Cattle and Calves

For cattle and calf ranchers, 2021 is forecast to look a lot like 2020, at least until late in the year. While many commodities have seen surges, cattle futures have been stubborn in recent months, despite improving restaurant demand and choice cutout prices. High feedlot inventories and slaughter weights have put downward pressure on prices, as ranchers are incentivized to push more cattle through to slaughter. Cattle also have not seen the export market surges that many other commodities have seen in recent months. In short, cattle markets are likely to face difficulties until inventories normalize by year end.

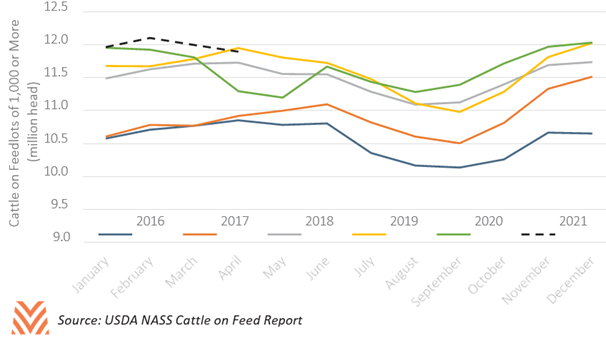

The amount of potential production in the cattle pipeline is near all-time highs. The number of cattle on large-scale feedlots in March was the second highest it has been since the late 1990s. Inventories climbed through the end of 2020, despite rising feed costs. These cattle are large, with dressed weights close to where they were in April 2020, at the height of slaughter disruption from the pandemic. This historic amount of beef in the pipeline prevented producers from seeing the full benefits of recent sharp rises in beef cutout prices.

Ranchers have been trying to work through this inventory. Beef production in the first quarter of 2021 matched the robust pace achieved in the first quarter of 2020. This pace would have almost set records but for disruptions in slaughter from the February storms that impacted much of the country. Ranchers have also seen rising feed costs for both alfalfa and corn, though alfalfa’s gains are not as extreme as corn’s. Between this and high dressed weights, producers are opting to send cattle to slaughter rather than waiting for the market to fully recover. This has led to forecasts for record total production of beef in the U.S. for 2021.

While beef is less exposed to export markets, it has seen less upside than anticipated at the start of 2020 in the immediate aftermath of several positive trade developments. Chinese and Korean beef purchases have been robust, but weak exports to Mexico, Japan, and elsewhere have lowered total export volumes. Beef will also see slower growth in developing export markets, like those in Southeast Asia and South America, as discretionary incomes in such countries have fallen in the wake of the global recession.

However, there is some hope for 2022. Beef supplies from major exporters like Australia and New Zealand have been tight, and trade agreements negotiated before 2020 still may lead to more beef exports in the future. Domestic consumption is likely to surge in the second half of 2021, which would help to soak up high production. While it will take time to work through the historic inventory backlog producers are facing, there is a strong possibility for good market conditions by the end of the year.