Farmland Values

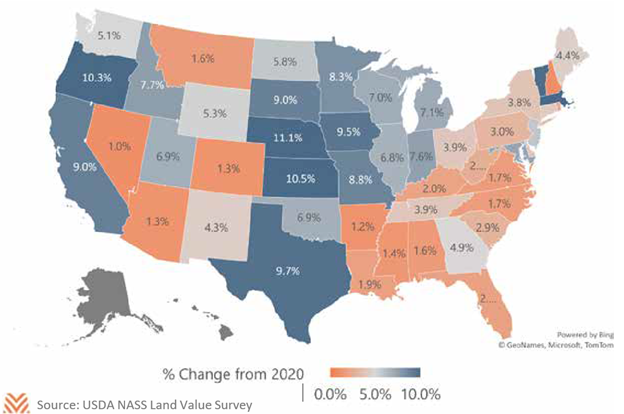

Farm real estate values have risen rapidly in the last six to twelve months. Surveys from the Federal Reserve Bank of Chicago show an increase of between 6% and 10% in Illinois, Indiana, and Iowa from September of 2020 and March of 2021. Researchers at Iowa State University measure the increase in land values in Iowa between the third quarter of 2020 and the first quarter of 2021 at nearly 20%. The Federal Reserve Bank of Dallas estimates average land values in Texas increased 11% during that same time frame. And the benchmark USDA Land Values report shows a national increase of 7% between June 2020 and June 2021.

Numerous economic factors contributed to the recent movement in land markets. The general increase in crop commodity prices in 2020 boosted the profitability outlook for 2021 and 2022. Combined with a generous amount of government support for COVID-19 disruptions, solid cash inflows gave many producers and land investors ample liquidity and working capital heading into 2021. Finally, the persistently low interest rate environment lifted all real assets, including farm real estate.

Profitability and Liquidity

The agricultural production sector experienced a broad increase in profitability and cash flow in 2020. While grain and livestock prices dropped early in the pandemic, grain prices ended the year up approximately 30%. The run on grain commodity prices continued in 2021 due to low global supplies, increasing international demand, and a weak U.S. dollar, all contributing to price appreciation. In early August 2021, corn, soybean, wheat, and cotton prices remained between 30% and 75% above early 2020. Hog and poultry prices are also elevated in 2021, helping to boost production economics in many protein-heavy production regions. Adjusting county-level revenue levels for recent surges in commodity prices, producer revenues are up nearly 30% in 2021 for major corn and soybean states like Iowa, Illinois, and Indiana, and more than 20% in Northern Plains states like Minnesota, South Dakota, and North Dakota, compared to 2017 levels (the latest Ag Census data available).

While higher farmgate revenues are a big variable in land value appreciation, recent government support programs are another important source of cash flow and liquidity for producers. The Coronavirus Food Assistance Program (CFAP) allowed the USDA to aid farmers, ranchers, and others in the food supply chain with direct payments distributed in 2020 and early 2021 to help offset the market disruptions from COVID-19. These payments came on the heels of the Market Facilitation Program (MFP) payments in 2019 and early 2020, giving agricultural producers two years of very high government support payments. The USDA estimates that government program payments represented over 5% of gross farm income in 2019 and over 10% of gross farm income in 2020, compared to a prior-five-year average of 3% per year. These payments helped restore much-needed working capital across the ag sector, and they gave many operators additional liquidity to tap for expansion and new land purchases. Seven of the top ten states by CFAP receipts are also in the top ten states by farm real estate value change in 2021. Overall liquidity in the U.S. economy can also be evidenced by the incredible surge in bank deposits in 2020 and 2021. Total commercial bank deposits ended July 2021 at $17.3 trillion, a $4 trillion increase from December 2019.

Interest Rates

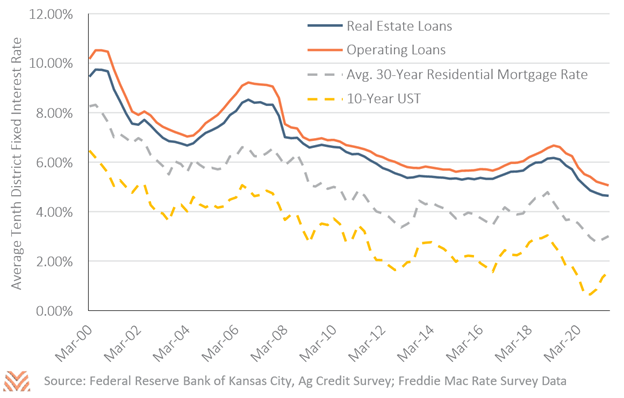

Interest rates for agricultural production remain near historic lows in 2021. The average fixed interest rate on real estate loans in the Federal Reserve Bank’s Tenth District fell from 5.31% in the first quarter of 2020 to 4.64% in the second quarter of 2021, as seen in the figure below. Meanwhile, average rates on farm operating lines have also dropped in the last year, while interest rates for farm production have generally tracked with residential mortgages and U.S. Treasury rates.

This lower interest rate environment has two effects on farm finances. First, the lower interest rates decrease interest expenses for producers with farm debt. Farmers can save between 7% and 14% in debt costs annually, depending on the term and tenor of financing. Second, a lower interest rate environment reduces the required return investment threshold in farmland to make the investment attractive. A lower hurdle rate due to lower interest rates can increase the willingness of investors to invest in an asset, and thus drives asset prices higher. The capitalization approach to farmland valuation implies that this downward shift in interest rates, if lasting, could drive an increase in farmland assets between 10% and 20% compared to mid-2020 levels.

Outlook

Persistent upward pressure on commodity prices and downward pressure on interest rates will likely help boost farmland values into 2022. Auction markets continue to see strong bidding and limited supply of land coming to market, which bodes well for the farm real estate assets that do come to market in the coming months. Markets may hit some resistance in 2022 if Federal Reserve monetary policy tightens or commodity prices back off recent levels. Water availability could also play a role in Western states. Access to adequate water may prove to differentiate property values rather than move the average. Slowing cash liquidity could also present a headwind to values in 2022; while commercial bank deposits remain at all-time highs, the growth stalled in May, reversed in June, and trod water in July of 2021.