Poultry

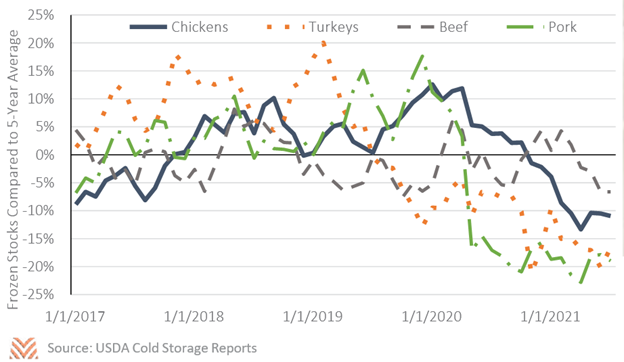

After years of building stocks, poultry producers are experiencing tighter supplies and growing demand, helping to boost prices in 2021. Broiler production is down slightly through mid-year, driven by labor shortages at chicken processing plants. Slower throughput from broiler processors drove down farmer-received prices throughout 2020 and early 2021, but the strong grocery and food service price inflation are helping to boost margins throughout the supply chain. Frozen stocks of all parts of the chicken are at multi-year lows in mid- 2021, especially for chicken wings. Turkey production is also down in 2021 compared to recent history, driven by dry weather conditions in the upper Midwest, rising feed costs, and several years of tight profitability in the sector. Frozen storage of all turkey meat has averaged 20% below the five-year average in 2021, virtually tied with pork for the shortest supplies in recent memory.

In addition to supply-side challenges, the story of declining stocks is a function of exceptional demand in the first half of 2021. Competition for the best chicken sandwich among quick-service restaurants continues to drive demand for white meat. Meanwhile, chicken wing demand remains robust in 2021 after a very strong 2020, and the demand has been strong enough to fuel wing-themed restaurants to create chicken thigh-themed offerings as a complement. Exports are another important driver of demand, and we’ve seen robust shipments to Mexico, Cuba, and Canada compared to 2020. Sales of turkey products to China have slowed in 2021 due to the rebound in pork production and reduced demand for meat substitutes, but the shipments to all other countries have more than offset this decline. There have been limited concerns about a recent outbreak of avian influenza in some global producing regions, but that has not dramatically impacted exports.

Farm prices for poultry look good heading into the fall, but profitability could remain under pressure in 2021 and into 2022. The USDA projects wholesale broiler prices to remain at approximately 93 cents per pound through 2022 and for turkey hens to average approximately 119 cents per pound. Both prices are substantially higher than 2019 and 2020 levels. However, rising feed costs are capping the benefits of higher retail and wholesale prices. The national broiler-to-feed price ratio, a measure of the price received for chickens compared to the cost of raw feed components, is at its lowest levels since 2012/13. Turkey producers see slightly better profitability levels, but the exuberance in turkey prices is capped by rising feed costs. If export and retail demand continue to pick up and processors can solve some modest labor shortages, the poultry sector should have a reasonably strong year in 2021 and into 2022.