Rising Farm Input Costs to Pressure Profits

As the saying goes, it takes two to tango. Farm profitability is not only a function of market commodity and food prices but also the prices and costs of inputs needed to raise agricultural products. Individual expense line-items vary across operations, but the USDA provides helpful expense categories that make it easy to track sector-level trends by expense item, including categories like feed, fertilizers, fuel, interest, labor, rent, and seed, to name a few. Total farm expenses tend to track very closely with farm incomes, as outputs from some farmers are the inputs for others (e.g., corn used for animal feed). There are also farm expenses that lag behind a good or bad agricultural economy, such as seed, land, and machinery costs. These expenses tend to rise after a period of strong profits and then slowly drift down after a period of stagnant profits. Finally, some expenses are uncorrelated with the annual sector changes and somewhat beyond producers’ control, such as interest, labor, and fuel costs. While every operation manages these expenses individually, the collective sector expense levels can indicate the overall amount of pressure farm profits may feel during the coming year.

The USDA released its first look at 2022 farm expenses this February, and not surprisingly, economists forecasted a significant rise in farm expenses. USDA economists project increases in eight out of the ten major expense categories in 2022, including a 12% increase in fertilizer expenses, a 10% increase in interest expense, and a 7% increase in animal purchase expense. These projected increases reflect recent increases in energy costs, supply chain disruptions, rising interest rates, and higher feed grain prices. The only categories forecast to either remain stable or fall were seed expense and net rent to landlords, but these expenses are small relative to the other categories. In total, the USDA expects farmers to spend approximately 5% more in cash expenses in 2022 relative to 2021.

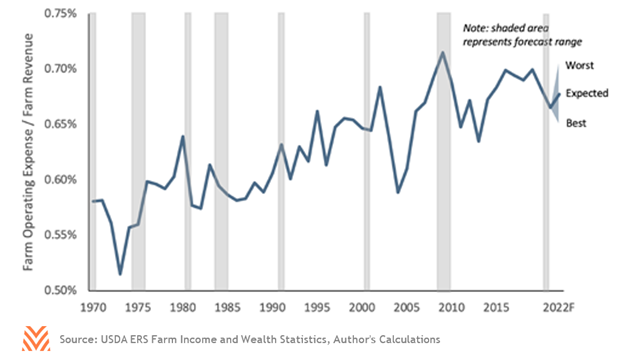

A good way to contextualize farm expenses is their level relative to income or the operating expense ratio. This metric shows how much of every farm dollar earned is lost to operating expense, and the figure below shows the historical trend of operating expense ratio from 1970 to 2022 forecast. Before the commodity price increases in 2021, the operating expense ratio was operating at a historically high level of 0.70. During the last supercycle, from 2012 to 2014, the ratio was below 0.65. Current estimates of 2021 operating expenses show a return near that level of profitability. But estimates of 2022 show a reversal back toward 0.70, and if expenses end up higher than USDA estimates (i.e., at a nintieth percentile historical increase) and commodity prices don’t increase to match, the operating expense ratio could exceed 0.70 in 2022. Conversely, if commodity prices remain elevated and world supplies see continued disruption, the operating expense ratio may retract to super cycle-era levels.

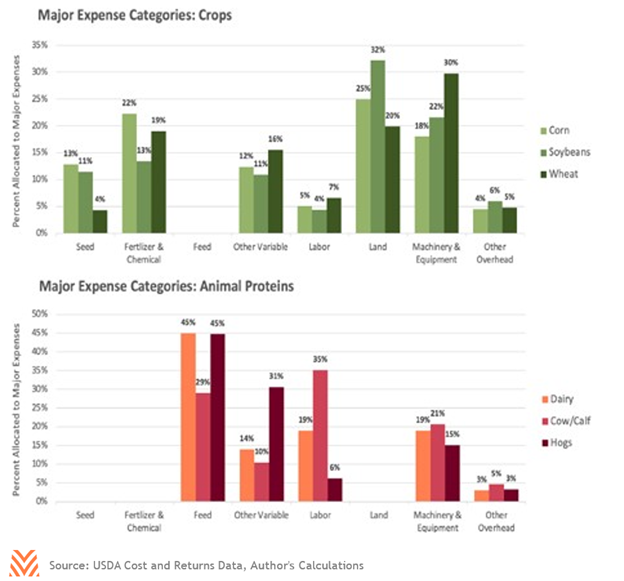

Different sectors will be impacted by different expense pressures. The figure below breaks down the major expense categories by the percentage of total production expenses for major crop and animal protein sectors. Corn, soybean, and wheat production have a high percentage of expenses in land, fertilizer, and machinery, so increases in any of those inputs will more adversely impact those sectors than others. Similarly, animal protein producers are highly exposed to feed, labor, and equipment expenses. According to data from Green Markets, fertilizer prices were up nearly 100% annually in December 2021 before settling back down to 57% above 2021 levels in February 2022 (before the Russian military actions in Ukraine). These dramatic increases will impact corn and wheat producers the most, although higher land expenses could also pressure soybean producers. Dairy, cattle, and hog producers are grappling with a 13% increase in animal feed price indices between January 2021 and January 2022. Combined with a 4.5% increase in agricultural servicer workers’ wages, animal protein producers of all sizes and scales are seeing expense levels rise at a rapid pace.

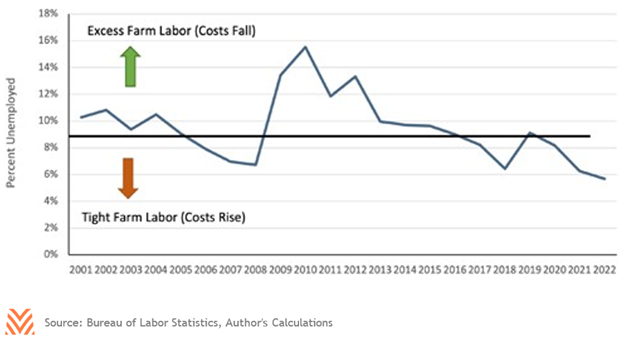

Specialty crop producers are feeling the pressure as well, particularly on the cost of labor. Data from the U.S. Bureau of Labor Statistics show that agricultural unemployment rates are at their lowest levels in the 20 years the data has been released (see the figure below). Low unemployment rates can mean there are more jobs available than workers to fill them, putting upward pressure on wages in those industries and areas. In states like California, where labor is the top expense line item, wage rates are rising even faster than the U.S. average. According to the USDA Farm Labor Survey, the average wage of California field workers increased 8.5% between October 2020 and October 2021.

The combined effect of these expense increases is downward pressure on profitability across agricultural sectors. It does not guarantee losses, but a tighter budget gives producers fewer chances to make mistakes and still ink the profitability levels experienced in 2021. Researchers from Purdue University and the University of Illinois show lower expected returns to crop producers in 2022, but the budgeted returns are still positive. Producers and lenders alike will need to approach the 2022 growing season with a careful eye to avoid buyers’ and growers’ remorse this year. Despite these challenges, commodity prices remain above breakeven levels for many, so profits can and will be inked by many.