Zoomcast Zingers

Bubbles

Many of the participant questions that were asked recently during meetings at the Graduate School of Banking at Colorado and the Ag in Motion event hosted by the Royal Bank of Canada centered on financial bubbles that have been created by governments’ fiscal stimulus and central banks’ monetary policy both here in the United States and abroad. The bank school faculty stated that there were probably very few farmland and residential real estate bubbles. If present, these real estate bubbles would be in certain regions or areas. However, the faculty was concerned that commercial real estate, particularly in urban areas, may see severe valuation corrections. The migration of the urban population coupled with the demand destruction and social distancing created by the COVID-19 pandemic may create long-term devaluation in many urban areas.

Next, all of the faculty member panelists agreed that the stock market valuations are being influenced by both fiscal and monetary policy. These programs have resulted in risk-taking by both institutional and retail investors attempting to post gains on stock market investments versus alternative investments. Investors choosing stocks because other asset classes offer even worse returns can result in the “TINA Effect.” This situation and the subsequent decisions of investors can cause the stock market to rise only because “There Is No Alternative” for investors. These risk takers are also active in the bond market as well as moving towards gold and silver investments.

In a survey of participants, 86% indicated that the Dow Jones Industrial Average would be between 20,000 and 28,000 points by year-end. However, they were also optimistic for the future, with 70% predicting that the Dow Jones Industrial Average would be between 25,000 and 30,000 points at year- end 2021. It will be interesting to see how these results play out.

Recession

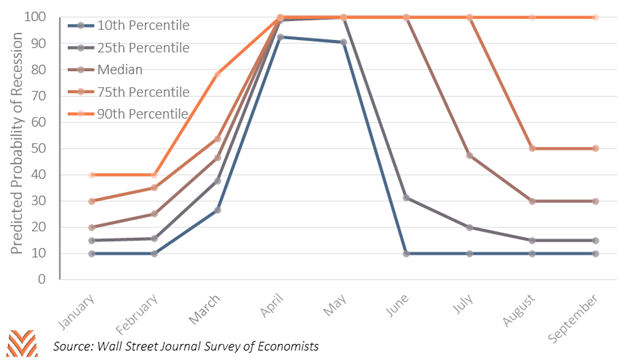

Moving to the U.S. and global economy, the panelists and participants were both asked about the expected length of the recession. Both groups felt that the recovery would begin sometime in 2021. However, 11% of the participants and one faculty member expressed that the recession could extend into 2022 and possibly 2023. Global recession forecasts were much more dire, with 57% of the participants indicating that the recession would end in 2021. However, 35% stated that it would be 2022 and beyond.

This recession may have a disjointed impact on certain regions and segments of the economy, both in the United States and abroad. Consumer service sectors may be in for an extended recession. Basic goods such as food, health, and modes of distribution aligned with convenience and favorable customer experiences may rebound quickly, as they appeal to the consumer. As one faculty member stated, lenders must assess their largest accounts to determine how vulnerable they are to certain segments of the economy. Do these companies have the business and financial strength and management skill set to navigate the new economic environment?

Consolidation: USA and Canada

Participants from both sides of our northern border inquired whether COVID-19 would further accelerate the consolidation trend for farms, ranches, and agribusinesses, or whether the pandemic would reverse the trend.

The answer is yes and no. The movement toward consolidation will accelerate with the business objectives of efficiency and optimization. However, a movement towards smaller, entrepreneurial operations that will serve certain local, regional, national, or international niche markets will emerge. In some cases, the hybrid model will be interspersed both here and abroad.

Local, state, and national government, societal trends, and the consumer will be the drivers of the change concerning all of these business models. The niche market model will require managers to adjust their strategy every four to six months as trends, opportunities, and challenges occur. Regardless of the model or market served, more businesses will be owned and managed by women, minorities, and others who aspire to be involved in agriculture and live in rural areas.

Speaking of rural areas, the importance of broadband internet access can either create a renaissance, if available, or demise, if not available. Technology, with a balance of natural amenities such as a lake, river, mountain, or viewshed will be talent magnets in this decade.

Customer Programs: Work Culture Shifts

One of the survey questions centered on changes in bank delivery options and possible shifts in work culture.

Improvement of mobile banking products and improvement of online banking was at the top of the list, with 50% to 65% of participants reporting modifications and ongoing changes. Curbside service and user-friendly technology, particularly for the baby boomer customers, is being instituted. Of the participants polled, 16% were closing branches, while 35% were reducing staff, specifically at the branch level. Surprisingly, 23% have seen very little sustained impact as a result of COVID-19.

More participants indicated that working remotely was more than a temporary shift. This was perceived to be a challenge for many banks, as Generations Y and Z are pushing for more remote work opportunities. However, senior management and board members are often Generation X, baby boomers, or members of the veteran generation, who are reluctant to change. The aversion to change positions on this issue could create recruitment and retention problems moving forward.

On a final note, the agricultural lenders were specifically asked about their opinions on the future of young people in the agriculture industry, regardless of the level. Wow! Nearly 40% of respondents were optimistic or very optimistic. As a matter of fact, it was almost a two to one ratio of positive to negative responses, which is encouraging for the agriculture industry. These zoomcast zingers are just the tip of the iceberg of some of the perspectives and foresight from virtual interactions. In future columns, we will continue to take the pulse of the industry based on some of the responses from polls and participant engagement.