The USDA’s First Forecast for 2022 Projects Strong Incomes

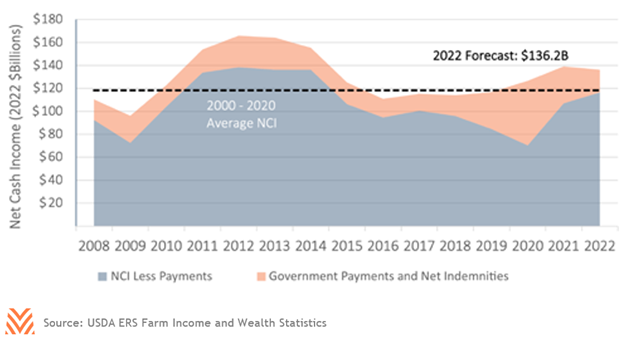

In early February, the USDA released its first forecast for national farm incomes in 2022. If realized, these forecasts indicate that the sector would earn record net cash income (NCI) this year. Unlike the strong incomes of 2021, this year’s income is forecast to come from strong cash receipt incomes, and not from high government payments. While new ad-hoc program payments were not created in 2021, many producers received payments from programs like the Coronavirus Food Assistance Program in early 2021. These significant spillover payments are why incomes are only forecast to be modestly higher in 2022, despite a much stronger underlying agricultural economy.

In inflation-adjusted terms, the release was not as positive, but still painted a picture of a strong forecast for agricultural incomes in 2022. The figure below shows the breakout of income from government- related sources and farming-related income between 2008 and the 2022 forecast. NCI in 2022 is forecast to be 15% above its average since 2000. These incomes are suggestive of an economy that may not be matching the peaks of the 2011 to 2015 supercycle, but that likely is in a far better position than it was over the last several years.

Despite this positive news, some of the immediate coverage of the USDA’s release had a bearish sentiment. There were some questions around whether the USDA forecasts accurately captured the rapidly changing costs observed within the last part of 2021 and first part of 2022. Producers in some regions have seen prices for certain fertilizers rise to almost triple prior year costs, while animal producers have seen feed costs that could eliminate profitability despite the high farm prices received. Meanwhile, geopolitical tensions have led to sharp increases in energy costs and have placed even greater strain on feed costs. In other words, there have been many recent changed to farm expenses that could lead to a potential underestimation of farm expenses in the first USDA forecast. However, there are also reasons to believe that the final 2022 figures could be even higher than this robust first forecast.

Production Expenses

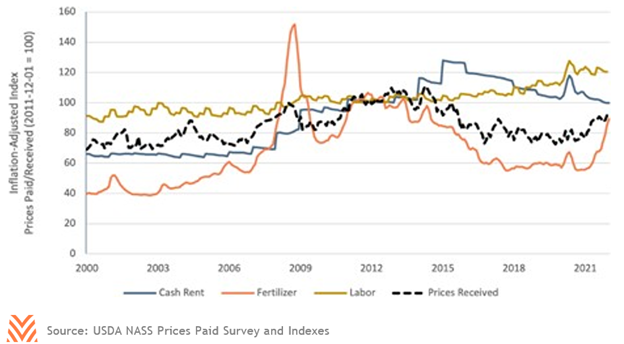

One missing component from the current discussion around production expenses is the historic context for prices paid. The figure below shows select indices for prices paid and received by producers, using the same inflation-adjustment technique used by the Farm Income and Wealth Statistics. While the USDA National Agricultural Statistics Service (NASS) has observed a sharp rise in fertilizer costs through December 2021, costs in real terms are still below the 2011 – 2015 supercycle era. Fertilizer prices have historically been aligned with prices received, something that is also true for other farm-origin expenses like feed and seed. What this means for the USDA’s forecast is that a rise in estimates for farm origin expenses is likely to be accompanied by an offsetting rise in cash receipts.

