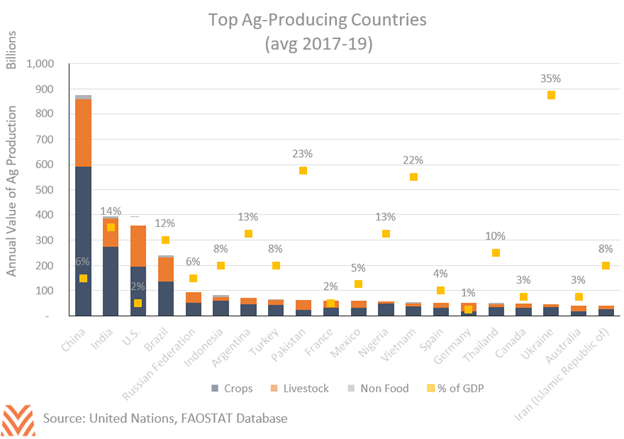

The figure below shows the top 20 agricultural-producing countries by the average value of farm and food production between 2017 and 2019. When looking at the chart, it is important to keep in mind that China and India produce most of their crops for self-sufficiency and do not export a high percentage of their output (less than 10%). Alternatively, the U.S. and Brazil each produce significantly more food and fiber than is required for domestic consumption and have a food trade surplus.

Brazil is the U.S.’s largest competitor for global food and fiber sales. The size of ag-producing countries falls off significantly after Brazil, with many similarly-sized ag economies between $75 and $50 billion annually. Of these, Argentina, Ukraine, and Australia have the greatest overlap in trading partners and agricultural products. COVID-19 and economic challenges continue to delay full recoveries in Brazil and Argentina. However, their output for the 2021 growing season remains at record levels, despite weather issues. Australia has almost no cases of COVID-19, and Ukraine’s levels mirror those in the U.S., so the recoveries are not likely to be shaken terribly by a viral resurgence.

This context will help shape these nations’ actions as the global pandemic continues to wane. Nations with high GDP concentration in agriculture have been more sensitive to policy changes that could threaten production and transportation. However, agriculturally-focused economies are also often poorer and are further behind in their vaccination efforts. Like India, these nations may be threatened by outbreaks in 2021. This results in populations that are more susceptible to major outbreaks this year, but governments that are more sensitive to how policy decisions impact agriculture.

Outlook

Because competition looks to stabilize, demand becomes the more significant driver of U.S. ag export growth in 2021. The speedy bounce in economic activity across much of the Pacific Rim should provide a strong lift to U.S. ag export demand for the balance of 2021. Grains and oilseeds are looking to be the largest beneficiaries of the rebound, with record-setting sales to China in the early months of the year. Beef sales to Mexico and Canada could struggle to gain until recoveries in those countries pick up, perhaps later in the year. Meanwhile, tree nuts could have a tough export year with slow sales in India and shipping channel constraints to other Asian countries. Cotton sales to India are sluggish, but they have picked up in China, and there is a positive outlook for the remainder of the year. While the shifting tides of the pandemic and recovery make it harder than usual to predict the shape of the global economy this year, the indicators discussed here generally support the USDA’s projection of a record year for U.S. agricultural exports.