High Retail Costs Finally Make Their Way to Cattle Producers

After almost two years of a difficult price environment, cattle producers are finally seeing some momentum. Futures markets have accelerated in recent weeks, with cash prices rising to their highest point since 2017. An almost 20% improvement in cash markets through November happened just as more good news came along in the form of slaughter data suggesting that a backlog producers have had for almost two years has finally dissipated. A combination of strong retail markets and the reduction in processing constraints means that ranchers might see a run of strong prices to start 2022.

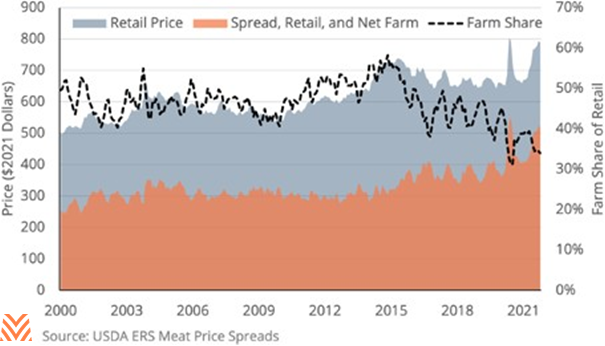

In inflation-adjusted terms, retail beef prices are at a record high. We should expect that such high beef prices will eventually be passed down to ranchers, although they’re taking a smaller slice of the retail pie than they used to. The last time prices were near this level, during the commodity supercycle, ranchers could expect to take home more than 50% of total retail prices. However, as of the USDA ERS’s latest data from October 2021, just 34% of total retail cost went to farmers. The figure below shows the relationship between retail price and farm price since 2000: In general, producers’ income share had been stable up until 2015, when growth in wholesale prices began to outstrip growth in retail and farm pricing.

Nevertheless, the latest industry data suggest that beef processing may be losing some leverage over producers. In November, carcass weights fell back to baseline levels for the first time since 2019. Slaughter rates remain elevated, with total annual production 3% above last year’s total as of early December 2021. The latest cattle on feed data also suggest that the herd has not seen significant growth and that placements have not yet responded to improving market prices. Combined with USDA forecasts that total domestic beef consumption will rise in 2021, cattle producers could see a situation where demand significantly outstrips supply.

The good news for beef producers is that demand might continue to improve. While exports have historically been a negligible part of U.S. beef consumption, total exports of beef between January and October 2021 are 20% higher than the same period the prior year. Increases in Chinese consumption are primarily responsible, but considerable growth from partners like South Korea, Japan, and Mexico indicate that this demand growth could be sustainable. In addition, the USDA announced $32 million in grants to beef and poultry facilities to expand their processing capacity. While these and other recent policy actions will not have immediate impacts on farm- to-retail spreads, it does signal that farmers could see stronger returns in several years.

After several years of lower prices and higher costs, ranchers are more than due for this good news. For some, even these surging prices might be too late. Producers across the country had dealt with rising feed costs and flat-to-low cattle pricing, even as beef prices at their local grocers continued to rise. In areas like the Pacific Northwest, these issues are so critical that local lenders fear that many producers will opt to liquidate their herd. But for those producers who have made it through this hard period, a reprieve is likely on the way.