Brazil’s Bin-Busting Harvest Weighing on Commodity Prices

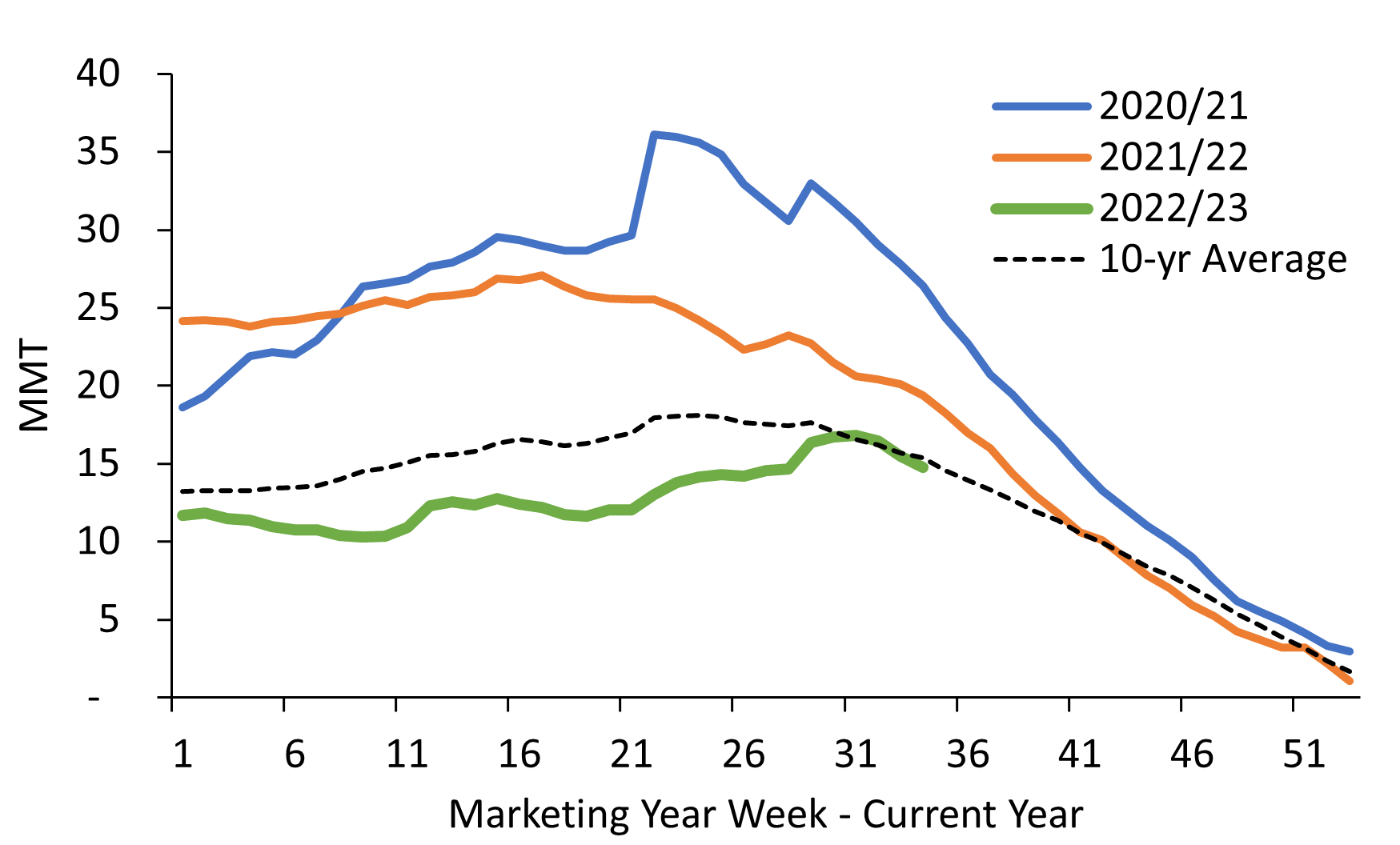

Commodity prices spiked in 2022, driven in part by tight global inventories and Russia’s invasion of Ukraine. Higher commodity prices helped boost U.S. farm incomes to the highest level on record. Since peaking in mid-2022, though, commodity prices have trended consistently lower. The Black Sea grain agreement which restarted commodity exports from Ukraine has contributed to the decline. Perhaps just as important though has been a jump in production in Brazil and other global competitors to the U.S. As a result, export demand for U.S. annual crops has been tepid in 2023 and could continue to face pressure.

Robust export demand for U.S. corn and soybeans helped lift farmgate prices to the highest level in nearly a decade in 2022. Prices have slid considerable in recent weeks though as the size of Brazil’s record harvest has come into greater clarity. Brazil’s corn and soybean crop is projected to increase 8% and 21% yoy, respectively, this year. Many importers have pivoted purchases to Brazil in order to capitalize on the bin busting harvest. Last week, China cancelled 327,000 MT of U.S. corn purchases, likely looking for Brazil to fill those sales instead.

