Analyst’s Corner: Farmland Debt Leverage Cycles

In economics and finance, researchers frequently talk about cycles. Business cycles, credit cycles, housing cycles—the adage, “What goes up must come down,” is apt for many historical patterns economists and researchers identify in asset and economic behavior. One such leverage cycle concept that has started to see more attention in recent years is one in which the amount of debt associated with an asset class ebbs and flows based on market conditions, interest rates, and asset values. While it might be a relatively small asset class in the grand scheme of trillion-dollar capital markets, farmland debt follows an identifiable cycle of expansion and contraction. The drivers of the three prior farmland debt cycle contractions can help put current market conditions into context and guide predictions of where we are likely to go.

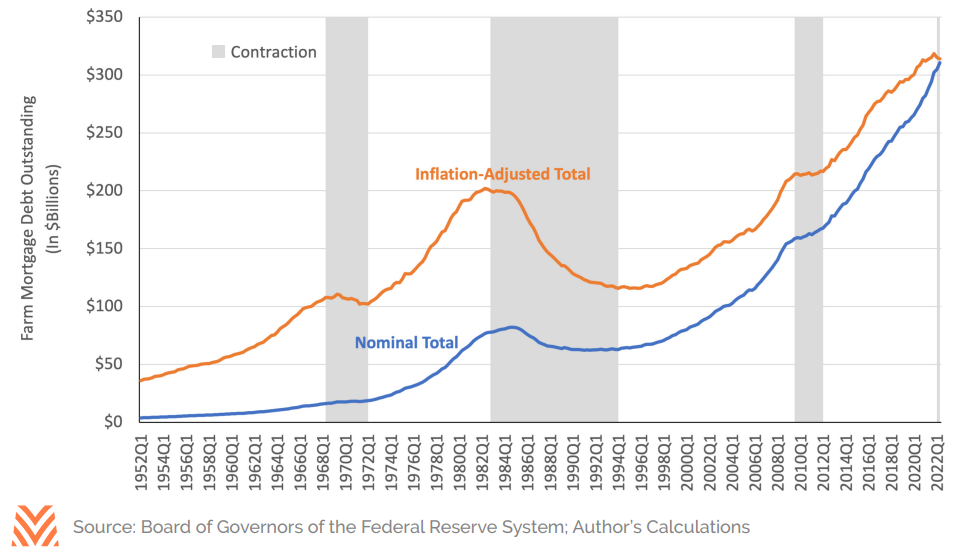

Plotting the historical path of farmland debt and inflation-adjusted farmland debt helps to highlight the timing and trajectory of farm mortgage debt. The figure below totals up reported loans backed by farmland mortgages at the four largest historical providers of farmland debt: Farm Credit System institutions, commercial banks, insurance companies, and government programs. There have been three periods since 1960 when lenders pulled back and the inflation- adjusted level of farmland mortgage debt fell. The most notable contraction was in the 1980s, when many borrowers and lenders struggled to manage rapidly rising interest rates during declining farm incomes. Two other contractions occurred in the history of the series; in the 1960s, when banks pulled back on lending after a contraction in the farm economy, and in the 2010s, when the global financial crisis contracted lending activity and international trade ground to a halt. In all three periods, the decline in farmland debt corresponded to a decrease in farmland assets.

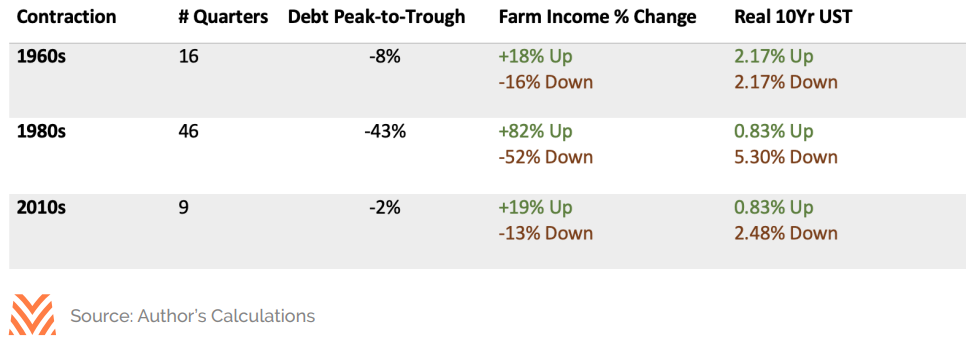

There is a common thread for each cyclical contraction in farmland debt: in the three years leading up to each cycle contraction, farm incomes ran up 18%, 82%, and 19%, respectively. In the years following the peak of each debt contraction, farm incomes fell 16%, 52%, and 13%, respectively. Real interest rates (defined as the rate on the 10-year U.S. Treasury bond minus consumer price inflation) were another contributing factor to the depth of the contraction.

Still, the relationship between interest rates and farm debt cycles has been weaker than the relationship between farm income and farm debt. In the 1960s, real interest rates were unchanged, yet farmland debt contracted 8%. In the 1980s and 2010s, a more recognizable pattern existed, in which a period of rapid increases in real rates followed a period of extremely low real rates. The figure below highlights the duration and related drivers of the three farmland debt contractions in modern farm financial history.

So, what does history indicate about farm debt levels in 2023? As detailed in other articles in this issue of The Feed, farm incomes have certainly seen a multi-year increase, which is a consistent signal for slowing farmland debt. Similarly, real interest rates were negative for much of 2021 and 2022, another consistent signal from two of the three historical contractions. Real interest rates are rising heading into 2023, which was a leading indicator of contraction in two of the three contractions. The biggest unknown is the trajectory of inflation and farm income in 2023 and 2024. Inflationary pressures did appear to ease in the third and fourth quarters of 2022, but some categories like services, transportation, and housing might remain elevated for some time. If inflation remains elevated, real interest rates are likely to moderate; but if inflation falls significantly, real interest rates could rise swiftly. Early indicators of components of farm income are generally positive, with revenues capable of holding steady and profits likely to erode slightly due to rising expenses. If farm incomes hold or increase, farmland debt is likely to hold or even advance; if farm incomes fall significantly, farmland debt could enter a fourth contractionary cycle.