The Future of U.S. Biofuels

Biofuels have played a big part in shaping the face of U.S. agriculture since 2005. With the Renewable Fuel Standard (RFS), policymakers prioritized the production of biomass-based fuels by setting minimum blend requirements for conventional petroleum fuels. The primary objective of this set of laws was to build demand for biofuels while using existing infrastructure to give the nascent industry a chance to mature and bring production to scale. The secondary objective was to spur innovation in low-carbon, energy-efficient biomass-based fuels like cellulosic ethanol and renewable diesel. Since its creation in 2005 and expansion in 2007, the RFS has prompted more than 200 billion gallons of U.S. ethanol production, helping raise octane and reduce emissions on roughly 2 trillion gallons of gasoline.

The primary feedstock for ethanol is corn, and ethanol consumes approximately 40% of all corn grown in the U.S. Since 2005, ethanol has expended more than 72 billion bushels of corn, with an annual demand of more than six billion bushels each year. While other biomass-based fuels are beginning to gain in popularity (e.g., biodiesel made from soybean oil and renewable diesel made from soybean, corn, vegetable, or animal fats and oils), corn-based ethanol is still the dominant player in U.S. biofuel production.

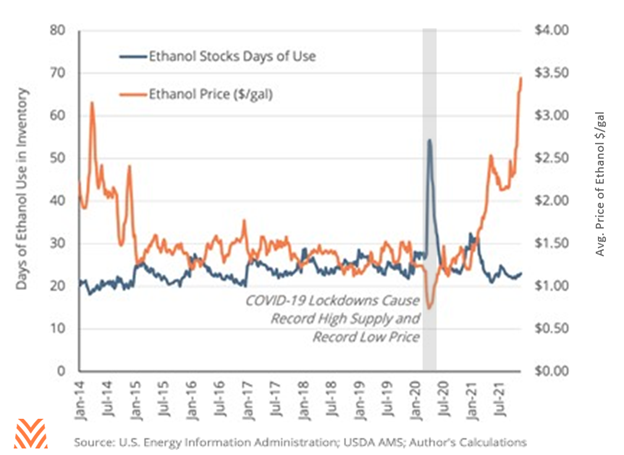

Coming out of the initial COVID-19 pandemic, the biofuels industry is at a crossroads. As the figure below demonstrates, when consumers stopped traveling for leisure or business, a large percentage of ethanol demand evaporated overnight. This caused a massive upswing in ethanol inventory and a downswing in market price, pushing many ethanol plants to temporarily or permanently mothball production. As consumers took to the roads again in late 2020 and throughout 2021, demand and prices came roaring back, taking ethanol prices and crush spreads to new heights. But the question lingers: What is the industry to do with a near-total reliance on gasoline blending for demand? With increasing consumer and legislator interest in electric vehicles and low- emissions fuels, as well as changing consumer behavior coming out of the pandemic, gasoline consumption in the U.S. is seeing downward pressure, which will be a headwind for future ethanol consumption. Fortunately, some offsets give the biofuels industry (and corn growers) time to reevaluate market conditions and make informed choices for the production and consumption of biofuels.

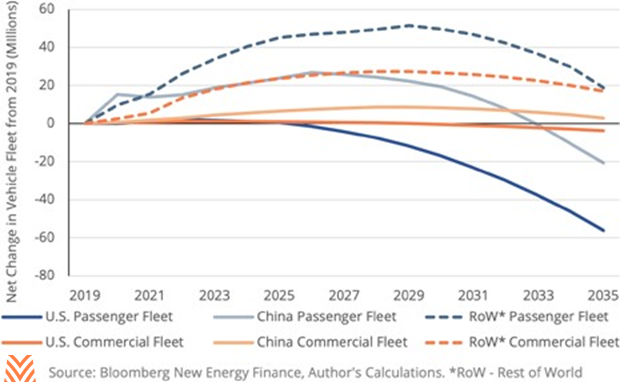

Until COVID-19, ethanol supply and demand were in relative harmony for years. Between 2015 and 2019, ethanol prices averaged $1.39 per gallon, and 80% of that time, the average weekly price was between $1.23 and $1.53 per gallon. That is a very tight price distribution compared to the experience in 2020 and 2021. Between 2014 and 2019, ethanol production grew at a modest 3% per year, and the demand growth was faster in export markets than it was for domestic gasoline blending. While supply will likely increase in 2021, given the persistently high gasoline and oil prices, capacity expansion has slowed considerably since 2018. The RFS gives the Environmental Protection Agency (EPA) the authority to set required blend minimums beyond 2022, but each year, the EPA takes longer to post the following year’s requirements, and there is growing unrest in political circles about the future of biofuel mandates. With rising consumer demand for electric vehicles that do not consume conventional fuels, future demand for ethanol feels less certain today than in years past. Bloomberg New Energy Finance (BNEF) forecasts 50 million fewer conventional passenger vehicles on American highways by 2035. If realized, that would take about a billion bushels of corn out of the demand function through blended ethanol.

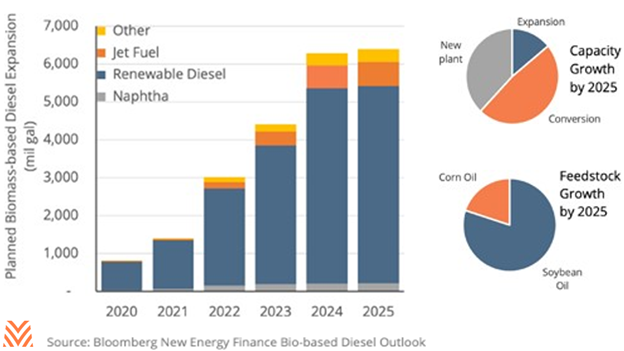

While ethanol demand faces headwinds from domestic gasoline blending, there are three major tailwinds that will buy time to reevaluate the industry’s likely still-bright future. First, the U.S. vehicle fleet will take many years to convert to electric. BNEF forecasts an increase in domestic vehicles using conventional gasoline and diesel fuel until 2027, and their research shows that commercial vehicles will take even longer to convert to electric. Second, international demand for conventionally-fueled vehicles is likely to rise through 2030 and beyond. Electric cars are expensive, and they require reliable electricity infrastructure to power. Advanced economies like those of the U.S. and the EU may be able to afford the fleet conversion, but the switch will take much longer in developing countries like China and India. The growth in conventional fuel usage in foreign markets should create export opportunities for the next 20 years, as more economies mature and emissions become a genuine concern. Finally, there is a growing interest in other bio-mass-based fuels, like renewable diesel and aviation biofuels. These fuels offer greater lifecycle greenhouse gas reduction, and both the RFS and California’s Low Carbon Fuel Standard prioritize their use over conventional biofuels like ethanol and biodiesel. Planned and announced production capacity in the U.S. is set to expand by over 5 billion gallons in the next four years, much of which will come from conversions of existing biofuel plants, with nearly all focused on soybean or corn oil (see the figure below). Consumption of these advanced biofuels will likely come from commercial transportation, which will probably be much harder to displace with electric alternatives in the intermediate or long-term.

Despite the near-term volatility in supply, demand, and market prices, the intermediate- term prospects for U.S. biofuels are somewhat bright. The feedstock and fuel-type mix will likely have to adjust to consumer, investor, and policymaker priorities. But there is no off-switch for biofuels in 2022. Demand for liquid fuels remains strong for commercial vehicles and all vehicles abroad, and agricultural feedstocks will continue to be a big part of the future biofuel mix.