Corn and Soybeans

Corn

U.S. corn production rebounded in 2020, a function of more acres planted combined with return- to-trend yields. Corn acres only increased by a modest 1% from 2019 levels yet yields increased 3%. The rebound in production drove domestic supplies back up to 10-year averages. The U.S. led the global recovery in corn production, with only Brazil and Mexico also posting meaningful production gains in 2020. Total world corn production set a record in 2020, topping the prior record set in 2017.

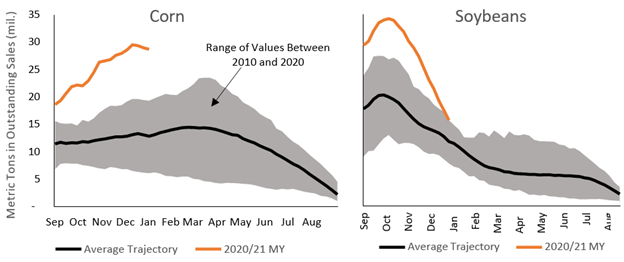

Corn demand is also up in the 2020/21 marketing year. Animal feed use is driving domestic demand up, but the pandemic-related drop in fuel offsets the rise, with ethanol production off 12% in 2020. Global demand for corn spiked this year, led by a rebound in China’s sizable hog industry. The USDA estimates China’s corn imports will increase 350 million bushels this year, much of which is already committed in U.S. export data. Outstanding corn sales for export are off the chart in the early part of the 2020/21 marketing year, nearly double the 10-year average and 50% above the highest level experienced in the last ten years, as the figure below shows. China’s Farm Minister raised corn import estimates again in mid-January, citing the recovering hog industry and the need for additional feedstocks. Food price inflation is running high in China, giving rise to the unprecedented import surge from the region. Without the high export sales levels to China, corn exports would be down in 2020 on reduced sales in Mexico and Japan, our top grain trading partners. Outstanding sales in winter tend to get converted to actual shipments in the spring months, so record high levels are likely to persist or even climb a bit until April or May.

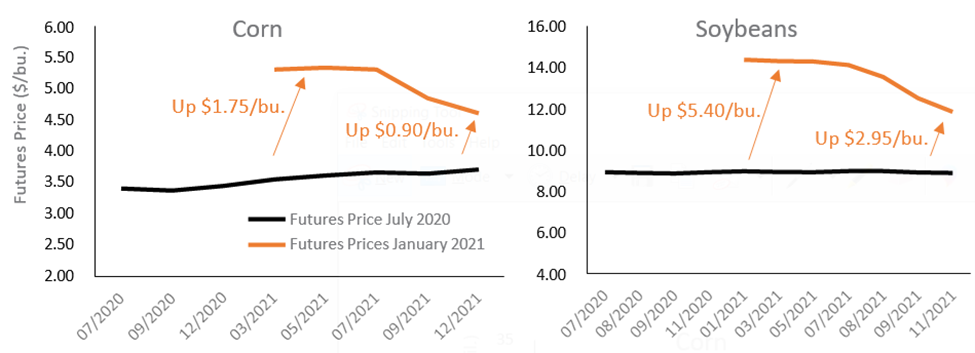

The spike in demand has been the catalyst for higher prices in the fall and winter months. Corn futures prices increased more than $1.75 per bushel between July and December, and the price curve is consistently hovering over $5.00 per bushel throughout the 2021 marketing year, as the figure below shows. The USDA estimates an average farm price of $4.20 per bushel in 2021, an 18% increase over the average 2020 price. Prices could moderate later in 2021, depending on the supply response to the higher prices and the rebuilding of corn stocks in China. Corn stocks-to-use, a ratio of supply and demand, is likely to be at its lowest level since 2014.

Soybeans

Both U.S. and global soybean production increased in 2020. Estimated production increased 16% in the U.S. due to an increase in both acres planted and average yields. More than half of the 7% rebound in global soybean production in 2020 came from U.S. producers. States notching the largest production gains include upper Midwest states, where acres and yield rebounded from a difficult 2019 growing season, and Missouri and Indiana, with record average yields for the crop year. Weather-related concerns have lowered output projections in South America, although rains across Brazil’s major growing regions in early 2021 have moderated some of those concerns. In its January World Agricultural Supply and Demand Estimates (WASDE), the USDA projected the second- largest soybean supply in history.

Like corn, the big story for the soybean complex in 2020 has been demand. The U.S. soybean crush has been very strong due to better prices and lower supplies in international markets. Meal demand has rebounded from a difficult 2019 as China has rebuilt its massive hog complex. Meal exports have followed a typical pattern this marketing year, but bulk soybean exports set records in terms of cumulative sales to date and outstanding sales in early January, as the figure below shows. Sales to China accounted for the bulk of the increase in 2020, but there were also sizable increases in sales to Egypt and the Netherlands. Vegetable oil prices have also been rising due to supply concerns, another demand pull for additional soybean crush.

Soybean prices reflect the higher demand and tighter- than-expected supply situation. Soybean futures rallied more than $5 per bushel between August 2020 and January 2021, a 56% increase. As of mid-January, the futures curve allows growers to price into 2022 at nearly $12 per bushel. This is a vast improvement over conditions just three months earlier. The biggest driver in the bullish market sentiment is the decline in expected soybean ending stocks. Global stocks- to-use are likely to fall to 0.14 in 2021, down from a peak of 0.19 in 2019. The U.S. stocks-to-use ratio is even tighter, falling to an estimated 0.03 in 2021 from 0.23 in 2019. These are the lowest stocks-to-use ratios since 2013, and in prior years with low relative stock levels, there has been a large production expansion the following growing seasons. Markets are pricing in a bounce in production into 2022, and that could indicate increased competition between U.S. and Brazilian producers. Infrastructure and transportation efficiencies will be incredibly impactful during such a production rebound.