Dairy

Few commodities saw as much volatility as dairy did through 2020. Dairy producers came into 2020 with high expectations after several important trade agreements and increased export opportunities. The burgeoning pandemic came to represent an existential risk, as dairy use in restaurants plummeted overnight and spot prices fell well below breakeven measures. Yet producers ended the year bullishly: USDA NASS found that producers increased their number of milk cows through the second half of 2020, and the USDA’s Economic Research Service forecasts that 2020 incomes for dairy producers were their highest since 2014.

One critical component of this volatility was the USDA’s Farmers to Families Food Box program. Of the round one contracts awarded, more than a quarter of the value was specifically for dairy products. This implies that of the $4.5 billion allotted for food box purchases, more than a billion dollars were expressly for dairy purchases. This represents a meaningful amount of the estimated $40 billion dollars dairy producers earned in 2020.

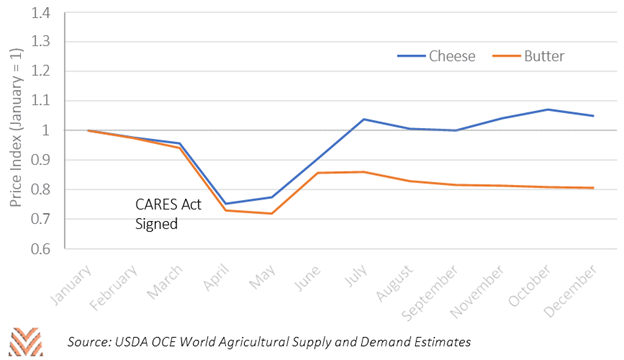

These purchases may have obscured some weakness in different subcomponents of the dairy market. Since March, strong pizza purchases combined with government programs led to stable markets for some dairy solids. However, drops in restaurant demand have hammered butter prices, which remain well below prior-year values. While the Farmers to Families program did have an impact on these markets, it is likely that a full recovery in the butter market will not occur until the service sector fully comes online, probably in the second half of 2021. Even then, high butter cold storage stocks may take months to come down to more normal levels.

Until the service sector can fully recover, the dairy sector remains susceptible to these severe price swings. As the USDA expended its initial $4.5 billion in emergency food purchases, futures for class III milk fell from high profit territory to below breakeven levels. The week Congress passed its December relief bill that included an additional $1.5 billion for purchases, prices immediately rebounded. That bill included an additional $400 million to pay for milk that would be processed and donated to nonprofit entities. While dairy producers may receive less total aid in 2021, these payments are a helpful stopgap until restaurant activity fully recovers.

Dairy producers faced more uncertainty than almost any sector in 2021, but have ended on a high note. This came from a combination of strong consumer demand for certain milk products, like liquid milk and pizzas, but was also contingent on strong government support. Producers are entering 2021 with more productive capacity even as restaurant activity continues to be well below prior year levels. While futures appear healthy through the first half of 2021, longer-term health may depend on the strength of restaurant recovery in the back half of the year.