“Pasture” Prime? An Analysis of the Equine Industry

Change From the Past

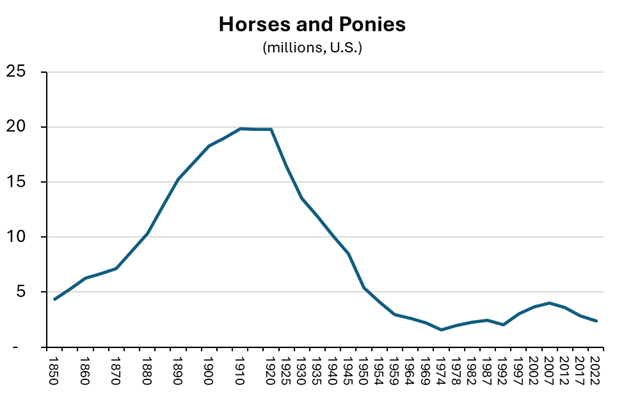

The U.S. equine industry remains alive and well despite some dramatic changes over the past century. The horse population in the U.S. peaked between 1910 and 1920 at approximately 20 million. Far from coincidentally, a renaissance in transportation also occurred during this period with the advent of gas-powered engines. In the decades that followed, people swapped horses for cars and farms opted for tractors over mules. The number of horses may have dropped dramatically from those years, but horses remain prevalent in the U.S. to this day. Furthermore, these animals remain incredibly valuable to their owners and the farms and ranches they are located on.

Horse Ownership Segments

There is no official classification system for horse ownership, but it may be helpful to examine the state of the industry by looking at the three major types of horse farms, which could be classified as follows:

- Hobby owners who generally own horses for pleasure over profit.

- Ranchers who utilize horses in the production of other livestock, such as for driving cattle or sheep.

- Commercial horse farms, which might vary from boarding and training to showing, racing, and even using horses in various sports.

Each segment faces unique economic conditions that influence its willingness and ability to raise horses. It may be superfluous to note, but equine in the U.S. is dissimilar to other livestock in that it is not consumed. As such, the market price of horses exhibits little correlation with global factors that impact prices for cows, pigs, chickens, and other livestock. Instead, the number and location of horses in the U.S. tend to reflect other macroeconomic factors.

Fewer Small Farmers Horsing Around

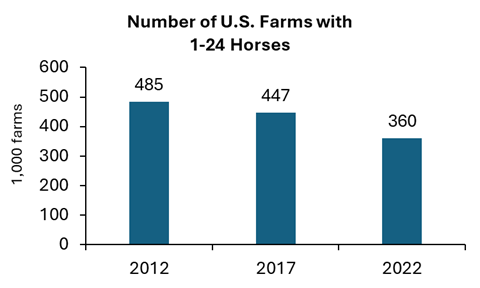

The number of small U.S. horse farms has dropped over the last decade due to several coalescing factors. From 2012 to 2022, the number of small horse farms—those with 24 horses or less—dropped by 26%, from nearly 485,000 to approximately 360,000. However, these farms remain a vital piece of the U.S. horse industry: as of 2022, approximately 72% of horses in the U.S. were on farms of this size. Still, that proportion has declined from over 77% of horses being on small farms in 2017. The decline in many ways reflects a wide variety of factors within and outside of the horse industry in general.

One notable factor is the simple economics of owning a horse. Horse ownership costs have increased steadily over the past decade, including hoof care, supplements, and routine vet costs. Feed costs also surged in 2022 and 2023 due to limited hay inventory, but have since cooled. Beyond these significant expenses, there are often ancillary costs associated with horse ownership that may not apply to other livestock or even pets, like dogs or cats. Teeth floating, farrier visits, and of course, the normal regimen of vaccines and checkups, can all be unique and additional costs associated with horse ownership.

Demographics also likely play a role in the decline of smaller horse farms as well. As the U.S. population has shifted increasingly to urban through time, fewer individuals are raised on farms or in a rural setting, and therefore fewer adults were exposed to horses or livestock in their upbringing. This does not prohibit horse ownership in adulthood. Indeed, many horse owners come from urban backgrounds with little experience on a farm or with livestock. However, the fact that horses require similar caretaking to other livestock can lead to a greater familiarity and comfort level among individuals raised in that environment.

