Rising Food Prices Persist

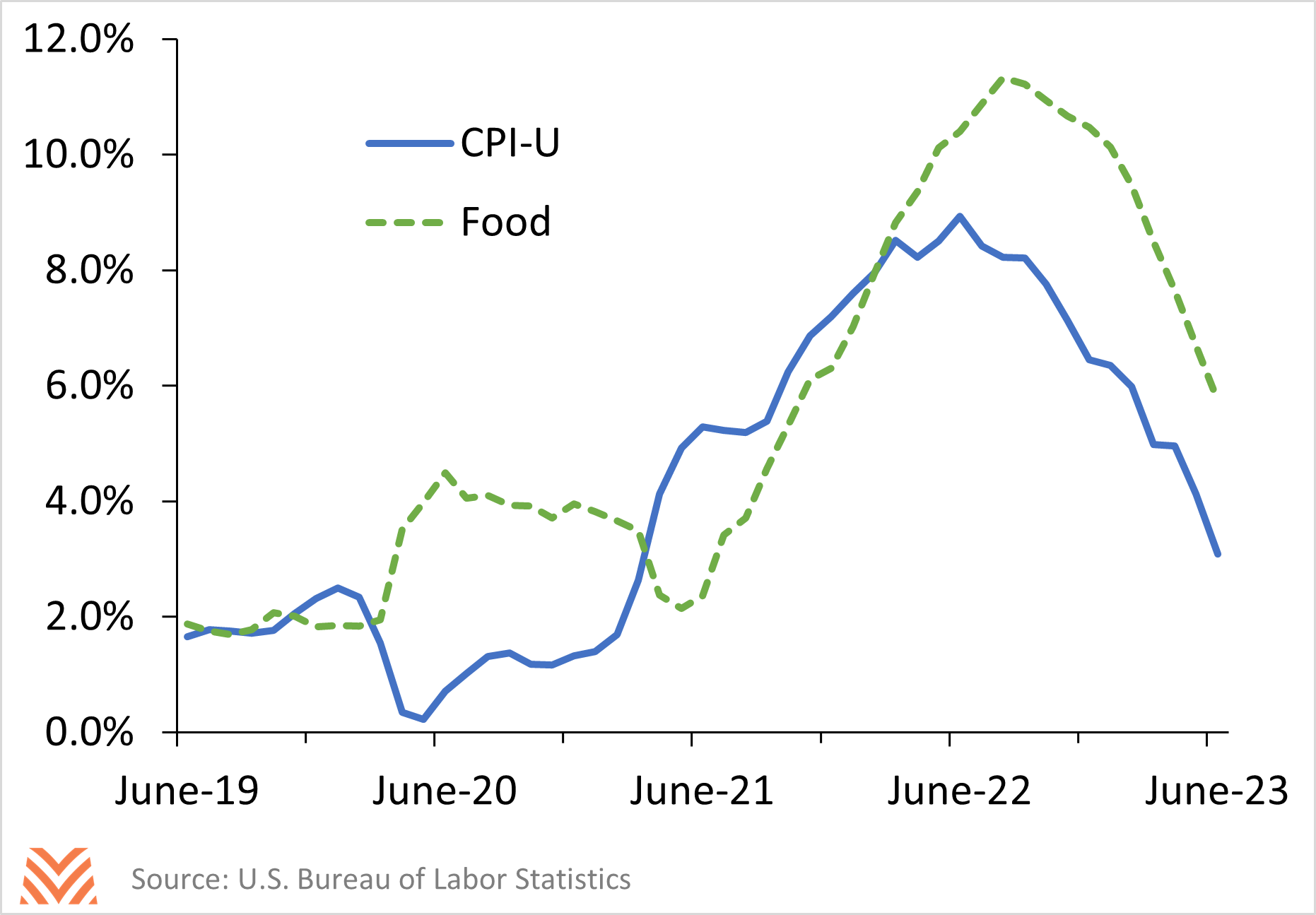

On Wednesday, the Bureau of Labor Statistics released updated data on the Consumer Price Index. The data showed the broadest CPI measure declined again in June to a 3.0% year-over-year increase, the lowest since March 2021. The release was a positive development and marked continued progress toward the Federal Reserve’s stated goal of driving down price increases. Still, several CPI components remain stubbornly elevated, including food.

Food is a significant component of CPI and accounts for over 13% of the total basket. Broadly, price increases for the food category remained well above the 3% level of the broader index. Examining the sub-components of the food category reveals many different subplots, though, as declines in some food prices were offset by large increases in others. Cereals and bakery products were 9% higher in June relative to last year while beverages increased 8%. Meanwhile, the composite prices of meats, fish and eggs actually declined modestly relative to June of 2022. Dairy prices increased a moderate 2.7% yoy but were offset by the 8% yoy increase in food away from home. The other foods category also increased 8% yoy, boosted by rising prices for sugar, oils, and other processed foods.

Food price changes have been driven by various developments in supply, demand, and processing costs. Global grain production has rebounded this year, but cereal food costs continue to increase in response to the Russia-Ukraine war and higher processing and transportation costs. A rebound from the avian influenza outbreak has helped push down egg and poultry prices. However, strong beef prices continue to prop up the meat index and have limited the downward impact of poultry. Farm-level dairy prices have cooled significantly in 2023, but retail prices have yet to follow. All told, each food sub-category has been driven by a unique story this year, many of which are unrelated to changes in interest rates.

The data for June likely cemented another interest rate hike by the Federal Reserve despite the continued trend lower in the CPI. However, futures markets interest rates do not currently expect a significant number of additional hikes this year. This is likely positive news for the agricultural sector. Beyond preventing a further nudge of the economy towards recession, interest rate hikes can also boost the strength of the U.S. dollar as monetary flows shift to capture higher rates. A stronger dollar can therefore weigh on U.S. commodity prices as exports become less affordable relative to international competitors. Still, the Federal Reserve has voiced commitment to driving inflation lower this year. This could result in additional interest rate hikes, regardless of their direct impact on food prices.