Proteins Show Strength

Pork Export Reversion

Pork producers in the U.S. pulled back on output in 2022 due to weaker prices and elevated input costs. While production dropped, pork exports remained robust and the momentum continued. Through May, U.S. pork exports were 13% higher by volume than in 2022, even in the face of a pullback in pork demand from China.

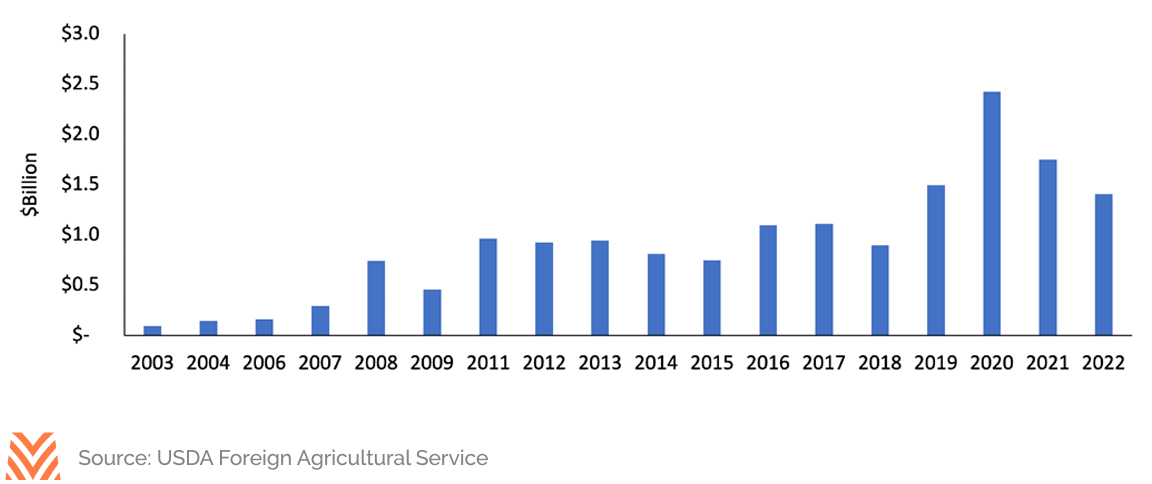

At first glance, a decline in pork exports to China may seem surprising. China was the number one export market for U.S. pork as recently as 2020, before shipments from the U.S. declined 28% and 20% annually in 2021 and 2022, respectively. But it hasn’t always been this way; in fact, the recent decline has primarily been a reversion to trendline growth.

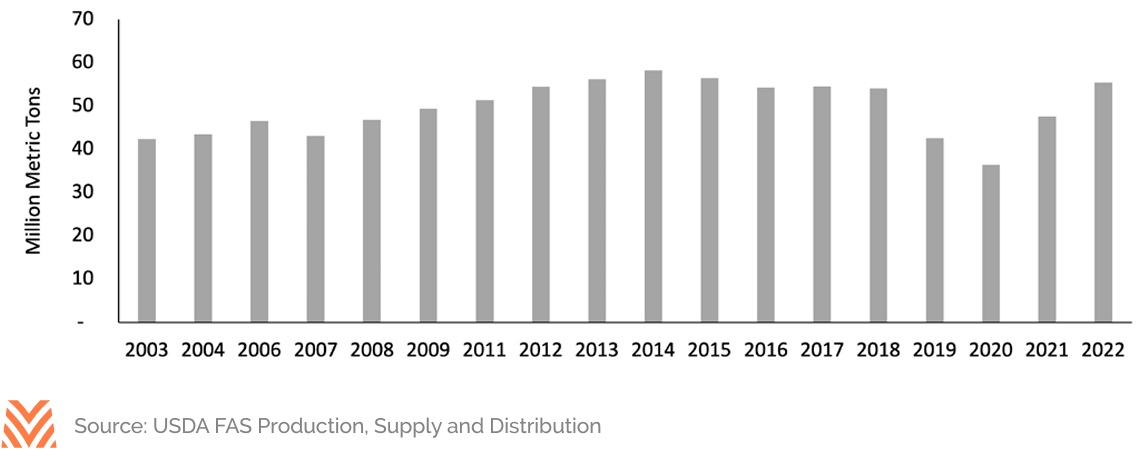

A confluence of factors starting in 2018 had led to a sharp uptick in pork exports to China. First, an African Swine Fever (ASF) outbreak caused Chinese pork production to decline by 21% and 15% in 2019 and 2020, respectively. As the largest pork-consuming country in the world, the outbreak led to a greater reliance on imports to backfill China’s pork supply. On top of the supply disruption, the U.S. and China agreed in January 2020 to a Phase One trade agreement that included lofty agricultural purchase commitments by China. The combined impact of reduced supplies and greater demand led to a surge in U.S. pork exports to China in 2020.

