Hogs

Hog markets have been volatile in early 2020. U.S. producers expanded production throughout 2019 as the African swine fever (ASF) hit China, and there was speculation of growing Chinese imports. The USDA’s March 2020 Quarterly Hogs and Pigs report revealed that hog inventory is up 4% over first-quarter 2019 levels, and is the third-highest on record. Roughly half of the annual increase is from operations in Iowa. Global hog inventory remains down from the spread of ASF, but pork production has edged up in the U.S., Canada, and China in early 2020.

The demand surge expected by producers started to materialize amid strong domestic consumer response from the COVID-19 pandemic and a slow recovery to China’s export supply chain. Grocery meat cases across the U.S. have seen a remarkable pickup in demand, as consumers respond to stay-at-home orders and stock up on food items. As freezers fill up and extreme home food buying slows, the domestic demand should ease somewhat. Fortunately, the supply path to China is easing as more of their employees return to work. Weekly pork exports picked up in early March after slowing considerably in the first quarter. Pork exports are coming off a year that set records in both quantity and value shipped, and 2020 could maintain those high levels, even with a dip in the first quarter.

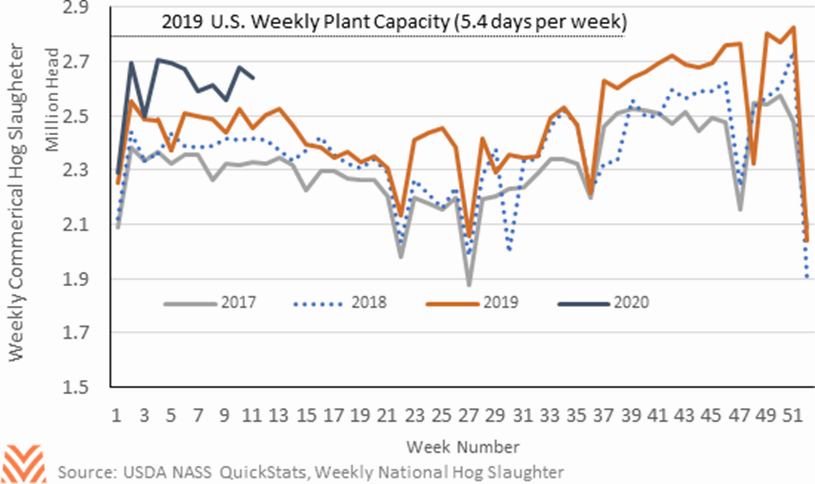

Due to the flux in supply and demand, hog operations will continue to see price volatility in 2020. Lean hog prices, like most commodities, fell precipitously in early March as markets reacted to the self-imposed economic slowdown to curb the spread of COVID-19. Futures and animal auction prices fell in February and early March, driven by hedgers pulling back. Prices rallied during the third week of March as commercial buyers returned to the markets while exports remained high, and processors worked overtime to move pork through the supply chain. Strong retail demand and the thawing of export shipments look to support prices in the last second or third quarter. Additionally, a drop in grain prices helps offset some of the pricing decline. However, prolonged or widespread slaughterhouse closures could swamp hog supplies, leaving producers nowhere to go with their animals.