Infinite Almonds

Abundant Almonds Weighing on Prices

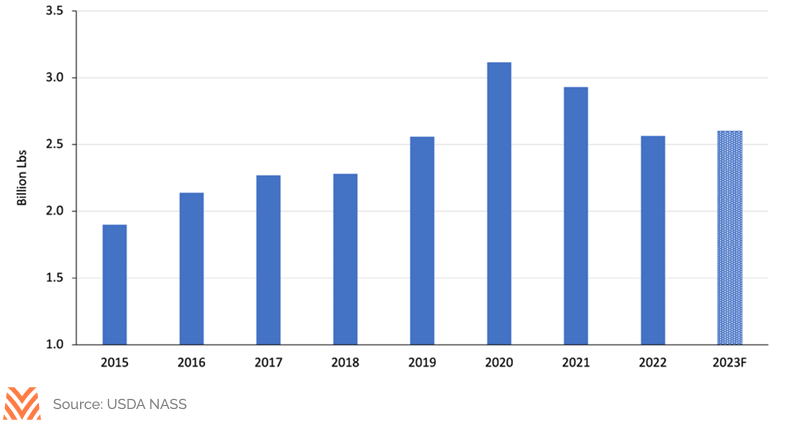

Almond growers welcomed record precipitation across the West Coast last winter that provided some relief to parched farmland and reservoirs. Unfortunately, a reprieve from one challenge has now highlighted another: an oversupply of almonds. As the epicenter of the global almond industry, the growth in U.S. almond production has been concentrated exclusively in California. From 2010 to 2020, U.S. almond production increased by 90% to over 3 billion pounds, all of which were grown in California.

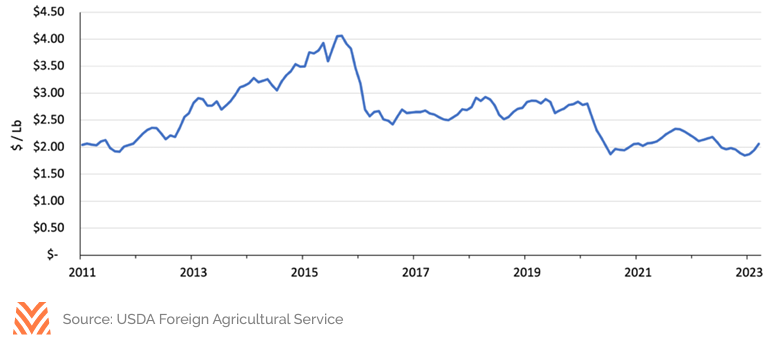

Higher domestic consumption and greater export demand initially absorbed the increase in supply and fueled a run-up in prices through 2015. However, harvests continued to increase as producers sowed additional acreage to capitalize on the profitable crop. Non-bearing almond acres, a leading indicator of future almond crops, quadrupled between 2010 and 2020. As more and more of these non-bearing acres grew and began to produce almonds, overall production expanded. Ample supplies allowed domestic and foreign buyers to purchase almonds at lower prices.

Indeed, the increase in almond production has not been a straight line higher. Despite a steady rise in bearing almond acres, total U.S. almond production has actually declined over the past two years. Almond production peaked above 3 billion pounds in 2020 before dipping in 2021 and again in 2022. These declines were partly due to the multiyear drought that led to water rationing. However, water will not likely be an issue in 2023, given the record snowpack across the U.S. Southwest and California’s 100% water allocation. Instead, storms, rainfall, and other inclement weather during the spring bloom impacted almond pollination this year. As a result, the USDA projects production will increase a modest 1% year-over-year in 2023 to 2.6 billion pounds. Favorable growing conditions this summer could boost the eventual harvest. However, the moderately larger crop may help limit the downward pressure on almond prices this year.

Exports Rebounding; Prices, Less So

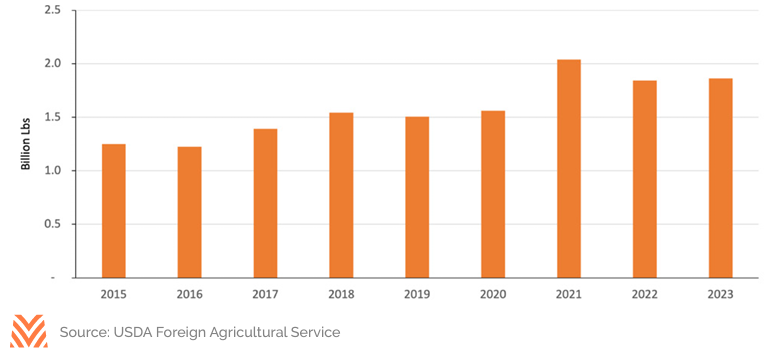

Exports have been integral to absorbing the growth in almond supply over the past decade. Approximately two-thirds of U.S. almond production is shipped abroad annually. Per capita consumption has increased in the U.S. as well, but not nearly at the pace that export volumes have grown. Given the proportion of production sold internationally, exports are closely watched as a bellwether in the industry.

