Grain Producer Income to Pull Back from Strong 2021

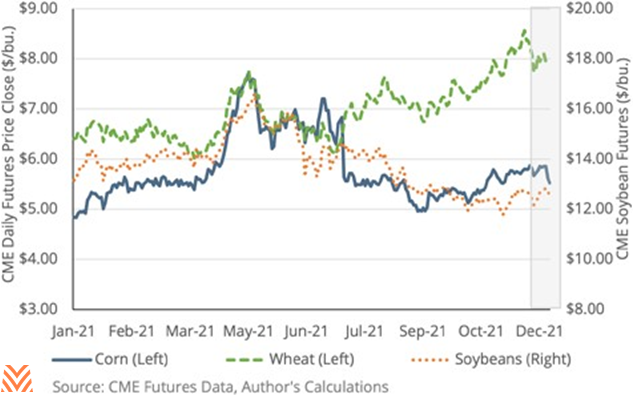

Many farm income statements look considerably better in 2021 than they did at any point in the last five years. Major grain commodity prices held firm this year, with corn, soybean, and wheat prices touching eight-year highs at some point during the calendar year 2021. Extremely strong exports for both corn and soybeans drove the liftoff in late 2020, and fears of tightening supplies drove a surge in mid-2021. Better-than-expected yield expectations started to bring corn and soybean prices back down in the summer months, but wheat prices continued to hang at multi-year highs with dwindling quality due to drought conditions across the upper Plains and northwestern states. Spring wheat conditions closed out the 2021 season the lowest in 35 years of recorded history, with only 11% of acres reported as “Excellent” or “Good” quality. Global supplies remained tight near year-end, keeping all-wheat prices near supercycle era highs. Global demand and commodity prices were boosted by a 10% drop in the value of the U.S. dollar between March 2020 and June 2021.

The healthier commodity prices raised farmers’ pay considerably during 2021. While total incomes were up in 2020, the real growth came from government support payments. Supply chain disruptions combined with overall demand constraints caused an unprecedented amount of government aid to be disbursed in 2020. Through the Coronavirus Food Assistance Program (CFAP) payments, the USDA distributed more than $23.5 billion to American farmers and ranchers during the year, and between 2020 and 2021 payments, more than $11 billion went to corn, soybean, and wheat production. In 2021, the story was slightly reversed. Government payments dwindled as commodity prices surged. The USDA forecasts that crop cash receipts surged nearly 18% in 2021, which came from higher corn, soybean, and wheat prices. The USDA estimates that average farm businesses involved in corn, soybean, and wheat production rose by 44%, 40%, and 20% in 2021 compared to 2020, respectively.

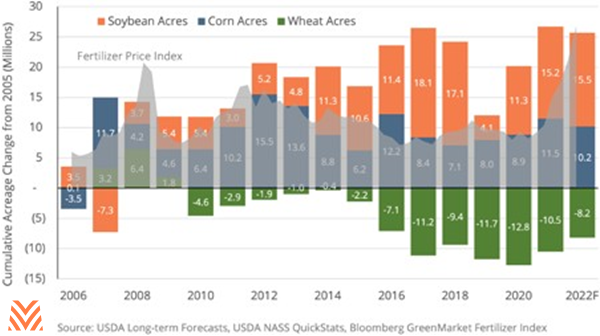

As 2021 wraps up, producers turn to plan and strategize the 2022 planting season. Since 2005, U.S. corn acres are up by 15 million, soybean acres are up 10 million, and wheat acres are down 8 million, a result of market demand and crop profitability (see the figure below). The USDA’s first release on 2022 planting expectations shows a modest decline in corn acres (1.3 million acres down), flat soybean acres (0.3 million acres up), and a substantial increase in wheat acres (2.3 million acres up) compared to 2021. That is a very small change overall, considering the level of disruption affecting the input cost equation.

Fertilizer prices are up nearly three-fold compared to late 2020, a result of higher energy prices, tighter global supply chains, and sanctions on Belarusian exports of potash. Fertilizer prices were this high in 2007, and there was a bigger change in acreage then than the USDA projects for 2022. Corn and wheat are much more nutrient-intensive compared to soybeans, and in 2008, nearly 11 million acres came out of corn and wheat and went into soybeans. One outcome in 2022 may be that farmers minimize costs and rotate away from corn in a similar pattern to 2008. However, global supply and demand for soybeans and wheat could tilt the equation back towards stability.

Land is another important input cost consideration for producers. Midwestern land values had a stellar run in 2021, with good quality farmland experiencing double-digit gains in Iowa, Illinois, Indiana, and Wisconsin. While cash rental rates did not rise substantially during the 2021 season, the combined forces of higher land values and higher profitability make a rise in 2022 much more likely. Cash rental rate increases tend to happen in the same year or on a one-year lag from major increases in commodity prices and profitability. Rental rates also correlate with increases in land values.

These increased input costs may put downward pressure on crop profitability in 2022. Fertilizer costs and land costs combine for some of the largest categories of input expense, and a 1% increase in each causes a 0.75% decrease in producer profitability. Budgets for 2022 should have some buffer built into them in order to absorb the uncertainty of these input costs. There is some movement in energy and nutrient markets that may give hope of a fertilizer price reprieve in time for planting, but for now, these trends look to hold through mid-year 2022.