Making (Too Much?) Hay While the Sun Shines

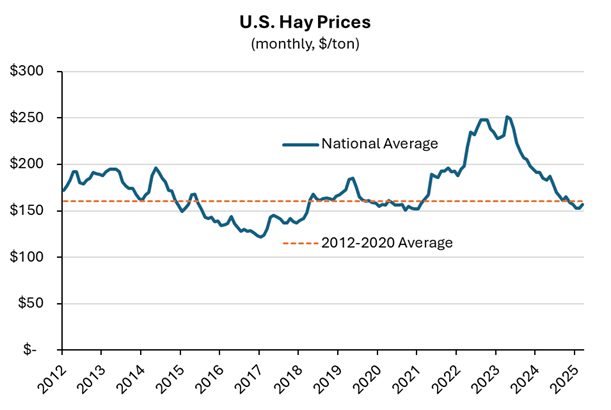

Roller-coaster market conditions have continued for hay producers in 2025. Hay prices have trended consistently lower since topping out in early 2023, with the national average hay price 40% lower this January than the peak. The drop has mirrored the broad decline in annual crop prices over the last two years. However, the factors driving hay prices lower extend beyond those impacting other annual crops.

Inventory Rebound

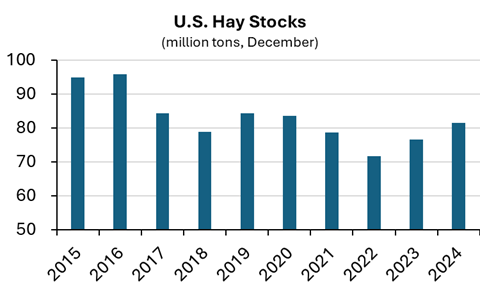

There are some factors driving both hay and other commodity prices, including a rebound in inventories. U.S. hay stocks have jumped over the past two years, and surpassed 82 million tons in December, up 6% from last year and 14% from 2022 levels. Hay inventories tend to oscillate higher and lower as supply and demand fluctuate. Indeed, the recent growth in stocks is attributable to changes in both. Hay production increased 6% in 2023 and an additional 3% last year.

The disappearance of drought conditions enabled this production rebound. The Western half of the U.S. had endured a multi-year drought from 2020 through 2022. While conditions varied across states, the broad nature of the drought had a significant impact on many types of crop producers, including hay. At the peak in 2022, nearly 40% of all hay acres in the U.S. faced drought conditions classified as severe or worse by the U.S. Drought Monitor. Scant precipitation combined with restrictions on irrigation water led to a significant production decline across thousands of thirsty hay acres west of the Mississippi River. Fortunately, the drought abated in 2023, enabling a rebound in hay output. Drought remains top of mind, though, for many producers, especially following a relatively dry winter.

On the other side of the price equation for hay, demand has been tepid due to a pullback in demand from livestock producers. Domestic consumption accounts for over 95% of U.S. hay production, largely by the beef cow and dairy sectors. Unfortunately for hay producers, the number of dairy cows has stagnated in recent years—and actually declined in the case of beef cows. The runup in hay prices in 2022 was partially linked to increased demand from cattle producers. As drought conditions punished hay acres, drought also impacted pasture conditions, causing cattle farmers to purchase more hay than normal. Since 2022, pasture conditions have largely recovered, and many cattle producers have reduced their herd size. The combined result has been less demand for hay, putting downward pressure on prices.

‘Hay’ There, Exports

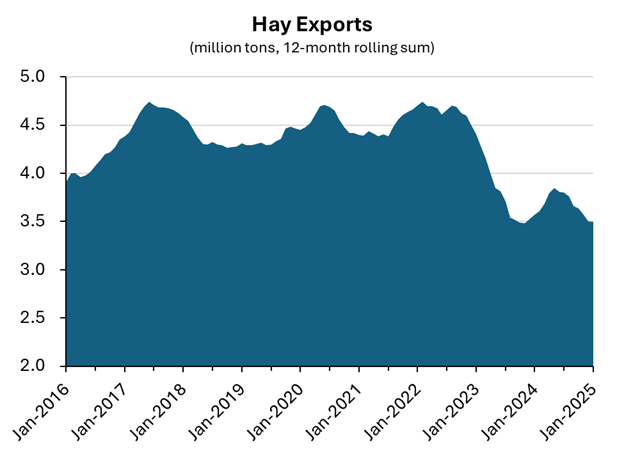

Domestic demand has not been the only challenge for hay producers: export volumes have also dropped over the last two years. Exports constitute less than 5% of total hay production in the U.S. For contrast, over 50% of soybeans and over 70% of almonds produced in the U.S. are exported. Still, foreign demand represents a key outlet for U.S. hay producers, especially in Western states.

Subdued export demand is yet another challenge for hay prices. Export volumes of hay peaked in 2022 before falling precipitously throughout 2023. A trailing 12-month average shows export volumes declined 27% from peak to trough before rebounding modestly in 2024. Still, export volumes remain tepid to start the year, despite being priced to move. Hay exports were 19% lower in January 2025 relative to the previous 5-year average.

There are several factors behind the drop in exports. Milk prices have been relatively weak in several key export destinations, including China. Importing premium feed from the U.S. has therefore become too costly for many of these producers. A strong U.S. dollar (USD) has also played a role, as the USD rose to its strongest value in 2024 in over 20 years (excluding a brief boom in 2022). A strong stock market and relatively high interest rates attracted capital to the country, further boosting the USD’s strength. However, this dynamic also created headwinds for exports by making U.S. products more expensive relative to competitors, including for hay.

Looking Ahead

Unsurprisingly, the outlook for hay prices in the U.S. is mixed. There are signs the U.S. beef herd may be in the initial phase of expanding, and the USDA projects that dairy cow numbers will increase this year as well. Both could provide a boost to demand and prices. On the other hand, future export demand is uncertain, and headwinds have mounted as U.S. trade policy has proven to be murky in early 2025. Because inventories continue to rebound, hay prices are rangebound and unlikely to return to early-2023 levels.