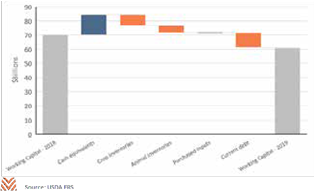

The USDA’s Forecast for Working Capital and Current Debts

In 2019, American farmers faced considerable headwinds from trade uncertainties and unprecedented weather events. However, a combination of robust government support and a few brief favorable price environments has led the USDA to forecast net cash farm income in 2019 at its highest point since the end of the commodity supercycle. Despite these higher incomes, the USDA initially projected working capital to continue to deteriorate through 2019 and 2020. While the USDA projects that producers will have more cash on hand, increases in current debt and inventory value declines are assumed to outweigh this increase.

Current Liabilities

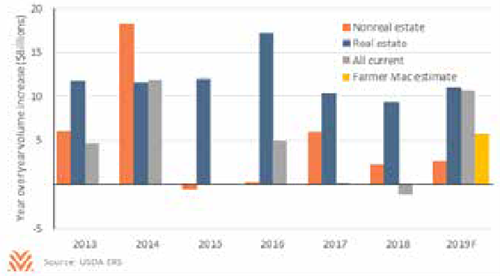

Current debt can refer to short-term debts, the current portion of term debt, accrued interest, or other accounts payable. The USDA’s forecast for current debts takes the ratio of current to noncurrent debt over the prior five years and then applies that ratio to their total debt forecast. While this methodology is serviceable, it has the potential to bias results if debt increases are seen predominantly in real estate or production loan volumes. This is the case in years like 2019, when increases in real estate loan volumes outpaced increases in non-real estate loan volumes.

While most production loans are current, the lengthy terms of most real estate debts mean that most of those volumes are noncurrent. Over the past five years, 64% of all non-real estate debt has been current, while just over 5% of real estate debt has been. If these shares are applied to the USDA’s 2019 forecasts for real estate and non-real estate loans, the increase to current debt would be $5.7 billion in 2019, rather than the current estimate of $10.7 billion. Carried through to working capital, this would imply a relatively modest decline in working capital of 6%, as opposed to the current projections of a 13% decline.

Creating the set of estimates and forecasts that the USDA does is a significant undertaking, and the data they produce is essential. However, their current methodology for estimating current debts has the potential to overstate movements in producer liquidity. This concept is supported by the Federal Reserve’s estimates suggesting that the use of short-term farm debt has waned. While last year was a very challenging year for American farmers and ranchers, higher incomes may have replenished some cash assets that had been sapped during down income years. With the new uncertainties brought on by COVID-19, these assets could provide valuable liquidity over the next 12 to 18 months.