Poultry

The USDA currently projects that annual broiler production will increase by 3.2% in 2020, while egg production is forecast up 1.2%. The poultry industry has seen significant movement, as Chinese officials moved to end their ban on the importation of U.S. poultry products, which had been in place since 2014. While chicken paws are the only product deemed profitable to ship to China due to the current tariffs, other products may become profitable depending on the outcome of U.S.–Chinese trade negotiations and on poultry prices generally.

Demand growth is forecast to be strong enough to increase average annual prices despite increased production, with average annual prices for broilers and eggs forecast up 1% and 11%, respectively. This can also be attributed in part to the reopening of the Chinese market. The USDA’s forecasts predict a 5% year-over-year increase in broiler exports between 2019 and 2020. Egg exports have also been revised, based on recent positive signs in exports at the end of 2019.

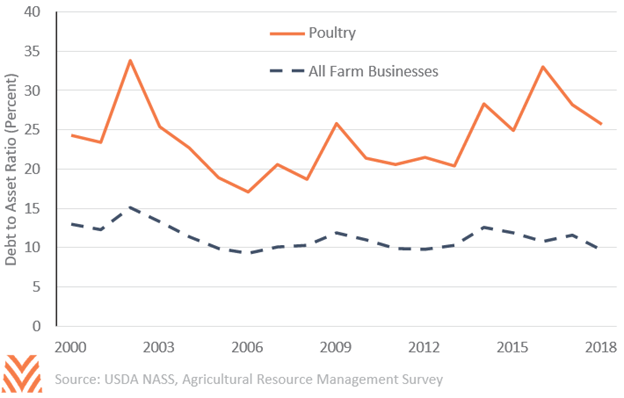

The timing of these increases comes at a good time for the poultry industry, which has seen some signs of strain through 2019. Prices received for broilers settled near decade lows in late 2019. Egg prices, while above recent lows, had fallen 30% from their 2018 annual average. While many commodities saw increases in measures of financial strain following the commodity supercycle, producers specializing in poultry saw faster increases in their strain. Between the end of the supercycle in 2013 and the last year when data are available, poultry producers saw their overall debt to asset ratios rise from 20% to 26%, peaking above 30% in 2016. Other measures of liquidity and efficiency for poultry producers also saw significant deterioration over this time.

The timing of the reopening of the Chinese market is especially good, as it offsets declines in growth from other emerging economies. Developing and emerging economies are forecast to represent 80% of the demand growth for protein products over the next decade. However, many of the emerging economies with the fastest growth in protein consumption have experienced economic slowdowns. Of the fastest-growing markets in South Africa, Latin America, and the Middle East, the IMF has revised 2019 GDP growth forecasts down between 0.5% and 1.2% since April 2019. The Chinese market, which will account for almost a quarter of protein consumption growth over the next decade, can more than make up for slowdowns elsewhere.