Measuring Regional Financial Stress

A key measure of agricultural stress is the share of delinquent loan volumes held by commercial banks. Following the high-price period of 2012 to 2014, delinquent loan shares fell to multi-decade lows before beginning a five-year ascent. The Federal Reserve’s most recent estimate is that 2.32% of loans secured by farmland were delinquent in the second quarter of 2019, above the 2000 to 2018 average of 2.1%. However, farm delinquencies remain below long- run averages that account for the latter portion of the 1980s farm financial crisis as well as the 1990s.

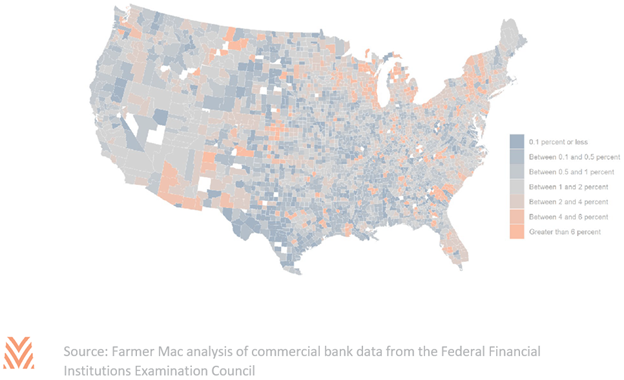

Many Regions Show Low Strain, While a Few Exhibit Considerable Stress

While national strain has increased moderately, a different picture emerges when looking at commercial bank delinquencies by region. By allocating delinquent loan volumes to counties, using a combination of regulatory information and data from the Census of Agriculture, a picture emerges of low overall national strain, with pockets of stress. Specifically, many counties in Wisconsin, Minnesota, and New York are estimated to have at least 6% of their agricultural loan volumes delinquent.

These states all are heavily focused on dairy products and milk, with dairy sales ranging from 20% to 50% of total cash receipts. The dairy industry’s struggles aren’t new: dairy products saw a less prolonged price increase than many other commodities between 2012 and 2014, and prices have remained low since 2015. The regional patterns apparent in 2019 did not begin until 2017, several years after the start of the current low-price environment. One possible explanation for this gap is that producers can keep current on their debts despite lower income by relying on either working capital or equity. By the time delinquencies begin to show, operations may have exhausted other options to stay current on their debt.

Price shocks to commodities with strong regional concentration may give us insight into how delinquencies will be distributed in the future. In the case above, specific shocks to dairy and select fruit products manifests as pockets of higher delinquency. If the relationship between sustained low prices and higher delinquencies holds, entirely different regions could see strain in 2020. Moderate increases in strain nationally can mask high strain in select regions, but specific regional strain doesn’t imply higher strain nationally. And five years into the current period of lower farm incomes, many regions appear to have made the adjustments necessary to keep current on their debts despite the lower price environment.