Raising the Steaks

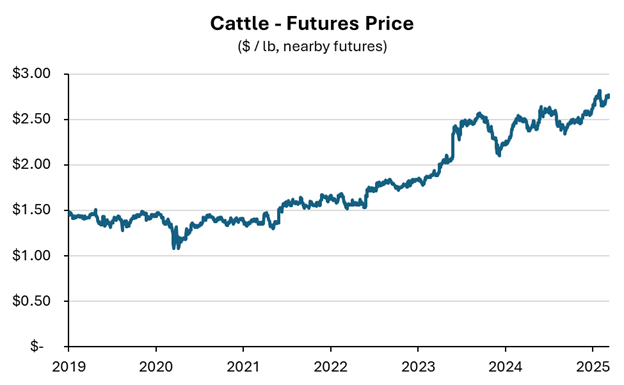

To say cattle ranchers have generally thrived in the past two years might be a dramatic understatement. Feeder cattle prices reached new record levels in 2023 as the cattle herd shrank by the largest percentage since the late 1980s. But the contraction didn’t stop there, nor did the price surge. By mid-2024, prices reached even higher levels, holding steady through the year before climbing again to a new peak in 2025. All told, consecutive years of record beef prices have been a welcome reprieve for cow-calf ranchers, who endured a tough profitability environment between 2015 and 2021.

Contraction Continues

Changes in the cattle herd alone suggest profitability will remain high in 2025 and beyond. The primary factor driving cattle prices upwards persists: a declining supply of cows in the U.S. Data released by the USDA in February revealed that the U.S. cattle herd contracted again in 2025, marking the sixth consecutive year of decline. Total inventory fell to 86.7 million head, 1% below last year’s levels and the smallest herd size in over 60 years. Though the contraction has slowed, it remains stubbornly persistent, and reversing the downward trend may continue to be a challenge. Record-high prices have prompted many ranchers to sell heifers to feedlots rather than retain them to expand their herd.

Further hindering expansion, some producers hoping to grow their herd face weather-induced obstacles. As of late April, drought conditions affected approximately 38% of the U.S. cattle herd, up from 17% the year before. Pasture conditions have deteriorated due to the lack of precipitation, forcing producers to rely on alternative feed sources. Fortunately, feed costs have fallen significantly, offering financial relief to producers who take this route. Hay and forage costs have dropped by 40% or more since peaking in the spring of 2023. Still, many beef producers may simply opt to downsize their herds in response to the ongoing drought.

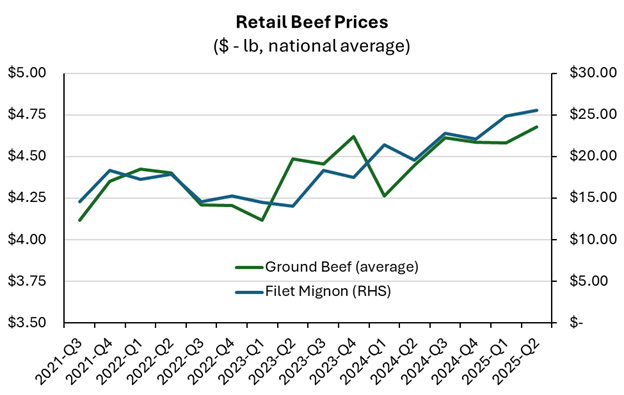

Retail Beef Prices

While the U.S. beef cattle population has declined in recent years, demand remains strong. Per capita U.S. beef consumption held steady in 2024 despite a 5.4% rise in average beef prices. Retail beef prices have continued to climb since 2023. In Q2 2025, retail ground beef prices averaged $4.68 per pound, up 5% compared to Q2 2024. High-end cuts, too, are seeing price increases, with retail filet mignon surpassing $25 per pound in Q2 2025. Domestic consumption has proven remarkably resilient amid rising prices.

Strong demand for U.S. beef extends beyond domestic consumers. Beef exports remained robust in 2024, rising 5% to exceed $10 billion. Exports to Asia rose 4%, driven by the top markets of South Korea and Japan. Compared to other agricultural commodities such as corn and soybeans, U.S. beef holds a quality edge over South American competitors, fueling global demand for U.S. beef.

Drought and Tariffs: A ‘Nothing Burger’ or Not?

Uncertainty clouds the outlook for the U.S. cattle sector. The herd has taken tentative steps towards expansion, with heifer retention rates set to rise and cow culling continuing to drop. However, drought remains a major wildcard, with precipitation scarce across many cattle-producing regions. As of April 15, 2025, approximately 38% of the U.S. cattle herd was in areas affected by moderate drought or worse. If drought conditions persist or intensify, cattle producers could face feed and forage shortages, and the herd may shrink again in 2025.

Much of the uncertainty in the beef sector stems from shifts in U.S. trade policy. In April 2025, tariffs were imposed on nearly every U.S. beef export market. By the end of the month, most countries had not yet imposed retaliatory tariffs. But U.S. officials have threatened to raise tariffs in July, and some countries may retaliate if a trade deal isn’t reached by then.

The potential impact of counter-tariffs on U.S. beef varies across countries, because the U.S. exports different types of beef to each market. South Korea, the largest U.S. beef export market by value, primarily imports high-end beef cuts such as steak. Counter-tariffs from South Korea would likely result in a direct reduction of U.S. beef sales to the country.

In contrast, Mexico is the largest importer of U.S. beef by volume, though much of it consists of lower-end cuts. About one-quarter of Mexico’s beef imports are offal—internal organ meats that are typically less desirable in the U.S. and other countries. Offal accounts for a small portion of a beef cow’s value—usually 5% or less depending on the animal. If Mexico imposes retaliatory tariffs on U.S. beef, processors might lower offal prices to offset the tariff, keeping the product flowing rather than seeking new markets. However, discounting other beef cuts could be far more expensive, and U.S. beef prices overall would likely drop in such a scenario.

Conclusion

Cattle producers, along with the lenders who finance them, face a pivotal year. Revenues have been historically strong, driven by record prices in consecutive years. Yet challenges abound as producers grapple with trade uncertainty, regional droughts, and declining consumer confidence, which could dampen retail beef demand. The near-term outlook remains positive, but uncertainty is likely to persist.