A backlog of agricultural products at West Coast ports in 2021 and 2022 weighed heavily on domestic prices. On top of this, exports to India languished over the past several years due to retaliatory tariffs placed on numerous U.S. agricultural goods, including almonds. Fortunately, the congestion at West Coast ports has largely been resolved thanks in part to efforts from the USDA. In addition to resolving the port congestion, India announced the removal of retaliatory tariffs on almonds in June. The impact of reduced tariffs will likely take time to filter through to higher grower prices. The step is a positive development for the industry, nonetheless. India is the largest export market for U.S. almonds, and per capita consumption continues to rise in the country. There are also macroeconomic tailwinds likely to boost global demand for almonds. A modestly weaker U.S. dollar has made U.S. almonds relatively more affordable globally, and almond shipments have benefited. Export volumes through July nearly matched last year’s exports despite the smaller crop produced this marketing year.

An important caveat to the rebound in export sales is that U.S. almonds have been priced to move. The average export price for almonds had dropped to $1.85 per pound by February, the lowest level since 2010. For context, almond export prices peaked above $4.00 per pound in 2015 and have decreased since then. Sharp price declines in 2016 and 2020 were followed by only moderate rebounds before prices continued moving lower. And while export prices do not fully reflect farmgate prices, they provide a timely reference point. The USDA currently projects that the 2022 almond crop will average $1.40 per pound to the producer, which would be the lowest price in over 20 years. The 20% reduction in India’s tariff rate this summer should help boost the average export price, but the price movement will likely occur gradually.

Acreage Adaptation

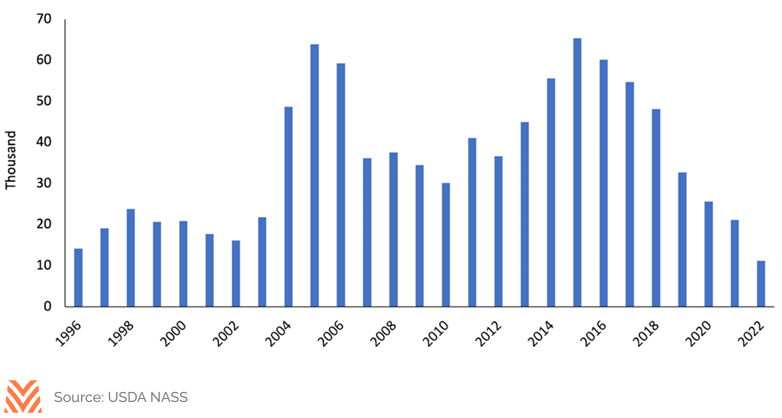

Producers have responded to the constant pressure on profitability over the past several years. New almond acres planted in California totaled 11,160 in 2022, which is 10,000 fewer acres than in 2021. This marked the seventh consecutive year that new almond acres planted declined relative to the year before. While the number of newly planted acres has dropped, total bearing acreage continues to increase as already-planted non-bearing trees are continuing to mature even as planters pump the brakes. Almond trees take approximately three to five years to reach full maturity and prime yields. This biological attribute can result in a significant lag between rising prices and producers delivering more almonds to market. Yet even when almond prices decline, producers are often reluctant to remove almond groves, given the significant upfront costs and time required to establish orchards. A reluctance to pull almond trees and reduce supply can therefore prolong a period of oversupply in the almond market. Still, almond trees have a relatively finite life and begin to see yields drop 20 to 25 years after planting. Therefore, planted acreage from the late-1990s is likely prime to be removed during the current market environment and many producers have done so.

Low prices are not the only factor motivating a pullback in acreage. The Sustainable Groundwater Management Act (SGMA) led many producers to alter their planting decisions years ago in anticipation of reduced water availability. Drought conditions over the past several years likely accelerated these decisions as producers shifted acreage to less water-intensive or no crops.

Conclusion

The almond industry is no stranger to swings in profitability. Historically, a spike in prices has been followed by periods of tight margins, a common theme across the agricultural sector. Almond producers have increased production faster than global appetites have grown for the commodity, at least at the previous price levels. The resulting abundance of almonds may continue to weigh on farm profitability in the near term. The removal of retaliatory tariffs by India should lift prices moderately in the short term. Looking further ahead, though, the pullback in newly planted acreage will likely provide support for prices in the years to come.