Land Sales Slow in Response to Higher Rates

The velocity and value of farmland sales are influenced by numerous inputs that push and pull on the supply and demand of farmland, which create the market clearing prices (i.e., the price points where supply and demand are in equilibrium). Higher commodity prices and inflation tend to boost farmland values, incentivizing landowners to sell, leading to more transactions. Farm operators’ changing demographics also play a role in farmland sales as landowners and operators age, retire, or consolidate.

Another major influencer is the cost of capital, most often proxied by interest rates. Falling interest rates can make real assets like farmland more appealing to buyers due to their long-term, reliable returns. Conversely, rising interest rates can slow farmland sales as buyers weigh the increased cost of borrowing. Farmland owners looking to sell today and buy other assets may be less motivated after comparing their locked-in interest rate with current market rates. This phenomenon is known as the “lock-in effect” and is also playing a notable role in the residential housing market.

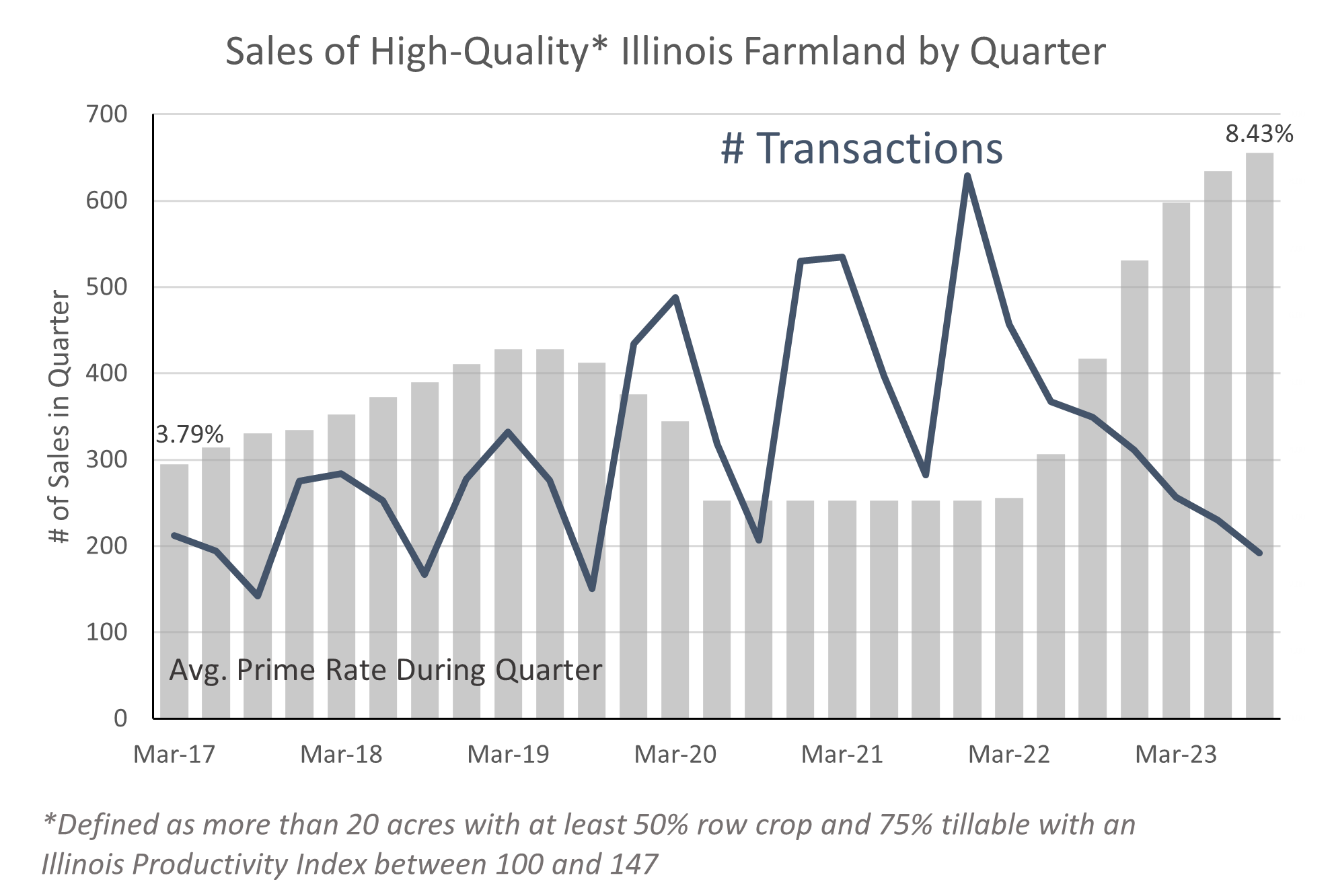

According to data from AcreValue, in periods of rising interest rates like 2018/2019 and 2022/2023, farmland transaction activity slowed significantly relative to the historically low-interest-rate pandemic era. Looking at Illinois as an example, sales of high-quality farmland in 2023 have fallen 60% since peaking in the fourth quarter of 2021. During that same period, the prime rate, the most common benchmark consumer interest rate charged by commercial banks, increased from just over 3% to over 8%. The last time Illinois farmland transactions were this slow was in 2019 when the prime rate rose from 3.8% to 5.5%.

