Grains and Oilseeds Supplies Challenged by Big Brazilian Crop

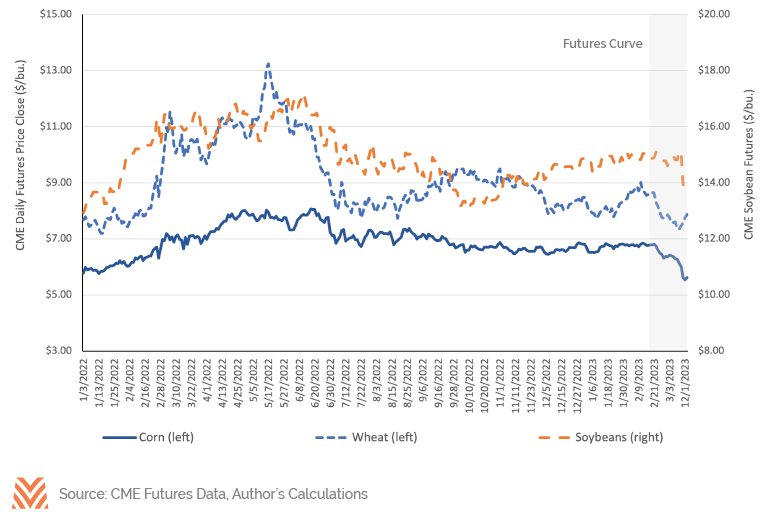

Grain operations in the U.S. have had a good run since 2020. High commodity prices drove revenues to new highs in 2021 and 2022. Input costs rose, but much of that run-up happened after farmers procured supplies for the 2022 crop year. Depending on the crop grown, operator profits soared to new records on a per-acre basis in 2021 and 2022. Stock-to-use ratios, a measure of the amount of supply relative to the demand, for corn, soybeans, and wheat touched multi-year lows in 2021 and 2022. The disruption in Ukrainian corn and wheat exacerbated these market conditions, pushing supply and demand further apart and increasing world food price volatility.

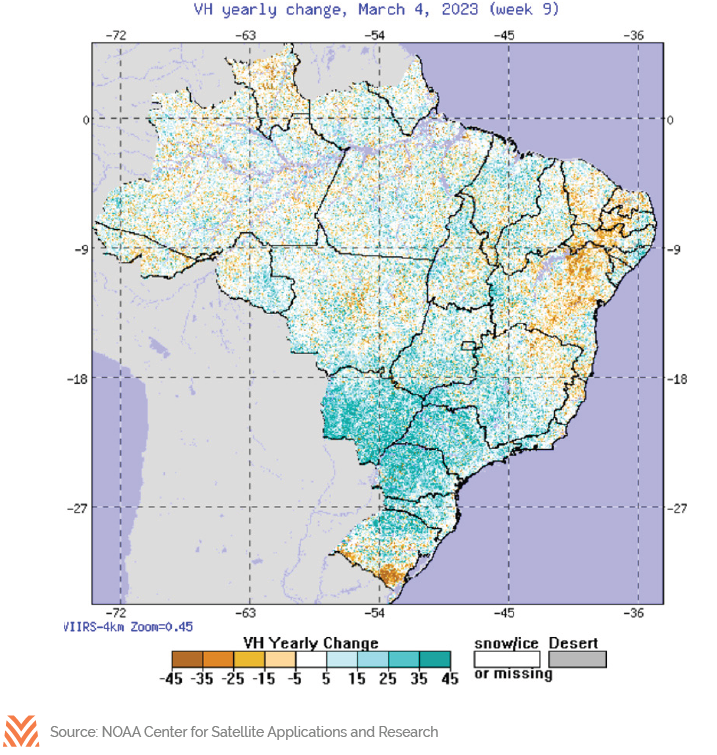

But now, two sources of market disruption are taking form in early 2023. First, Brazil is set for a bumper crop of corn and soybeans in 2023; the USDA’s March World Agricultural Supply and Demand Estimates (WASDE) forecast a record crop for both commodities. Brazilian farmers planted approximately 5% more acres in 2023 compared to 2022. While there is some speculation that a warmer, dryer fall could hurt ultimate yields, the downside risk to the crop is limited this late in their growing season. Vegetative health in early March was much improved compared to 2022, further evidence that Brazilian crop yields could still be healthy at harvest. Large corn and soybean crops in Brazil increase global supplies and can put downward pressure on commodity prices.

Second, relations between the U.S. and China became more strained in early 2023. National security concerns, the future fate of Taiwan, deglobalization, and the ongoing Russia-Ukraine war have challenged Sino-American relations. China was America’s largest agricultural trading partner in 2021 and 2022, and a downturn in the relationship could jeopardize billions in demand for U.S. exports, particularly for soybeans.

With production costs in greater focus, supply and demand are likely becoming the biggest drivers of commodity prices and crop profitability in 2023. Corn and wheat are leaking out of Ukraine at a slower pace and smaller volume than pre-war. Despite concerns about Sino-American relations, U.S. exports to China were exceptional in January and February of 2023. Brazil will certainly provide an effective challenge for U.S. producers, putting additional supply in the market in 2023. Renewable diesel and other low-carbon biofuels are spawning new sources of domestic demand for soybean oil and corn that could help offset any disruption to exports. The U.S. Energy Information Administration estimates another 100,000 barrels per day of renewable diesel production will come online in 2023, and the total U.S. production capacity will more than double by 2025. Soybean, canola, and corn oil will be high-energy feedstocks for renewable diesel and sustainable jet fuel. Taken together, the increases in grain demand could be an important offset to the increasing supply, and growers and lenders should continue to follow both threads carefully into 2024 to monitor profitability levels.