Farm Income Can Push and Pull on Rural Economies

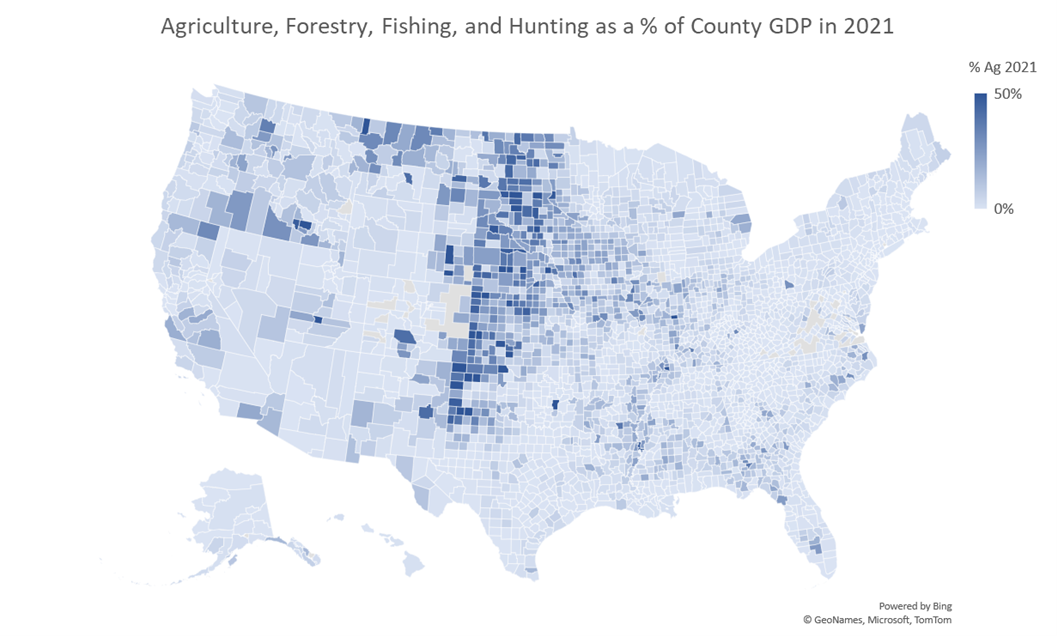

There may be no other U.S. industry with as direct an impact on the economic vitality of its surrounding communities as the ag sector in rural America. Farm incomes in particular serve as an important determinant of rural prosperity.

Encapsulating net farm income and net cash farm income, farm incomes represent the financial returns to all the stakeholders involved in farm production, including operators, landlords, and contractors. They are a critical component of rural economic growth, influencing investment in agriculture, stimulating local businesses, and supporting public services.

In 2022, net cash farm income reached a record high of $202.2 billion, marking a $52.9 billion (35.4%) increase from 2021. However, the USDA’s August forecast for 2023 indicates a decrease of $53.6 billion (26.5%) to $148.6 billion. While the current levels of economic activity are still above historical averages in most ag-intensive regions, this volatility could have important implications for rural communities given how heavily farm incomes can weigh on local economies.

Farm Incomes Help Shape the Economic Landscape of Rural Communities

Farm incomes directly impact the purchasing power of producers, influencing their ability to invest in farm inputs, machinery, and technology. An increase in farm income drives up working capital and capital investment. Conversely, a decrease in farm income, like the one forecasted for 2023, has historically correlated with slowed spending on farm capital investment alongside a rise in the use of debt capital to offset declines in annual income.

The vibrancy of rural businesses is also influenced by farm incomes. Producers’ spending on goods and services stimulates local economies, creating jobs and fostering economic diversification. That means that changes in farm income could lead to expansions and contractions in local business spending and, ultimately, to changes in local unemployment and poverty rates in rural areas.

Finally, farm incomes contribute to the local tax base, supporting public services such as education, healthcare, and infrastructure development. During ag expansions, there can be a revival in many of these services; conversely, a decline in farm incomes can slow down the provision of these essential services and investments.

Conclusion

As we navigate the complexities of the 21st-century economy, the importance of farm incomes to rural prosperity cannot be overstated. This also means that any potential volatility in farm incomes in 2024 should be monitored in the coming months.

Ag and rural lenders are important capital providers at both ends of the farm revenue cycle: providing the working and investment capital that helps fuel business expansions and new land purchases, as well as the debt capital to help offset income declines. Historically, however, often their biggest impact comes from the services they provide during slowing farm economies. As we face a potential pullback, ag lenders can play a vital role in helping to keep farm capital flowing.