Farm Income Forecast Reveals a Mixed Bag

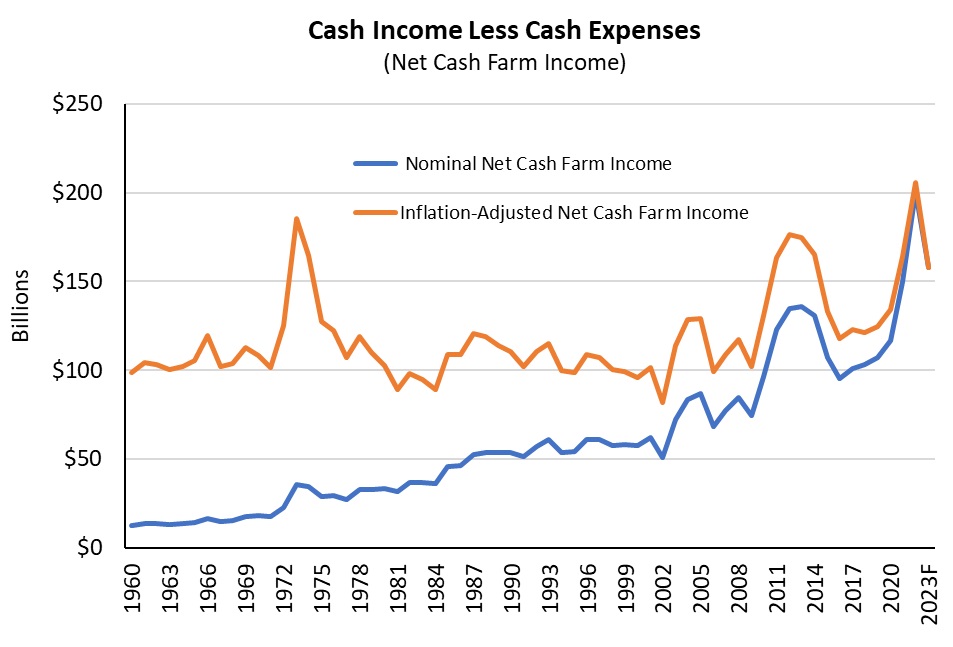

The USDA released its final forecast for 2023 farm incomes in late November. In its updated report, the USDA projects that net cash farm income will drop to $158 billion in 2023 from over $200 billion last year. The headline-grabbing 21% decline would mark the largest percentage drop in over 60 years. However, the decline also potentially overshadows an equally important story. Farm incomes reached record levels in 2022 and, if projections are realized, would still be nearly 50% higher than the trailing 20-year average. Producers entered 2023 on strong financial footing and elevated incomes are projected to further boost financial conditions, albeit to a lesser extent than in 2022.

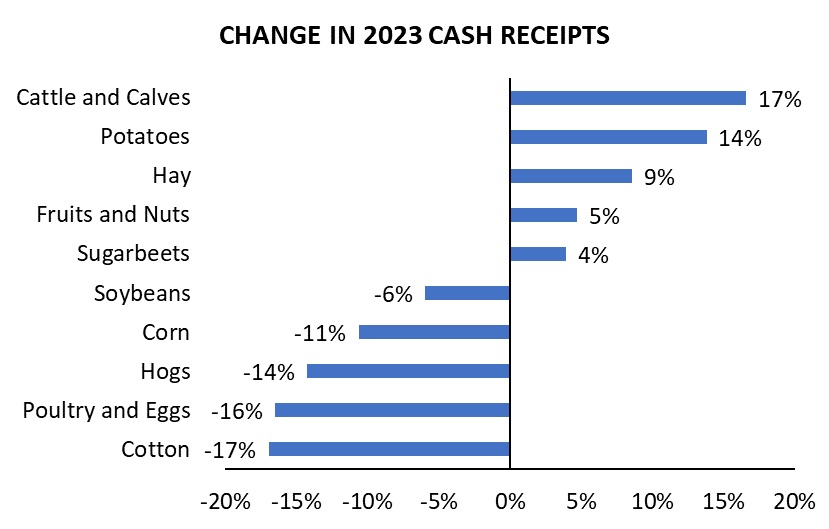

Lower farm incomes are partially the result of declining farm revenues. Crop and livestock receipts are forecast to decline 4.4% and 5.0%, respectively, in 2023. However, there is significant variation within each of these categories. For example, corn receipts are forecast to drop 11% in 2023, while hay receipts are expected to increase 9%. Likewise, in the livestock sector, pork receipts are projected to drop by 14%, while beef receipts are expected to increase by 17%. Each of these commodities has faced different supply and demand circumstances in 2023, but in aggregate, total farm receipts are expected to decline 4.4%. On top of lower receipts, government payments are also projected to decline. Government payments, which are often countercyclical, are projected to drop 22.3% in 2023 to $12.1 billion. However, this drop still reflects the ongoing profitability in the sector because most of the projected payments are related to conservation programs.

