What will it take for farm income to improve?

Wisconsin State Farmer

By: Anna-Lisa Laca

“Reprinted by permission of Farm Journal media, April 2019”

The original article appeared on the Farm Journal website.

Economic farm experts say farmers are doing a much better job managing risk today than in years past.

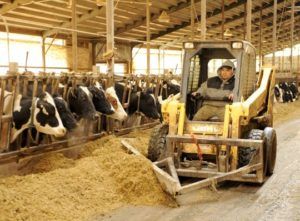

(Photo: Sue Pischke/HTR Media, Sue Pischke/HTR Media)

USDA projects average net farm income at $80 billion for the next decade. For 2018, net farm income was $66 billion, which is dramatically lower than when real net farm income peaked at $134 billion in 2013. What will it take for farm income to recover? Curt Covington and Jackson Takach of Farmer Mac say there are a few key factors to watch.

“You can’t not talk about commodity prices,” Takach told AgriTalk host Chip Flory. “That’s the revenue driver.”

While commodity prices are largely out of farmers’ control, he added, it’s essential to have a good marketing plan and take advantage of profitable opportunities when they come.

Additionally, he said trade resolution will be key to increasing demand for agriculture products, which will result in higher revenue.

“Having a good outlet for the grain sector, and then the livestock sector, all supports U.S. agriculture, so let’s get this resolution with China out of the way,” he said. “Let’s go ahead and make some deals. Let’s get Congress to ratify the USMCA, let’s get Europe on board [and] let’s get Japan on board. And then I think it’s a pretty positive runway once you can get some of these deals, and some of the haze around the trade picture, cleared up.”

A weaker dollar would aid farm income, he added.

“The dollar has been very, very strong and that’s a headwind to trade as well as commodity prices,” he explained. “Everything is dollar denominated. When you’ve got a strong dollar, you’re going to have weaker commodity prices. We see maybe some money moving overseas if you can get some strength in Europe in different parts of Asia [and] if we can get some growth in China. Maybe the dollar weakens up a little bit.”

Thinking back on some 40 years of experience in agriculture lending, Covington said the long-term perspective shows the industry is simply experiencing short term pain.

“What really makes this kind of an interesting time, is that both bankers and farmers are relying on institutional knowledge—what they’ve been through in the past,” he said. “Most farmers have very little control over their revenue, but they do have control over their expenses. And if you take a look at what farmers, particularly Midwest farmers, have done in the last two or three years to control their expenses [it’s impressive].”

Additionally, he said farmers are doing a much better job managing risk today than in years past. Overall, Covington is bullish on American agriculture.

“They’re not making any more land. You’re not making any more land and the United States has always been our harbor for the highest quality food at the lowest cost for not only domestic consumption, but globally,” he said. “I think you get through some of these just things we need to take care of right now and the long-term opportunities in this sector are boundless.”

To View Full Article: Click Here