America Facing Increased Competition in Ag Transportation

For years, the relative high quality of American infrastructure has provided U.S. farmers with a competitive advantage over most foreign producers. Other nations have historically struggled to compete— as can be seen by using Brazilian soybeans as a case study. Brazil transports most of its soybeans on trucks, often on unpaved or inferior roads, and its major ports have often seen considerable loading delays.

However, while infrastructure remains relatively stable in America, developing nations are beginning to catch up, and Americans could be losing their competitive advantage. In 2006, transportation costs from the critical Brazilian soybean region of Mato Grosso to Shanghai were almost half of the total landed cost. But Brazil managed to cut this figure almost in half by 2019, to 28%. Part of this is due to Brazilian investment in their infrastructure. Agriculture represents almost 7% of the total Brazilian GDP, and their government has been working to improve this rapidly growing industry. The government has paved and modernized major roads that connect soybean regions to ports and has begun to privatize some ports to spur additional investment in those facilities. Brazilian railways have also received attention, with new networks being completed that connect major growing regions like Goiás to ports for the first time.

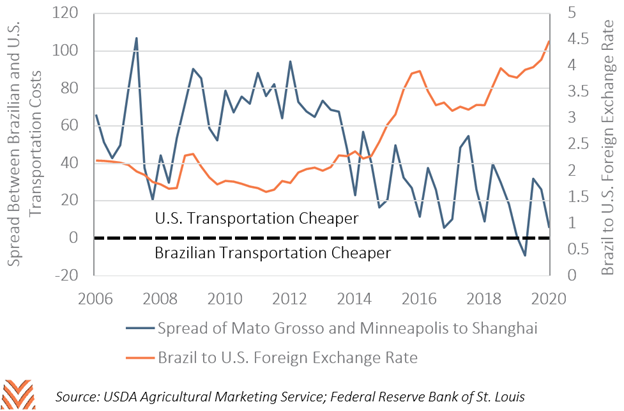

A second factor in slashed transportation costs has been the continued depreciation of the Brazilian real. Brazil is an economy driven by commodity exports. In 2015, broad declines in oil, coffee, and agricultural commodities prices drove the economy into recession. This led to a swift decline in the real, which still has not recovered to pre-2015 levels. Finally, in the second calendar quarter of 2019, something happened that was once unthinkable: transportation costs to Shanghai became cheaper in Brazil than in America.

These trends are also evident among other major agricultural exporters in developing regions, like Argentina. Argentinian soybeans have been cheaper to transport to China for years, an advantage that has grown since the supercycle era. The Argentine peso has fallen even more against the dollar than the Brazilian real, falling from an exchange rate of 8.5 at the start of 2015 to over 86 pesos today. The Argentine government has also used similar tools to modernize their infrastructure, creating a series of public-private partnerships to invest in infrastructure related to agriculture.

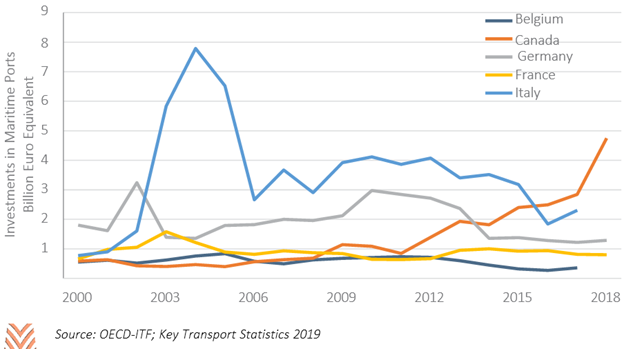

This pattern of depreciation and continued investment is not true of all major American competitors. Four of the top 10 largest agricultural exporters by value are in the European Union. Of those, none has seen consistent increases in their maritime infrastructure investments over the last two decades. Like the U.S., these nations had been able to rely on more robust existing infrastructure that had given them an advantage. The relationship between the dollar and euro has also been stronger between that of the dollar and South American currencies. Like it is in the U.S., agriculture is a small portion of the overall economy for these developed exporters, meaning that infrastructure investment for agricultural purposes may have a lower priority.

Different commodities will face different risks based off this trend. The most exported agricultural products from Europe, like pork and dairy, are less likely to see sharp changes in their competitive advantage stemming from transportation costs. However, corn and soybeans may face high risk from these changes. This can also extend outside South America. Wheat may face challenges as countries with commodity-reliant economies, like Russia, see currency devaluation and have easier opportunities to improve their existing infrastructure.

Even developed nations may see their transportation cost competitiveness to certain markets increase in the coming years. Over the last decade, Chinese port operators like COSCO have become increasingly involved in European port activity. China’s Belt and Road Initiative has helped spur some of this activity, leading to Chinese entities being involved in port acquisitions and partnerships in Belgium, Spain, Greece, Italy, and around the European continent. If the intention of these acquisitions is to reduce transportation costs between China and the world, the U.S. will see its competitive advantage in shipping costs to China decline.

This trend doesn’t have to be permanent. Department of Transportation grants like the Port Infrastructure Development Program may help further reduce American shipping costs. And the recent downward pressure on the U.S. dollar may help American shipping cost competitiveness over the near term. If commodity-driven economies like Brazil can rebound in the coming years, a rebound of those exporters’ currencies would help improve America’s competitiveness even further. In other words, there are reasons to suspect America will be able to come back out on top of the transportation costs arms race—but the days of enjoying first place without real competition may be over.