Broad Geographic Pullback in Transactions

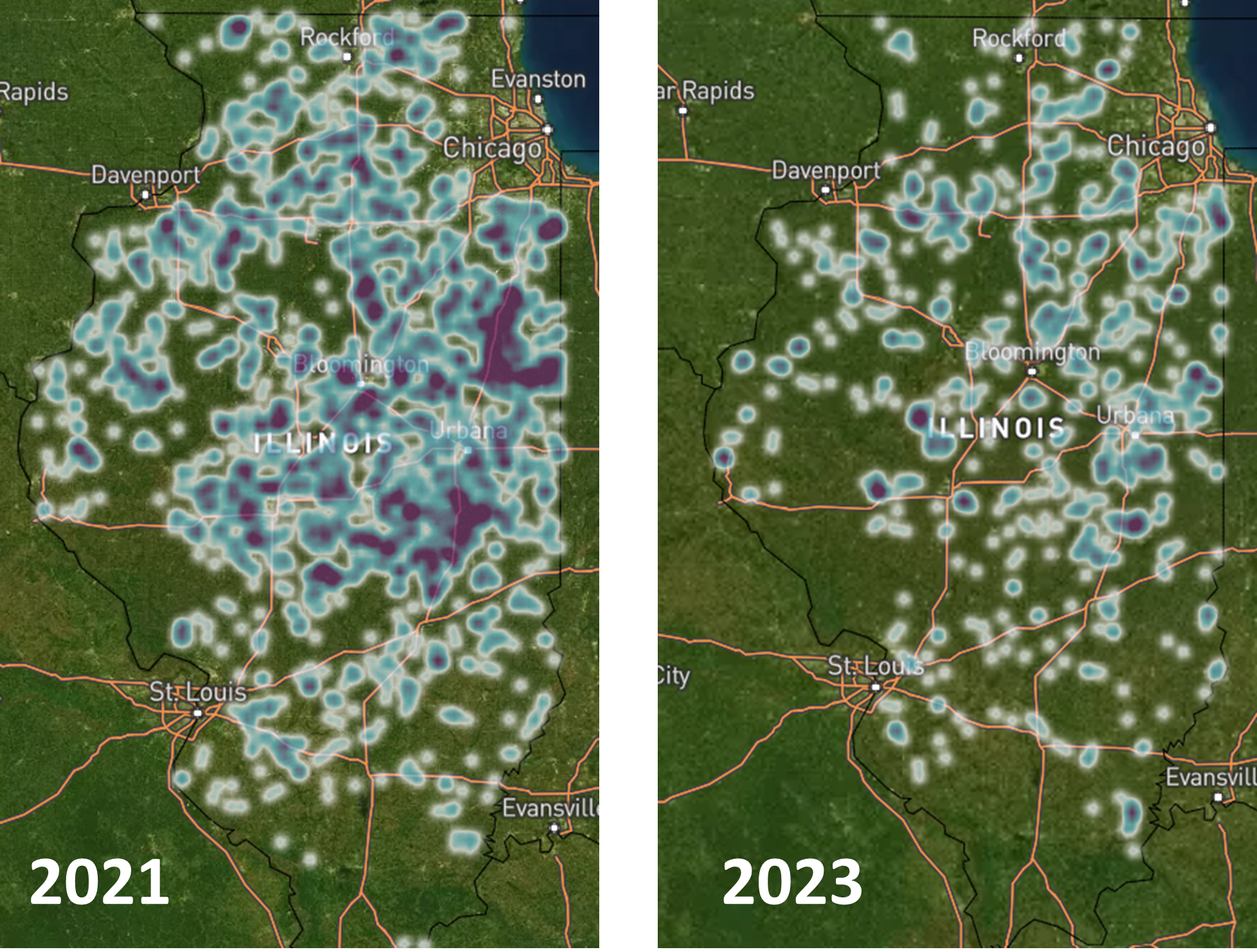

Data on Illinois can also be used to demonstrate broader trends happening across the region. Comparing Illinois farmland sales in 2021 and 2023 reveals a dramatic decline in activity between these two very different interest rate environments. A land sales heat map in 2021 shows vibrant colors in all corners of Illinois, while the 2023 map is sparse and spotty across all areas.

Interest rates are not regional, and the effects of higher rates are felt in all land markets and agricultural production regions resulting in a slowdown in land sales activity across most major agricultural states. Data from AcreValue demonstrates these trends have been felt across the Corn Belt, throughout the Plains, in the West, and into the Southeast.