Ranches Turn to Machines, Again

History tends to repeat itself—or so goes the saying. Ranchers, once again, are shunning horses in favor of new gas-powered machines. Unlike a century ago, though, it’s not cars that are replacing horses. Today, horses face competition from off-road vehicles (ORVs), such as all-terrain vehicles (ATVs) and utility terrain vehicles (UTVs).

Demand for ORVs has increased dramatically on U.S. farms and ranches over the last two decades as the machines have increased in complexity. The interest in ORVs is not isolated to just ranchers who used to turn to horses. Demand for ORVs has spiked among all sorts of consumers. In fact, North American sales of ORVs were 805,000 in 2023, up 9.5% from 2018. This growth mirrors a trend in global demand for ORVs, which were 43.6% higher in 2023 than 2010. While ranchers only constitute a small proportion of those ORV sales, demand for ranch horses has felt the impact, especially as ORV models are increasingly customized for end users like ranchers.

Horses have long been associated with ranches—perhaps one of the few things that cowboy movies get right. Many of the reasons horses were ubiquitous on ranches in the 1800s are still relevant today. Simply put, horses can often navigate pasture and range conditions that pickup trucks and many other farm vehicles cannot. From rough, rugged terrain to swamps and rivers, and every type of pasture in between, horses long held an upper hand over motorized vehicles. Couple this with a horse’s agility and endurance, and it’s easy to see why they’re great sidekicks to ranchers.

In recent years, however, many ranchers have moved away from horses in favor of ORVs to conduct ranching duties. ORVs have evolved rapidly over the last two decades. Many models today rival horses in their ability to navigate challenging terrain and their agility in doing so. While costly upfront, ATVs and UTVs generally do not require the same level of inputs to run. These machines rely only on gas and limited maintenance, while horses require feed, rest, and veterinary care. This doesn’t imply horses have been entirely replaced on ranches. There are still some terrains that even today’s ATVs and UTVs cannot navigate, and many ranchers prefer how their livestock respond to horses relative to machines. Still, the growing prevalence of ATVs on farms and ranches helps explain the reduced demand for horses on many of those same operations.

Large Horse Farms on the Rise

Not all segments of horse farms are on the decline. In fact, the number of farms with 50 or more horses increased 9% between 2017 and 2022. The growth is perplexing at first glance, given the significant decline in farms with a small number of horses. However, there are numerous factors behind the growth that indicate this segment could continue to expand in the future.

Perhaps the most publicly visible segment of the horse industry are racehorses. The horse racing industry has benefitted from a period of sustained growth over the last several decades, most notably abroad. In fact, the global horse racing market is projected to increase 7% annually between 2023 and 2030. Yet while the largest growth may be occurring abroad, U.S. racehorse owners stand to benefit. Many U.S. racehorse owners market their animals and genetics outside of the U.S., especially offspring from top-tier racehorses. Still, horse racing remains popular domestically, and many large U.S. horse farms are growing to help supply the racing industry.

One other significant driver behind the growth in large horse farms has been, ironically, the decline in small horse farms. Confronted by the challenges of owning a small number of horses (and a property big enough for them), many hobby horse owners today are opting to board their horses at commercial operations. As with other areas of the agricultural sector, economies of scale come into play. Commercial stables that house dozens of horses are often able to purchase many items in bulk, including hay, feed, and vet supplies. Many of these facilities also employ in-house vets, which can reduce the cost per visit for routine or ad hoc vet services.

On top of this, commercial stables are also able to spread one of the most expensive items across numerous horse owners: the land and facilities itself. Farmland values have spiked across the U.S., increasing 29% since 2019 nationally. The increase has been arguably even greater for land within close proximity to cities, where many horse owners reside, due to the sharp jump in demand among housing developers since 2020. Facilities are also cheaper when spread across numerous animals. The per-unit cost to build a barn for two horses is significantly higher than the per-unit cost for a 100-unit barn. While commercial stables do expect a financial return for housing other people’s horses, the growth of these operations indicates that many horse owners today feel the caretaking costs associated with these facilities are more than worth it.

Conclusion

Horse numbers in the U.S. have long been influenced by changes within the U.S. agricultural sector and, really, the broader economy overall. Predictions of the demise of horses a century ago proved to be false, and the horse industry in this country continues to evolve to this day. Farms with a small number of horses may be in decline, facing pressure from numerous factors such as land availability and rising costs. Still, the sector continues to adapt just as it has for over a century, and demand for horses for both leisure and sport remains strong.