Rising Interest Rates: Farmland vs Housing Market?

Farmland values surged over the last several years, boosted by high farm incomes and low interest rates. A steady increase in interest rates since early last year has weighed on the stock market and other asset prices. Farmland values, though, have remained remarkably robust, due in part to higher farm incomes. Still, the potential for even higher interest rates remains a headwind that could impact the direction of farmland values this year.

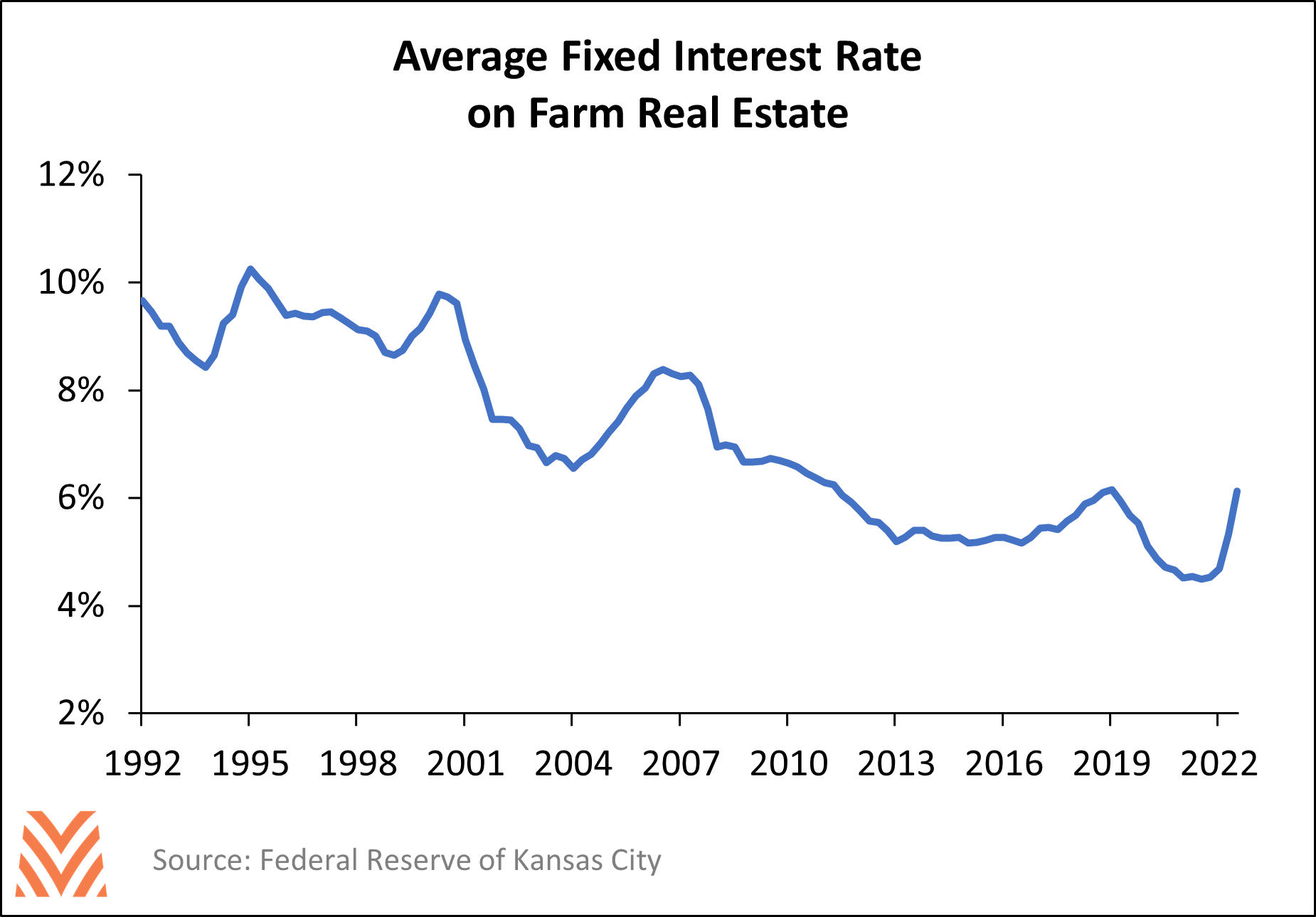

Since early-2022, the Federal Reserve has raised short-term interest rates eight times to try combat elevated inflation. Tighter monetary policy has also fueled a rise in long-term interest rates. Interest rates on home mortgages topped 7% in November, the highest level since 2002. Meanwhile, the average fixed interest rate on farm real estate followed a similar trend after bottoming out around 4.5% in 2021. Long-term rates could rise further still, especially if the Federal Reserve continues to tighten monetary policy.

Rising interest rates weigh on asset prices by reducing the purchasing capacity of buyers. The monthly payment on a 30-year mortgage is over 50% higher today than in 2021. This has had a pronounced impact on the housing market as many potential buyers can no longer afford to buy. Home mortgage applications dropped to lowest level this month since 1995, and lumber and home prices have both slumped.

Rising interest rates have not had the same impact on farmland values thus far. Farmland has continued to fetch record prices this winter despite the higher financing costs. Strong farm cash flows help partially explain the robust farmland values. Farm incomes reached record levels last year and have largely offset higher interest costs for farmland purchases. Incomes are projected to remain elevated this year as well, albeit at lower levels. As such, it is unlikely that farmland values will experience a significant decline in the near-term. More likely is that higher interest rates will slow the pace of increase in farmland values this year.