Ag Lender Trends & Competition

In the last issue of The Feed, the article “The Improved Financial Health of Ag Borrowers and Lenders” explored how the strength of farm finances (and the capital providers serving them) has significantly improved since the farm crisis of the 1980s. In that article, we identified some reasons to believe that ag producers and lenders are on solid footing despite recent market and agriculture volatility. Here, we continue that thread by exploring how the financial sector has supported borrowers during past volatile economic environments and how lenders might respond in this one.

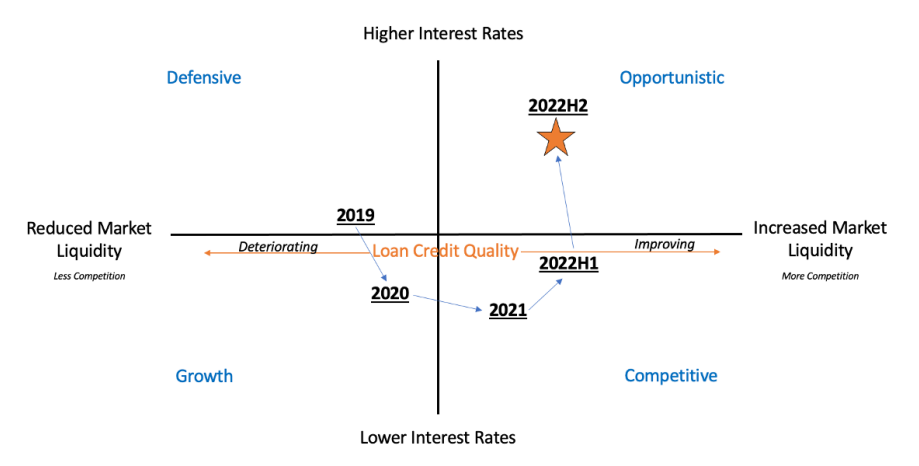

When we look at prior periods of volatility, we see that most financial institutions generally managed financing deployment based on the level of interest rates, market environment (e.g., recession or expansion), and industry and borrower credit quality. The circular movement of financial market financing availability is largely based on the interaction of and the expected future path of these components. For example, as credit quality improves, more lenders compete for loans in the industry. As interest rates are reduced, more borrowers seek credit, and competition for high-quality borrowers picks up. As industry profitability wanes, credit quality deteriorates and competition for ag loans slows. Finally, as interest rates increase, fewer borrowers seek credit, reducing the supply of lending opportunities and increasing competition.

As the figure below depicts, the current environment has transitioned through a period of historically- low interest rates, an expansionary market, and generally favorable credit quality, ending in a period of significant financing availability but also significantly higher interest rates. As the perceptual map indicates, agricultural and agribusiness lenders are currently experiencing an ‘opportunistic’ lending environment characterized by a decline in loan demand, forcing lenders to strongly compete for opportunities when they exist. As we proceed through what could be a volatile 18 months, it remains to be seen if financial sector liquidity will transition into a more ‘defensive’ posture that could impact the overall health of the agricultural borrower. When industry conditions are ‘defensive,’ lenders pull back from the industry and tighten lending standards and conditions, which increases the financial burden placed upon borrowers.

To better explain this transition, we first assessed liquidity in the syndicated and commercial and industrial loan markets and their respective loan growth rates over the last 20 years. The result is a clear correlation between the components highlighted above. There was a significant decline in large, syndicated loan volume during the great financial crisis, and this decline strongly correlated with a large decrease in commercial loan growth for all U.S. banking institutions during the same period. The market stresses brought on by the COVID-19 pandemic resulted in a similar outcome.

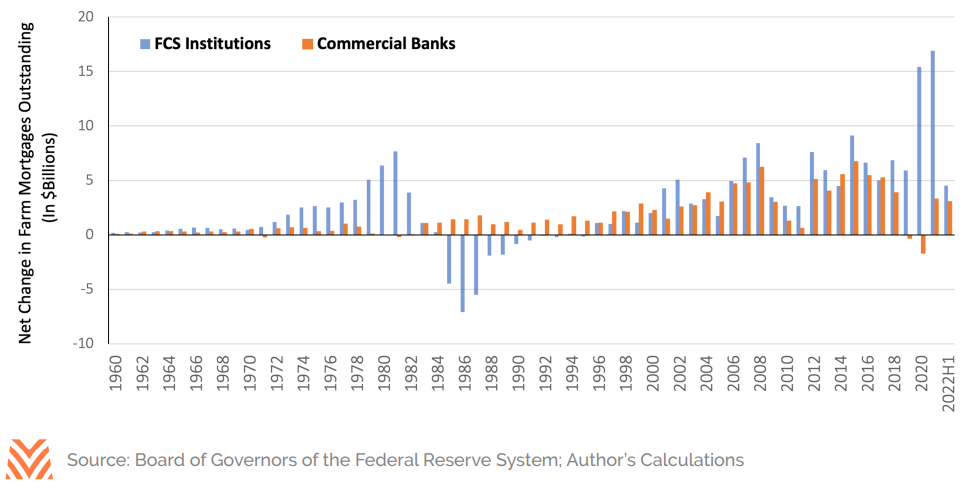

One unique twist on this dynamic is the competitive balance between Farm Credit System institutions (FCS) and commercial and community banks (which we will refer to here simply as “banks”). Since 2005, there have been very few quarters in which real estate and operating debt commitments decreased in the FCS, even during the great financial crisis of 2008. In fact, real estate and operating debt within the FCS increased by 18% and 22%, respectively, during the great financial crisis. Conversely, there was an overall decrease in growth for the same types of loans within banks. A similar scenario occurred during the recession caused by COVID-19 in 2020. Historically, during periods of rising interest rates, farm mortgage lending at banks has grown faster than at the FCS, and the opposite has been true during periods of declining interest rates.

The figure below highlights the net annual change in farm mortgages outstanding at FCS and banks. In periods of stable and rising interest rates, banks showed positive growth that outpaced the FCS (1980s and 1990s), and in periods of falling rates, the FCS growth outpaced that at banks (2010s and 2020s). As of June 30, 2022, after two years of record-low interest rates, only three of the top 20 agricultural lenders are banks, and those three banks’ portfolios declined by nearly $2 billion in total agricultural loans in the last 10 years. The top three FCS lenders gained nearly $30 billion in total agricultural loans over the same time period.

It remains to be seen how the financial markets will react to the potential market volatility over the next few years. The strength of the financial sector, capital and liquidity levels, and industry and borrower credit quality is at a decades-long high. This environment has historically aligned with more competition and available liquidity. However, it is important to keep in mind that, as past market stresses have shown, conditions can reverse course quickly.