Alternative Proteins: Niche Markets or Game-changing Disruptors?

Animal protein production is a tentpole of American agriculture—between 2011 and 2020, cattle and calf sales averaged more than $75 billion in annual receipts, poultry averaged more than $46 billion, while dairy averaged more than $43 billion and hogs averaged more than $24 billion. In fact, nearly 50% of all U.S. agricultural cash receipts come from the sale of animals or animal products and, according to the 2017 Census of Agriculture, over 980,000 farms (48% of all farms) sell animal products. In 2020, Americans bought more than $162 billion in meat, poultry, and dairy products at grocery stores alone, with billions more purchased at restaurants, leisure, and hospitality locations; meanwhile, additional billions of dollars’ worth of animal protein products are exported to foreign markets each year. Thus, our animal protein sector is not only an important part of American agriculture, but is also deeply embedded in the global economy and the global food system.

The animal protein sector isn’t just important because of its output; on the input side, it serves as a huge source of demand for grains. According to the American Feed Industry Association, animals used in protein and product production consume more than 260 million tons of animal feed each year. Corn is a significant input for animal feed, and approximately 45% of domestic U.S. corn demand comes from animal feed. All told, animals in the U.S. consume around 30 million acres worth of corn and another 30 million acres of soybeans.

Demand for animal protein has been on the rise, with U.S. per capita consumption of beef, pork, and poultry approximately 265 pounds per person in 2020, up from about 250 pounds per person in 1999. Global demand for animal proteins and products has also been rising over the last decade. However, the sector is experiencing a pair of substitutes on the rise which threaten to disrupt the animal protein demand trajectory: plant- based proteins, and cultivated meat.

Amidst a backdrop of changing demographics in the U.S. and heightened consumer sensitivity to climate change, more companies are challenging the dominance of animal-based proteins. Plant- based meat and dairy alternatives are already on the market and seeing sales growth, although they remain at less than 1% of total U.S. retail grocery sales. Meanwhile, cultivated proteins (meat created from animal cells in a bioreactor through tissue engineering) are gaining investor interest, and companies are rapidly working to lower production costs. This article examines recent trends for each category and their prospects for disrupting the animal protein sector.

Plant-Based Proteins

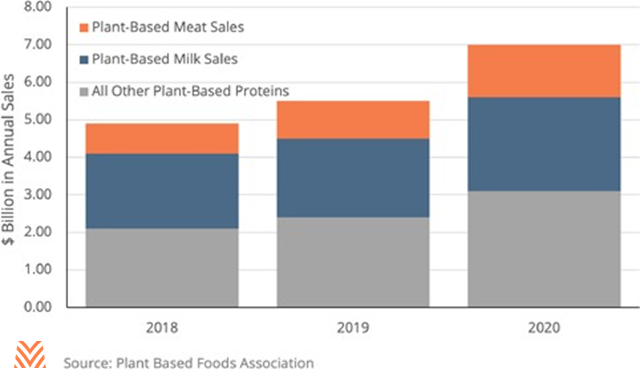

Plant-based meat and dairy alternatives are substitutes made from vegetables, grains, and fruits designed to mimic the structure and flavor of animal products. Plant-based fluid milk alternatives, such as almond milk and soy milk, have become widely available in grocery stores and restaurants, with more than $2.5 billion in sales in the U.S. in 2020 (see the figure below). These products are well-established in the marketplace with decades of brand building, and the milk- alternative sector has built up to a 15% market share for U.S. fluid milk and milk-alternative consumption and a 10% global market share. Meat alternatives have yet to establish a meaningful market share, but some brands like Beyond Meat and Impossible Foods are building demand in both grocery and restaurant channels. Sales of plant-based meats increased a respectable 45% in 2020, nearly double that of animal-based proteins.