Recent evidence does find producers paying more for fertilizers than even supercycle peaks. The USDA Agricultural Marketing Service’s (AMS) production cost reports for Illinois in late February have seen average bids for anhydrous ammonia at a record $1,500 per ton, though some fertilizer indices remain below supercycle peaks. Recent energy price spikes may also concern producers looking at rising prices for farm diesel. However, even these recent rises do not significantly exceed the supercycle input prices, and in some cases are still below supercycle peaks. During the height of the supercycle, inflation-adjusted anhydrous prices were as high as $1,200 per ton. Diesel prices during the supercycle were well above today’s level in inflation-adjusted terms. These inputs may continue to climb, depending on what happens with major fertilizer and energy exporters in 2022. However, cost and returns reports suggest that these high input prices will diminish, but not eliminate, profitability for cash grain producers in the 2022/23 crop marketing year.

Other production expenses that are less aligned with the agricultural cycle may be more cause for concern. Expenses like labor are challenging because they have shown consistent appreciation that does not correspond with agricultural cycles. For example, labor prices at the end of 2019 were on average 20% above their 2011 levels, while commodity prices were still well below those supercycle peaks. This has downstream impacts on other costs, such as storage and transportation. Some costs, like cash rents, also take years to be factored into farm expenses, as these costs react slower than prices received. In 2015, the NASS index for cash rents hit a high mark, even as the farm economy showed signs of slowing. Cash rents data also are updated once yearly, and a sharp rise in cash rents for this growing season might not have been captured in the USDA’s latest forecast for this year.

Cash Receipts

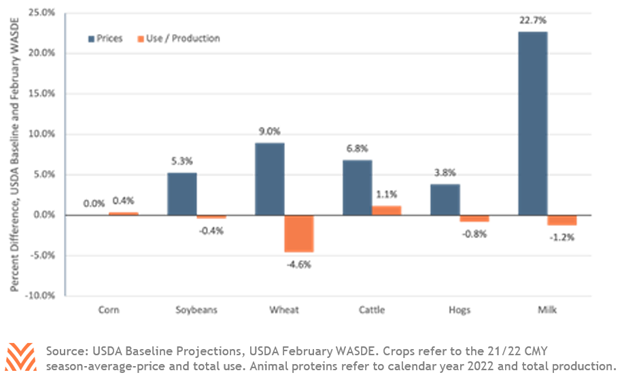

Still, it’s possible to tell a more bullish story for farm incomes in 2022. While production expenses are rising, so are market prices. The USDA’s forecast for 2022 includes some non-public data, but many data points for the forecast can be found in the USDA’s baseline projections from late December 2021. The figure below shows the difference in prices and production between the USDA’s baseline projection and the February World Agricultural Supply and Demand Estimates (WASDE). For almost all commodities, season average prices for 2022 were raised, while there were no limited forecast changes to production.

Even these strong price gains are underselling the potential cash receipts producers could see in 2022. The USDA’s February WASDE estimated a season average price for wheat of $7.30. With May futures contracts exceeding $10.00 as of early March, the final season average price is likely to far exceed even the strong February numbers. While farmers are unlikely to capture the full value of these price increases due to rising input costs, the price increases provide a substantial buffer to increases in labor, fuel, and fertilizer.

The net effect of these findings is that it is reasonable to assume that the net cash income projections for 2022 will hold, and there are reasons to believe that the final figure could be even higher. Research on the accuracy of the income projections has found that the USDA’s first forecast for net cash income is, on average, 11% below its final estimate. While the study found that the first forecast has historically underestimated production expenses by 1.4% on average, this was more than offset by average underestimation in crop and livestock receipts of between 3% and 4%. There are many signals that this year could follow the same pattern. Incomes are not reliant on government support, and prices have risen since the USDA’s first estimate. Meanwhile, indications show that most expense increases should be offset by rising cash receipts. While the uncertainty caused by geopolitical tensions could strain profitability in unanticipated ways, it is also possible that farmers will look back on 2022 as one of their strongest years in recent memory.