Dairy Profitability Stressed Despite Strong Prices

Over the last several months, dairy producers have seen a tale of two markets. As of the beginning of March, early 2022 futures contracts for class III milk were almost 50% above 5-year values. In 2021, the U.S. exported a record value of dairy products, herd sizes fell, and inventories of solids like butter and cheese fell precipitously. The USDA Economic Research Service (ERS) forecasts that dairy producers will see nominal record net incomes in 2022, given the current price environment. However, producers were also met with some of the highest prices for feed in history, and prices for other inputs, like labor and energy, saw significant cost increases. This rising expense environment has been suggested as a leading cause for why herd growth has been limited, despite positive market signs.

For producers and lenders, the dairy markets of 2022 are best thought of in terms of profitability, not price. According to the 2020 USDA Agricultural Resource Management Survey (ARMS), the typical dairy business spent 75% of its gross revenue on operating expenses. This was the highest measure of any commodity measured in the survey, and it shows that dairy farms are uniquely susceptible to production cost increases. As feed costs represent almost half of all expenses for a typical dairy, the rise in feed costs represents a significant threat to profitability.

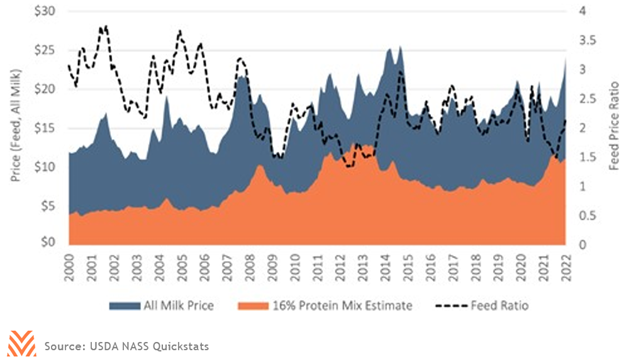

The figure below shows one common measure of how feed costs impact dairy profitability: the milk-to-feed price ratio. While recent milk prices are nearing heights set during the commodity supercycle, profitability as measured by this metric remains lower than it was through the majority of 2015 – 2019, which were years in which the sector struggled. Futures data suggest even more headwinds in the coming months, as corn and soybean futures surge while dairy has seen only modest gains. While no futures market exists for alfalfa, bids data point to strong price growth. In late February, California bids for supreme quality alfalfa were as high as $380 per ton.

The challenge for dairy producers is that feed expenses are only one aspect of the potential profitability concerns in 2022. According to the USDA ARMS, 12.5% of a typical dairy’s expenses were for labor costs in 2020. To date, labor costs increases have matched average national wage growth, with average farm labor wages rising from $15.87 to $16.59 between October 2020 and 2021. Current projections for national wage growth in 2022 are for less than 2021 levels. If farm labor continues to follow national trends, this implies that wage growth pressure for dairies in 2022 will be like the prior year.

There are several other costs that dairies are exposed to, although to a lesser degree. Many dairies grow their feed, meaning that surges in costs like fertilizers are relevant to many dairies. Energy costs also are a small but important part of dairy income statements, meaning that recent cost increases may further chip into profitability. In short, the caution dairy producers have exhibited in recent months is well deserved. Strong prices and robust exports are positive signs, but the rising expense environment can quickly eat into producers’ bottom lines.