Beyond declining receipts, higher expenses also contributed to tighter profitability this year. The factors driving the increase in 2023 were starkly different than those that fueled the increase last year. Fertilizer prices surged in 2022 following Russia’s invasion of Ukraine but have since retreated near 2021 levels. Seed, pesticide, and fuel costs are all also projected to decline in 2023 after increasing last year.

Instead, the growth in farm input costs this year is largely attributable to higher interest expenses. Total interest expense is expected to increase by $10.3 billion (43%) to $34 billion this year, more than double the 2015 total. The surge reflects the sharp rise in both short- and long-term interest rates. The impact of financing costs on producer cash flows will likely remain an important topic moving forward if the Federal Reserve maintains tighter monetary policy to combat inflation.

Strong Farm Incomes Boost Balance Sheets

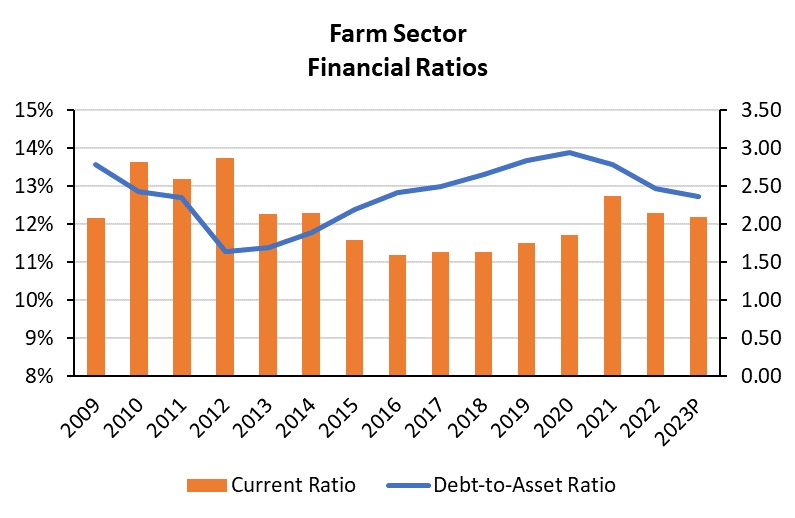

Consecutive years of strong farm incomes have boosted the overall financial position of the agricultural sector. The USDA projects that the farm sector debt-to-asset ratio will improve again in 2023, dropping to 12.7% from 12.9% last year. The decline is not attributable to a decline in farm debt, which increased 5% to $521 billion. Rather, the improvement in the farm sector debt-to-asset ratio is attributed to a gain in farm assets. Among farm sector assets, farmland is the largest and constitutes nearly 85%. Nationally, farmland values increased 7.4% per acre on average this year, boosted by strong farm incomes and a combination of other tailwinds. Rising farmland values helped boost projected farm sector equity by $244 billion in 2023. Of course, balance sheet equity can fluctuate year-to-year based on changes in asset prices. However, stronger balance sheets can provide a cushion to producers as profit margins are squeezed.

Indeed, not all financial ratios are expected to improve this year. The USDA projects that farm sector working capital will decline by $6 billion in 2023, dropping the sector’s current ratio from 2.15 to 2.09. Working capital generally includes a producer’s most liquid assets, such as cash, and helps gauge a producer’s ability to meet short-term obligations. A decline in the sector’s current ratio suggests farmers may be using their liquid assets for purchases rather than tapping into long-term equity sources, which is most commonly farm real estate. One motivating factor for this behavior could be rising interest rates. As interest rates have increased, producer preferences when making purchases may have shifted away from debt and towards using cash. Still, the USDA projections show the sector’s current ratio will remain strong into next year and the farm sector overall remains on solid financial footing.

Outlook for Farm Incomes

Many of the prevailing factors pushing farm incomes lower in 2023 could persist into next year. Global crop inventories have started to rebound, and prices are likely to fall if supplies continue to trend higher. Acknowledging this, farm incomes are unlikely to plummet in the near future. Farm-level prices today and futures market prices for many commodities remain elevated relative to historical averages. This, combined with lower crop input costs, bodes well for farm profitability in 2024, even if net cash farm income were to decline again.