Grapes

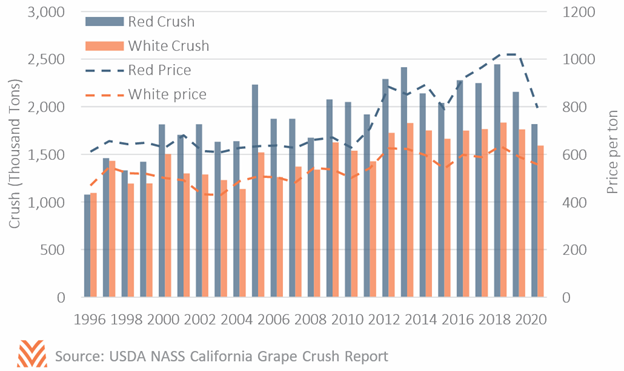

Of all the commodities impacted by COVID-19, grapes may have seen the most strain. The collapse of the restaurant and hospitality industries had severe impacts both on table grapes and wine. Producers who had relied on service sector outlets for their products had to reroute through grocery stores, which was challenging for smaller winemakers. Data released over the last two months paint a picture of an industry that saw declines in 2020. In California, average prices for wine and table grapes fell through 2020, despite lower crush totals. The combination of these factors implies revenues that were up to a third lower than prior year totals. In Washington state, wine producers did not see price declines, but also saw crush totals fall to recent lows.

These numbers suggest significant oversupply in the grape sector last year, and new USDA NASS data indicate that producers may be adjusting. In 2020, non-bearing acres fell more than 10% for both table and wine grapes. This indicates that producers may be scaling back on newly planted acres, which will reduce future supply. However, as grape vines take up to three years before first harvest, this reduction in new acres will have little impact on 2021 production. Over the short term, grape producers will need more help from the demand side.

Initial data suggest good news for grape demand in 2021. According to Google mobility data, more than half of states have already returned to pre-pandemic retail mobility levels, and some were well above baseline as consumers have flocked back to bars and restaurants. In March, retail sales at restaurants and bars were within 5% of pre-pandemic levels and had seen sharp upward swings from prior months. Many restaurant owners still believe the best is yet to come. The National Restaurant Association’s index of expectations found that expectations for the second half of 2021 are the highest since they began collecting data in 2003.

All of this points to potential strong demand for grapes of all kinds through the end of 2021. USDA AMS has already seen an uptick in grape imports, which may signal greater winemaking activity. While total wine export values remained low through February 2021, the average price has risen to pre-pandemic levels. Some of this may be due to the resilience of high price products, but on average it signals a strengthening industry. In short, all grape producers are likely to see some benefit from the recovering service sector—which many Americans, including the authors of The Feed, intend to support heartily in the coming months.