Sweet and Sour: The Two Sides of Food Price Inflation

Inflation and Interest Rates

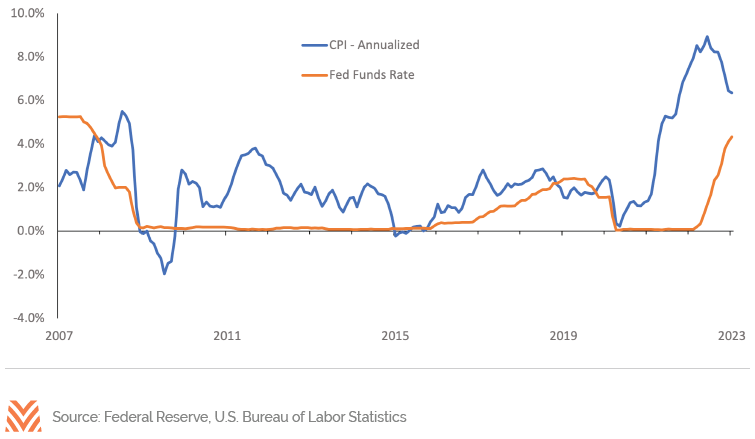

After several years of near-zero interest rates, the Federal Reserve responded in force in 2022 to the sharp increase in U.S. consumer prices. Short-term interest rates were raised at the fastest pace in decades, while long-term rates rose in response to a shrinking Federal Reserve balance sheet. The figure below shows how the pivot in monetary policy helped reverse the rising trend in consumer prices. The Fed has stated a commitment to driving inflation even lower, which may indicate we’re seeing a new normal for high-interest rates, at least in the near term.

The impact of persistently high inflation on the agricultural sector varies. Input costs for fuel and fertilizer rose 43% and 32%, respectively, in 2022 as Russia’s invasion of Ukraine sparked a rally in global energy prices. Labor costs also jumped last year as U.S. producers competed for workers in the tightest labor market in several decades. Fortunately, higher costs were largely offset last year by rising revenues. Farm-level commodity prices jumped in 2022 and boosted Net Cash Farm Income (NCFI) to the highest level on record.

Elevated Food Prices

Food constitutes a relatively small portion of the Consumer Price Index (CPI) basket but has contributed to the broad increase in consumer prices. The Fed’s goal to reduce inflation means slowing the increase in CPI, including for food prices, but the numerous unique factors driving up food prices complicate that goal. For example, factors like avian influenza and drought conditions across the western U.S., both of which have contributed to higher food prices, cannot generally be solved by monetary policy alone.

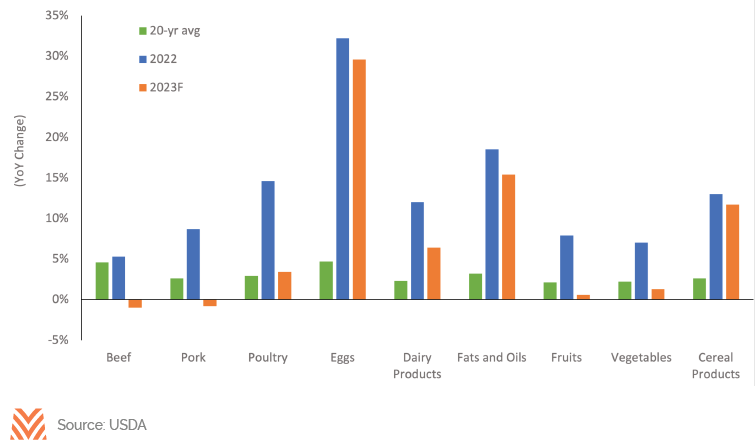

The figure below displays agricultural products and the corresponding changes in prices that have factored into the CPI calculation. There were numerous individual factors behind the rise in food prices last year. Egg prices surged as an avian influenza outbreak led to lower egg supplies. Beef prices rose due to record export demand amid lower U.S. cattle inventories. Multiple other commodities also benefitted from record export demand, including dairy and poultry. Meanwhile, fruit and vegetable prices rose in response to higher labor, water, and other production costs. The collective impact of these different factors was food price inflation reaching the highest level last year since the late-1970s.

Food price gains are expected to moderate in 2023 but are not expected to pull down overall inflation. Current projections show food prices increasing 8% in 2023, modestly lower than the 10% increase in 2022. Farm-level prices are broadly lower this year relative to last, highlighting an important attribute of retail food prices: labor, packaging, transportation, and other marketing costs constitute a much larger proportion of retail food costs than the underlying commodity. On average, agricultural producers receive only 15% of each dollar spent on food in the U.S. Therefore, changes in costs for the remaining 85% can have an outsized impact on food prices and inflation. Notably, higher labor and transportation costs have contributed significantly to higher retail food prices over the last year.

Importantly for agricultural producers, farm profitability tends to rise during periods of elevated food price inflation. Since 1951, NCFI has, on average, been 10% higher during years when food price inflation exceeded 5%. When accounting for government payments, which are often counter-cyclical, the difference in NCFI is even larger. While elevated food prices may weigh on consumer budgets and raise the likelihood of continued interest rate hikes, history suggests that overall farm profitability could follow food prices and remain elevated. Overall, it remains to be seen how food price inflation—and the Fed’s efforts to cool it down—will play out in the near term, but producers and lenders should continue to monitor food price levels as an important indicator.