The Conservation Reserve Program

The Conservation Reserve Program (“CRP”), which offers annual payments to producers in exchange for their removing environmentally sensitive land from production for up to 15 years, has become a subject of renewed interest at the USDA. The CRP has seen several changes in recent years, including increased enrollment caps, higher payment rates, and greater contract flexibility. The USDA is currently offering higher payments and other incentives in a push to entice producers to enroll the maximum-allowable 25 million acres. With current enrollments at just over 20 million acres, there are questions about whether the USDA can hit its intended target—and how this current push might impact agricultural markets.

One factor working against the 25 million acre goal is that total enrollments declined over 2020, due in part to the large number of acres whose CRP contracts expired last year. The over 5 million acres that expired were heavily concentrated in the western Plains states, ranging from Montana to Texas. In these areas, it was common for more than a quarter of all enrolled acres to expire last year. Meanwhile, few acres from the Corn Belt region expired. Many CRP acres expiring in 2020 would have been enrolled around 2010, when sudden increases in corn and soybean prices may have led to fewer enrollments in that region. While current market conditions may not entice new CRP enrollments in the Corn Belt, total CRP acres in that area may not decline significantly over the next few years.

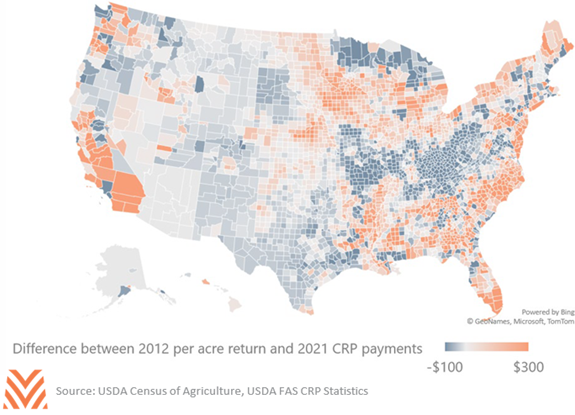

Another factor working against new enrollments is the fact that, like in the supercycle era, cash grain prices are seeing strong returns that may dissuade producers from enrolling acreage into CRP programs. One way to get a sense of how enticing new CRP enrollments may be is to compare the 2012 Agricultural Census implied per acre returns against the current average 2021 CRP payments. While there are some differences between the markets in 2012 and today, there are enough similarities in the grains markets to glean some insight. The figure below shows this at a county level. Areas that are deep orange may be less likely to sign up for CRP, given current market strengths. However, there are areas around the country where CRP payments may be more competitive, such as in the South or western Plains regions.

This map suggests that the USDA may be able to reach its target of enrolling 25 million acres, though it is unlikely to make great strides in corn and soybean territory. The regions that see the most expiring contracts today, like around Texas and Montana, are also the ones where the economics of CRP enrollment look good for local producers. This has some minor implications across commodities. Corn and soybean production are unlikely to decline as a result of the new CRP programs. However, sorghum and winter wheat areas may be more likely to enroll acres. While the consistent returns of a CRP program may be enticing to some producers, it’s hard to pass on $6 corn.