The Return of Global Food Insecurity

While the outbreak of the Russia- Ukraine conflict has led to an increased focus on global food insecurity, the global food situation has been deteriorating since 2019. In June of 2021, the USDA’s Economic Research Service estimated that the number of food-insecure people globally had risen from approximately 900 million in 2020 to 1.2 billion in 2021. Macroeconomic impacts of the COVID-19 pandemic and a reduction in global grain stocks rendered food both less affordable and less available in many lower-income nations. However, even this outlook from June 2021 understates the current challenges to the global food system.

Since the USDA’s report, global food prices have continued to rise. Production problems and shipping constraints led to rapid increases in the second half of 2021, while the onset of the Russia-Ukraine conflict has placed even further pressure on global food prices. The Food and Agriculture Organization of the United Nations projects that global food prices rose 26.1% in 2021 and will rise 16.3% in 2022, the fastest two- year growth in history. Prices have increased faster than they did during the 1972 wheat crisis, the 2008 financial crisis, and the 2011 supercycle (when high wheat prices contributed to the onset of the Arab Spring).

Export Restrictions

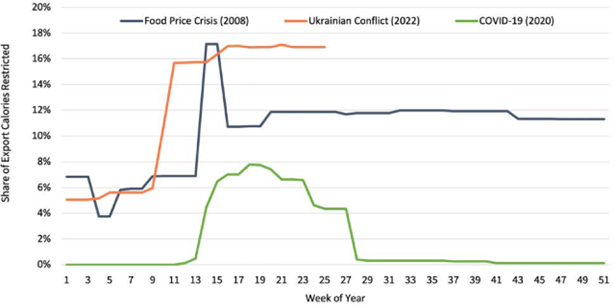

The challenge for the global system is that policy decisions may exacerbate the problem. Some nations, like Indonesia and Argentina, already had export bans in place for specific commodities at the start of 2022 due to rising prices. The war in Europe has led to a rapid expansion of export bans as nations try to mitigate food cost increases, including from important agricultural exporters like Russia. As of the middle of June, the International Food Policy Research Institute has found that there are 19 nations with active bans on at least 31 commodities, as well as additional export licensing. Almost 17% of all traded agricultural calories were potentially subject to export bans or other restrictions, exacerbating the current food crisis.

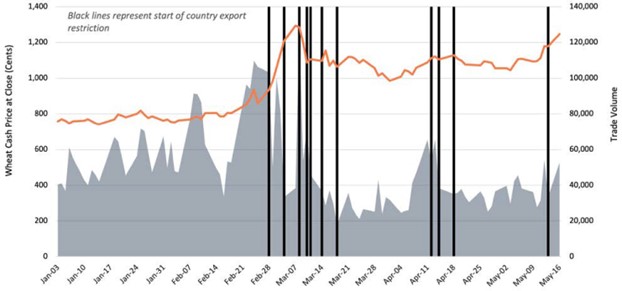

Export restrictions can lead to market uncertainty, and in many cases lead to price movements in commodity futures markets. Some of the current restrictions, like those in Russia and India, represent large shares of all export calories and have the most potential to be market moving. Others, like Serbia and Moldova, are less market moving because, while a large share of produced wheat is exported, the total quantities represent a small share of total traded calories. Still, others (like Algeria and Egypt) are typically not wheat exporters and had little-to-no impact on markets.

Not all restrictions are created equal. Russia’s wheat ban was specifically for the 2021/22 wheat crop, and only applied to other nations in the Eurasian Economic Union (EEU): Armenia, Belarus, Kazakhstan, and Kyrgyzstan. The primary impact was that it created a ripple effect where all other EEU nations banned wheat exports shortly following Russia’s decision. While this illustrates the potentially contagious nature of export restrictions, it has had limited impact during the current crisis, and Russian wheat exports to importers like Turkey, Iran, and Egypt have been almost unchanged. This was also true of Russia’s 2020 export restrictions, which capped exports well above prior year export values.

However, a second set of restrictions has emerged that has the potential to be more harmful. India’s May 13 export ban on wheat had less to do with the Ukrainian conflict, and more to do with rapidly rising domestic prices. Unlike Russia’s ban, India’s extends into the next crop marketing year, covering a time when a large share of new crop wheat would be exported. Many nations that import wheat from India were already seeing rising food insecurity, including Bangladesh, Sri Lanka, Indonesia, and Yemen. While recent discussions have talked about potential exemptions for food-insecure nations, the uncertainty caused by the announcement has led to even further pressure on prices.

Unequal Impacts

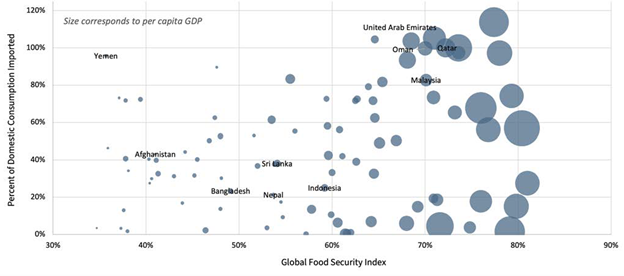

India’s ban on the export of wheat offers a case study into the potential unequal impacts of export bans. The figure below shows the share of cash grains a country imports relative to domestic consumption compared to their overall food security, as measured by The Economist’s Global Food Security Index. The named countries represent the top 10 destinations for exported Indian wheat during the 2020/21 crop marketing year. India primarily serves three sets of customers: wealthy nations with limited agricultural production, poorer nations with large agricultural production, and states with intense need. These groups are unlikely to feel the impacts of India’s food ban equally, highlighting two aspects of food insecurity: affordability and availability.

For the wealthiest nations with minimal agricultural production, access problems can be overcome by incomes. These nations often devote their scarce production resources to higher-value commodities, like animal protein production and specialty commodities, while importing most of their cash grain commodities. Nations like the United Arab Emirates have responded to potential access issues in the past by increasing their imports of cash grains during periods of strain. By consistently importing more food than is typically consumed, these nations ensure important redundancy to avoid access problems.

For the second group of poorer agricultural producers, food is often available but may be less affordable. Throughout the high-price period of 2008, nations like Bangladesh and Indonesia saw very limited impact to the total overall domestic consumption of cash grains. Ending stocks did not necessarily fall, but there was evidence of potential calorie switching in domestic consumers. Nations like Malaysia saw declines in beef consumption during the high price period, despite the negligible change in other consumption. For these nations, export restrictions contributed to a narrowing of domestic food choices, even if cash grains were still available.

For the group of states with intense need, export restrictions are acute challenges that can lead to true availability issues. In Afghanistan and Yemen, high-price years lead to very small or nonexistent ending stocks for major commodities. Stocks-to-use ratios are consistently low, and even lower during years of export restrictions. What is imported is generally eaten, often as a direct good rather than for protein production. When these nations lose access to markets due to export restrictions, there may be no replacement for them on the global stage.

This pattern was evident in 2008 and may be a foundation for the pattern of 2022 as production declines, high prices, and export restrictions roil the global commodity markets. Wealthy nations pay more, middle-income nations cut back on choice, and poor nations are often forced to go without. The threats to the global food system in 2022 are likely to be more severe than any shortage faced since the 1972 grain crisis, and the results may be more severe than any outcome in recent memory. Like so many times before, two things are likely to happen if these threats continue to play out: many major agricultural producers around the world will place restrictions on their exports, and America’s farmers and ranchers will do what they can to help meet the need.