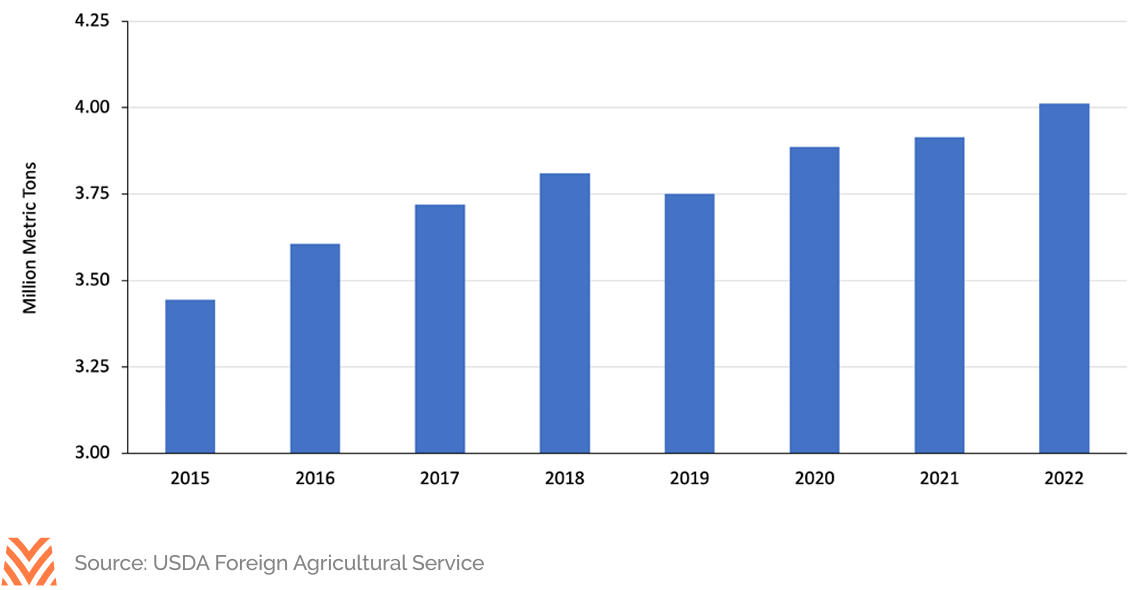

Pork exports to China have since trended lower following the conclusion of the trade agreement and containment of ASF. Domestic pork production in China surpassed 55 million metric tons (MMT) last year for the first time since 2015 as pork producers restocked the domestic herd. Despite the bump in supply, shipments of U.S. pork to China remain higher than pre-2018 levels and likely reflect long-term demand growth.

While exports to China have moderated, Mexico, South Korea, and numerous other countries continue to increase purchases of U.S. pork. Nearly 50 countries increased purchase volumes in 2022, providing support for prices during a period of profit margin compression. The favorable start to the year, combined with a modestly weaker dollar, suggests pork exports will remain strong in 2023.

