Corn and Soybeans

Corn and soybean prices have continued their rapid ascent through spring, touching heights not seen since the supercycle era. Ending stocks-to-use ratios are forecast to be at historic lows at the end of the 2020/21 crop marketing year for soybeans and near record lows for corn. While global supplies are not as drawn down, markets have shown strong reactions to any changes in supply or demand due to very tight stocks. Poor growing conditions around the globe and some unexpected strength in biofuel demand have accelerated recent price increases.

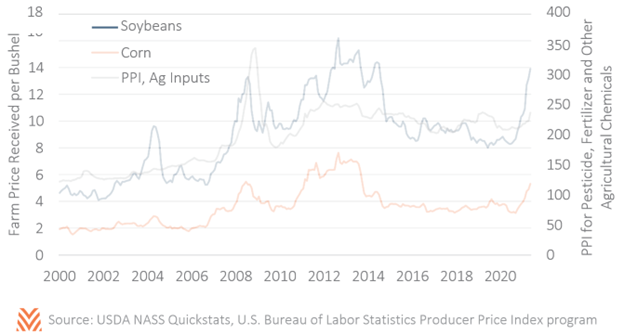

Even though this is good news for farmers who successfully raise a crop this year, producers may not capture the entirety of these high market prices. During periods of rising corn and soybean prices, costs of fertilizer, pesticides, and other inputs rise in tandem. For example, pesticide and fertilizer price indices rose 5% in Q1 2021 against where they were in Q1 2020. This increase alone suggests a $10 increase in operating expenses per acre of corn, assuming producers used the same number of inputs as the prior year. Current USDA forecasts for the 2020/21 CMY suggest that producers will gross on average $200 more per harvested acre of corn than they did in the 2019/20 CMY. While farmers may see some increases in operating expenses due to inflationary pressure on inputs, they should capture most of the higher prices.

The good news for producers is that these already strong prices may run up further. In early May, near- term corn futures shot up on news that corn use for fuel alcohol in March had risen to 420 million bushels. Rising ethanol prices have more than offset rising corn prices, meaning that corn use for ethanol may outpace the USDA’s current projections and place a further strain on tight corn supplies. The U.S. Energy Information Administration’s Short-Term Energy Outlook forecasts that oil prices will remain near current levels through at least 2022, implying some stability for ethanol prices. Those same forecasts indicate that motor gasoline consumption will rise above summer 2020 levels, even though current forecasts are below pre-2020 levels.

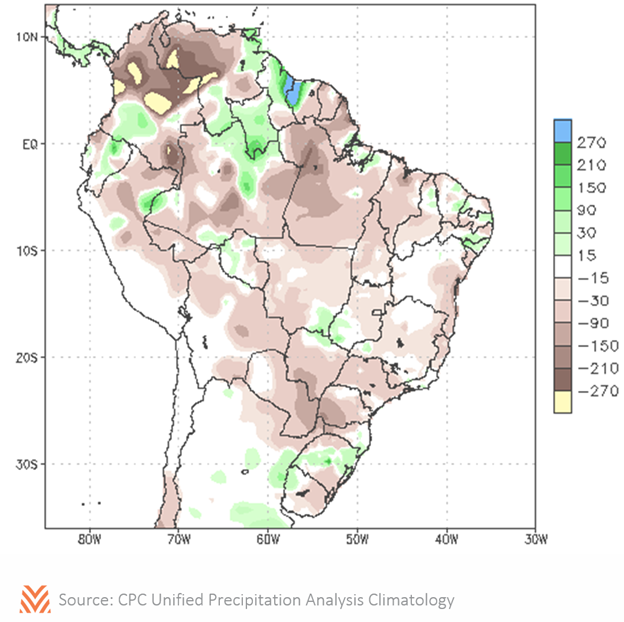

Producers are getting additional good news from overseas. Major growers like Brazil have seen dry weather patterns that have cut into expectations for soybean and second corn crop production. The figure below shows rainfall in South America relative to historic averages. Important growing regions like Mato Grosso do Sul and Paraná have seen severe shortages in rainfall, leading to very poor crop conditions. This will have the most impact on Brazil’s second corn crop, the Safrinha, which is predominantly harvested in May and June. Final production numbers are unlikely to reach earlier estimates, meaning that supplies will be very tight through the upcoming U.S. harvest.

However, there are growing signs that production for the 2021/22 crop marketing year could surpass expectations for both corn and soybeans. Initial World Agricultural Supply and Demand Estimates (WASDE) yield forecasts for the 2021/22 CMY point towards considerable increases in yields for both corn and soybeans. There have also been indications that far more acres could have been planted than estimated by the USDA’s initial planting intentions report. Despite corn farm prices received forecast over a dollar above 2020/21 CMY estimates, the latest WASDE report suggests that total acres will be almost unchanged from 2020/21 levels. A similar story has emerged for soybeans.

Commodities markets have already started to anticipate this additional production as industry forecasts point towards far more acres. Futures for new crop corn and soybeans have fallen well off- peak, even as old crop contracts remain near-record prices. USDA will update their 2021/22 CMY acreage estimates on June 30, and there is likely to be considerable volatility depending on the divergence between that update and private sector estimates.

Regardless of the June acreage report, corn and soybean producers can still expect strong incomes for the 2021/22 crop marketing year. Record Chinese purchases for both corn and soybeans have left global stocks near historic lows, and South American production has been weak. A weak dollar has further bolstered already strong exports. Ethanol prices imply profitability for those producers for corn prices as high as $8 per bushel. While corn and soybean producers might not see prices at supercycle heights for the 2021/22 CMY, most producers should expect to sell at levels well above breakeven through at least the start of the 2022/23 harvest.