Implications for Lenders and Landowners

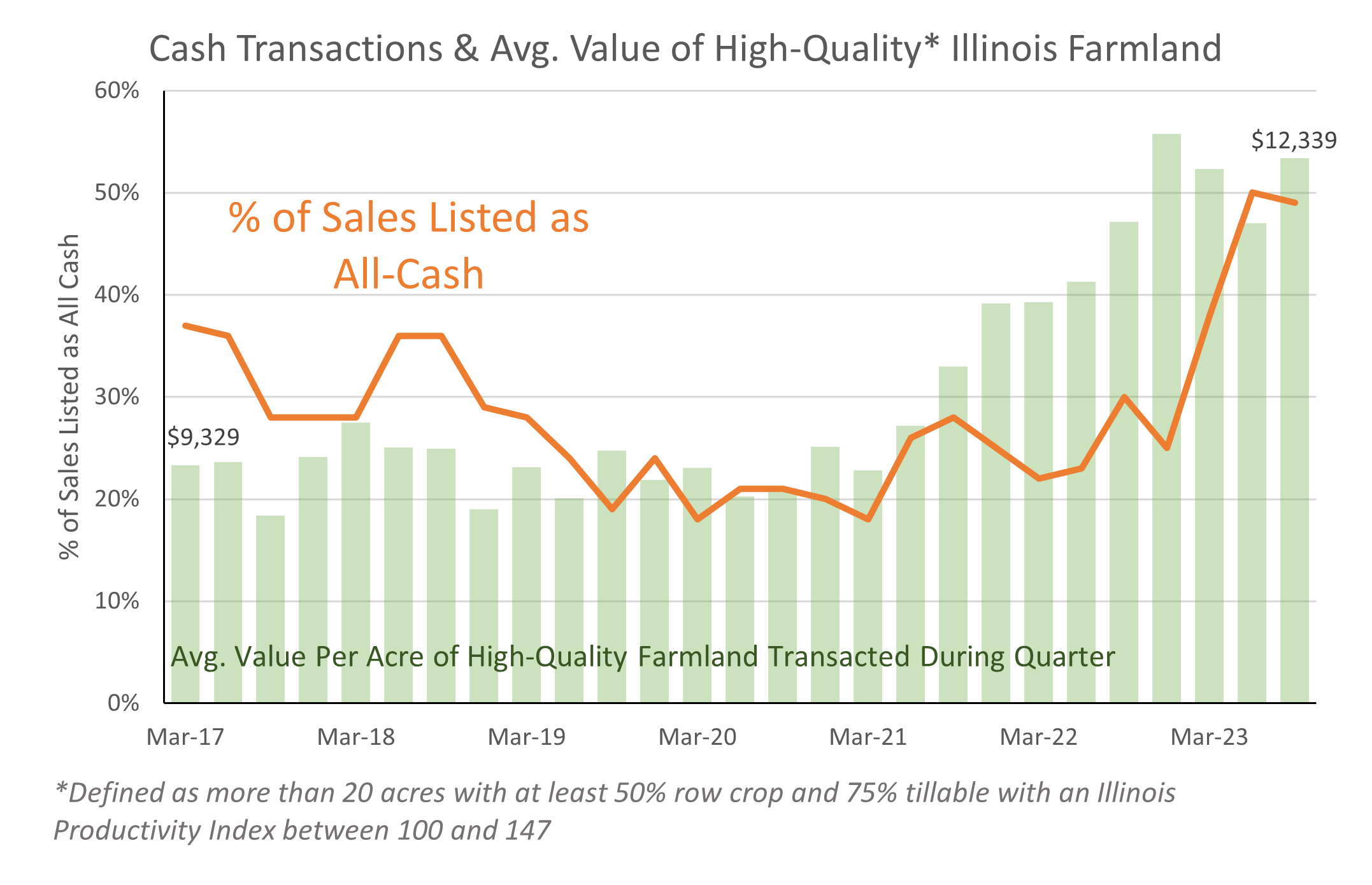

The changes in sales activity and interest rates have several implications for landowners, investors, and lenders. First, land buyers have had fewer purchase opportunities in recent quarters because of the slowing sales. Second, the drop in land available for sale has helped to support land values. An average acre price of high-quality Illinois farmland sold for $12,339 per acre in the third quarter of 2023, a 5% increase from the third quarter of 2022 and a 13% increase from the peak of sales activity in the fourth quarter of 2021. Finally, the higher interest rate environment has lowered the demand for debt capital on the sales that occurred in recent quarters. During the low-rate environment of 2021, only 20% of Illinois farmland sales were all-cash and free from mortgages. In 2023, nearly 50% of Illinois farmland sales were all-cash, demonstrating the increase in all-cash purchases and corresponding decline in demand for farm loans to finance land transactions. Borrowers often balance higher rates with lower loan amounts to manage annual total debt service requirements.

Conclusion

All things equal, the higher interest rate environment will likely continue to keep downward pressure on the number of land transactions and, thus, provide some support to values. Ample cash has allowed many land sales to transpire without using mortgages or financing, decreasing lending activity relative to 2021.

Many factors could change this calculus in 2024. Tightening profitability, dwindling cash, landowners taking advantage of high prices and high rates of return on alternative investments, or lower interest rates could all change the balance of land supply and demand. Looking ahead, lenders and potential land buyers could see increased activity in the coming quarters as conditions change and the lock-in effect wanes.