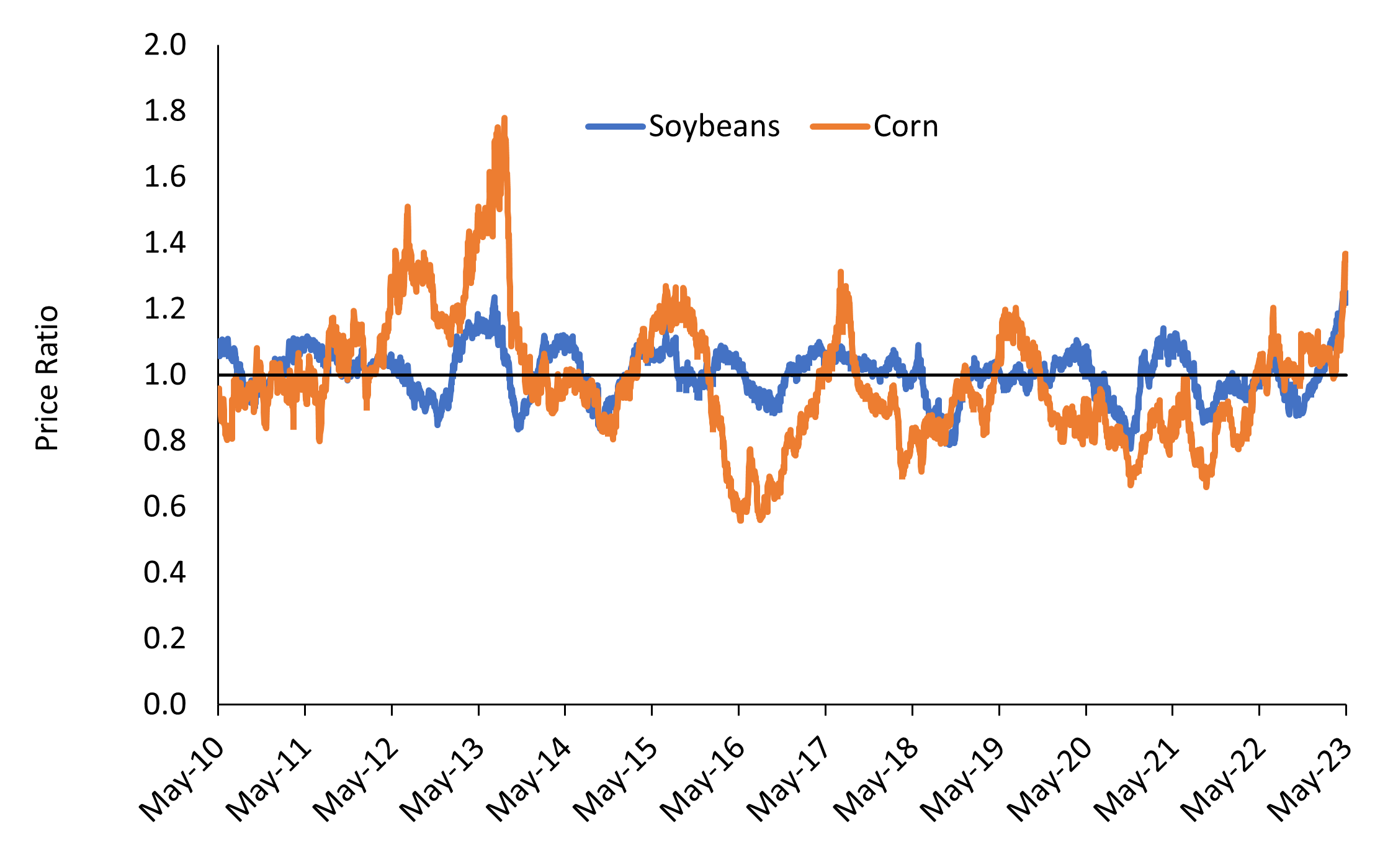

Complicating the matter for U.S. corn and soybean exports has been U.S. prices relative to Brazil. Commodity prices in the two regions have generally been closely linked, with seasonality causing fluctuations in which market is comparatively more expensive. Occasionally, though, noteworthy factors can arise that cause the relative prices in each market to deviate significantly from the other. The Midwest drought in 2012 caused the price of U.S. corn to surge relative to Brazil. On the other side of the equation, U.S. and Chinese trade tensions led to Brazilian soybeans commanding a premium price in the late 2010s versus U.S. soybeans.

Recently, the price of U.S. commodities relative to Brazil has swung dramatically higher. The ratio for corn prices is at the highest level since 2013 while the soybean ratio has not been this high since at least 2010. Spot prices for Illinois corn and soybeans have declined 7% and 6%, respectively, over the last month. In Brazil, though, spot prices have dropped a significantly larger 26% and 10%, respectively. The difference in declines is partially due to Brazil’s ongoing large harvest. However, this large of a gap in prices between the two countries has historically been short-lived. If 2013 serves as a guide for future commodity price movements, U.S. annual crop prices could see additional pressure.