Plant-based protein products present some threats to agricultural producers, though there are also some opportunities. Threats include the obvious competition for consumers’ protein calories and the more efficient conversion of grains into proteins. Cattle are not terribly efficient at converting feed into protein (it takes an average of six pounds of feed to create one pound of animal weight), so for every pound of beef not consumed, six pounds of feed become at-risk. On the other hand, the primary ingredients for many of these products are easily grown and can be domestically sourced. Soybean products are a common ingredient for many plant-based proteins, and pulse-based products (legumes used as a dry grain) are another one. These types of crops thrive across the Midwest. Today, many of the pulses and beans used to make plant- based meat have to be imported, providing an opportunity for growers in the U.S. to switch some production into new crops like yellow peas and mung beans. We can see another switch happening in California, where agriculture has been transformed by the rise of almond milk— almond-bearing acres there have doubled in the last 15 years.

It’s hard to say how much this sector will continue to grow. Plant-based dairy alternatives went from no share of the market to 15% in under 10 years— though that may not be the best benchmark for adoption, since many consumers of plant- based dairy products have dietary restrictions. Ultimately, though, the appetite consumers have for plant-based substitutes will likely be the determining factor in the timing and level of risk plant-based proteins pose to the animal protein sector.

Cultivated Meat

Going by many names and descriptions, cell-cultivated meat is the textured proteins constructed in a controlled environment using animal cell cultures, growth mediums, and protein scaffolding processes. While the concept of cell- cultivated meat may read like science fiction, the technology does indeed exist. Depending on how quickly new advances are made, farmers and lenders should evaluate the next few years carefully.

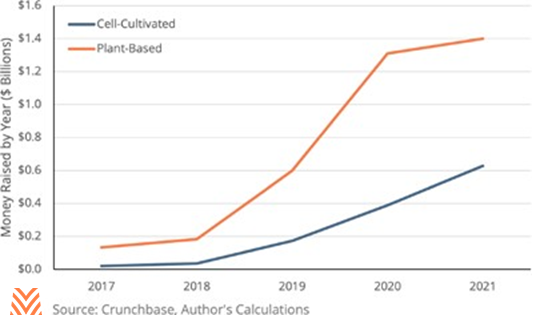

The concept has been floating in scientific circles since the 1950s, but the practice and theory really took shape in 2013, when the first lab-grown hamburger was constructed and consumed by researchers and journalists. In the last decade, more than a billion dollars of venture capital have flowed to companies building cultivated meat products (see the figure below). Many of the major meat processors and integrators are also investing in companies pushing this nascent industry, including JBS (BioTech Foods), Tyson (Upside Foods), and Cargill (Aleph Farms), among others. In December 2020, Eat Just became the first company approved to sell cultivated chicken in a commercial restaurant in Singapore.

Proponents of the industry cite greater efficiency in feed-to-protein conversion and the potential for lower transportation costs and, thus, a lower carbon footprint. Proponents also cite the controlled environment in which the food is created, limiting exposure to diseases and eliminating animal antibiotics. Opponents cite the highly-processed nature of the resulting food, the high energy demand needed for creation, and the high production costs as reasons why the industry might not challenge animal protein producers in the near term, if ever. Due to the early-stage nature of the industry, production scale is low, costs are high, and the USDA and FDA have not yet approved any products for consumption in the U.S.

If the science works, the product is priced competitively, and consumers get on board—three big “ifs”—this industry has a high potential for agricultural disruption. But a lot has to go right for the disruption to become a reality, particularly the cost and consumer sentiment elements. Some analysts estimate it will take another decade for cell-cultivated meat to reach price parity with animal proteins.

If this industry does manage to overcome its hurdles, there will be some new opportunities for producers, such as growing the feedstock used to feed and structure the cell-building process (e.g., corn, sorghum, and grains). Challenges could include the transfer of protein production from farmers to the industrial sector and the disruption to feedstock growers.

Like many things that end up in retail sales, much of the future of alternative proteins will be written by consumers. If domestic and international consumers adopt plant-based and cell-cultivated proteins, they are potentially highly disruptive to the protein complex. Marketing and lobbying budgets are likely to get a workout in the coming decade as the battle for consumer sentiment heats up.