Almonds Markets Head Towards Pre-pandemic Equilibrium

The almond sector has been waiting on a turnaround since seeing disruptions in early 2020. Shortly after the outbreak of COVID-19, almond prices fell by almost in this category this year. On the positive side, exports to emerging markets like India have surged, allowing almond export volumes to climb after years of stagnation—Combined with continued 25% and have remained near those lows since. Producers have faced headwinds from both stagnant foreign demand and growing domestic supplies. The good news is that while current market indicators are not unanimously positive, the almond sector appears to have some opportunity to return to a pre-pandemic price environment in the coming year.

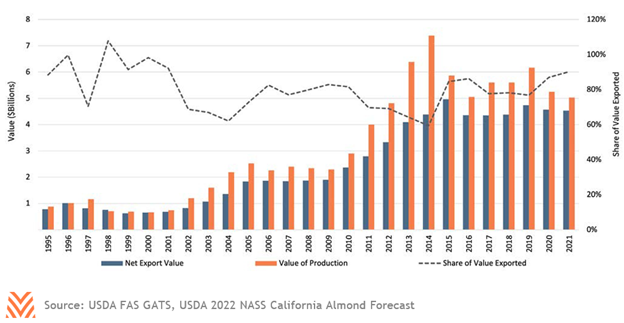

Foreign demand has always been one of the most important components of the almond industry, and almonds will likely face both risks and opportunities strong exports to developed, slower-growth countries (like those in the European Union), total export value has the potential to match the previous peak set in 2015. The figure below demonstrates that the almond sector is growing increasingly reliant on foreign demand, with an estimated 90% of cash receipts coming from foreign sales in 2021.

However, as discussed earlier in this issue, rising prices have the potential to place headwinds on these export markets, with consumers in middle- income nations like India more likely to reduce consumption in the wake of price increases. And even among developed nations like Japan, currency devaluation means that the implied price of U.S. almonds has risen 25% from exchange rates alone over the last year. While consumers in these nations change their buying behavior less as a result of price increases, significant increases could lead to some changes in consumption.

The larger challenge for almond producers has been the surge in domestic supply. Early estimates for 2022 are that there will be 1.37 million bearing acres of almonds, 50 thousand acres above last year’s peak. Between 2010 and 2020, total U.S. almond production doubled, while total quantities exported rose by only 25%. Within the U.S., per capita availability of almonds continued to rise, with the number of pounds of almonds available per American rising from 0.83 to 2.46 pounds between 2000 and 2020.

Luckily, there are some indications for 2022 that the sector is beginning to pull back from the rapid expansion that has dominated the last decade. The number of non-bearing acres, or acres younger than three years, is forecast to fall in 2022. Next year will feature the first year where acres planted after the 2020 price declines will enter into production, and producers in the wake of the price declines appear to have scaled back new plantings in consideration of drought issues. Production estimates for 2022 are below 2021 levels despite record acres, which will further help move the markets into equilibria.

It is unlikely that producers will see a return to the old days of $3.00 per pound over the near term. The COVID-19 pandemic exposed the gap between supply and demand that had been coming in the industry for years. However, the current market is also unlikely to reflect what producers will experience after this growing season. Export quantities have surged to new developing markets, though global prices still present risks. Producers have scaled back new acres, and are likely to start reaping the rewards during the 2023 growing season. The realities of water availability and climate have led to near-term production declines that have helped stabilize price free-falls. Almond producers are likely to face one more year of a suppressed price environment, but for the first time in a while there are some hopeful signs for the future.