Beef Herd Contraction Weighing on Exports

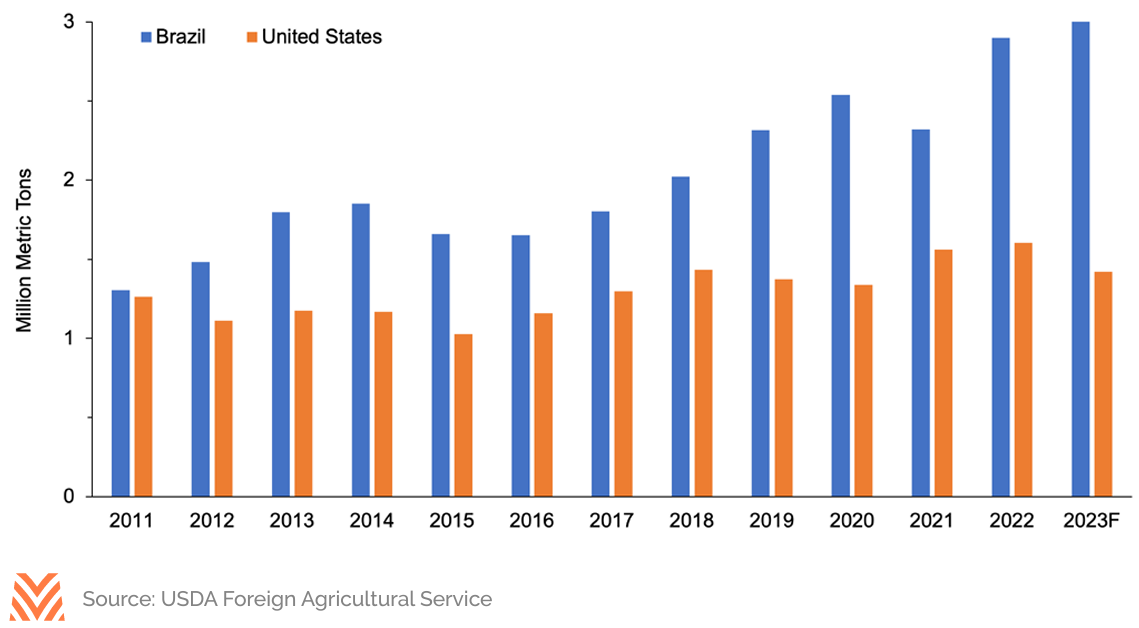

U.S. beef exports set a record in 2022, surpassing the previous high-water mark from 2021. Exports increased 11% and 3% in 2022 by value and volume, respectively. However, a shrinking U.S. beef cattle herd now represents a headwind to maintaining this momentum. The U.S. beef cattle herd experienced the largest contraction over the past year since the late 1980s: First, an intense drought across the Pacific Northwest caused a liquidation of cattle herds in Montana and Idaho. This was followed by drought conditions across the Southern Plains, which hindered pasture growth and reduced hay production. With limited hay availability and elevated feed costs, many producers chose to sell cows and reduce their herd size. After a temporary uptick, U.S. beef production is now forecast to decline 5% in 2023 due to fewer cattle. With less beef being produced and continued robust retail demand, exports are forecast to drop 11% by volume in 2023.

USDA economists expect global competitors to try to capitalize on declining U.S. beef exports this year. Brazil in particular competes heavily with the U.S. and continues to ship greater volumes of beef abroad. Brazilian beef exports are forecast to be twice as large as the U.S. this year despite Brazil producing 13% less beef. Historically, there has been a significant difference in quality between Brazilian and U.S. beef. Brazilian beef is generally perceived as lower quality in international markets and has accordingly been cheaper. This lower price point helped fuel the growth in Brazil’s export volumes. Given the difference in quality, though, the U.S. is likely to recapture market share of the global beef trade when domestic beef production rebounds. Still, competition from Brazil is likely to grow.

Non-North American Demand Fueling Growth of U.S. Poultry Exports

The global rising popularity of chicken continues to benefit U.S. producers. Despite the old joke of complimenting food by saying it “tastes like chicken,” consumer palates have demonstrated a clear preference for the real thing. In 2016, poultry surpassed pork as the number one consumed meat globally per capita. This trend has continued as poultry expanded its lead in the years since. U.S. poultry producers both contributed to this trend and benefitted from it. By focusing on the efficiency of poultry production, U.S. producers helped drive down the cost of producing poultry. In turn, this more affordable protein source has contributed to greater export demand. U.S. poultry exports neared $6 billion in 2022, 14% higher than the previous record. And while exports increased to most countries last year, export markets outside North America were the most significant drivers.

Before the signing of NAFTA in 1993, Japan held the title of the largest export destination for U.S. poultry products. NAFTA changed that dynamic, and exports to Mexico and Canada skyrocketed through the 1990s and 2000s. However, export volumes to Mexico and Canada have remained relatively flat for the past decade. This is mainly due to import quotas in these countries designed to protect domestic production. Indeed, Mexico’s domestic production has increased significantly, rising 36% between 2013 and 2022. Beyond greater domestic production, though, Mexico has increasingly looked to source poultry imports from countries outside the U.S. Chile and Brazil have increased exports to Mexico. In contrast, U.S. exports have stayed nearly flat.

Tepid demand growth from Mexico has not derailed the trajectory of U.S. poultry exports. Instead, growth has been fueled by a combination of smaller markets. Cuba, for example, has emerged as the fourth largest export destination for U.S. poultry products. Cuba imported 277 thousand metric tons of U.S. poultry last year, nearly quadrupling the 2003 import volume. Relative to last year, poultry exports started 2023 slow but have picked up momentum mid-year. The sector could benefit over the long term if successes like the increased exports to Cuba can be replicated in other markets.