Grains and Oilseeds Extend Profits Into 2023

From crop years 2014 to 2019, grain and oilseed crop profitability had been in a bit of a grind. Global production of corn, soybeans, and wheat increased rapidly during that period due to a combination of near-perfect weather conditions and expanding production in North America, South America, and parts of Europe and Asia. Global supplies of grains and oilseeds increased as a result, with ending stocks of the major crop commodities peaking between 2016 and 2018. Then demand destruction from cheap oil and the extended outbreak of African Swine Fever in China took a toll on commodity prices, and U.S. producers faced a difficult profitability picture.

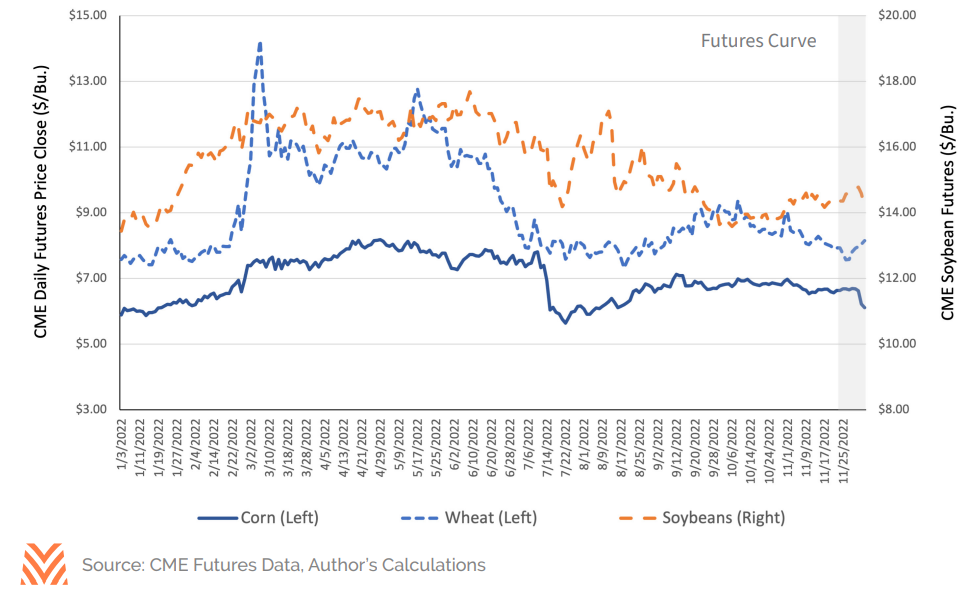

Yet the last three years have at long last seen a remarkable turnaround for U.S. grain producers. Things began to change in 2020, as the world economy responded to COVID-19 and, despite supply chain challenges, food consumption increased. Strong demand for animal proteins increased grain usage for feed, particularly in Asia, where hog populations began to rebuild. The good run continued into 2021 with a strong global economic recovery and steady grain and oilseed production. Corn, soybean, and wheat prices pushed higher throughout 2021 and into 2022. When Russia invaded Ukraine, traders feared a global supply disruption, bidding up wheat and corn prices dramatically. Importers of grains sought to secure supplies, causing a squeeze on stocks between March and June of 2022. Futures prices presented in the figure below highlight the extreme commodity price volatility in the market during the first half of 2022. Markets settled in 2022Q3 due to better-than-expected weather conditions and a tentative agreement between Russia and Ukraine to allow grain shipments to resume. Still, commodity prices remained much higher than in recent experience throughout the year.

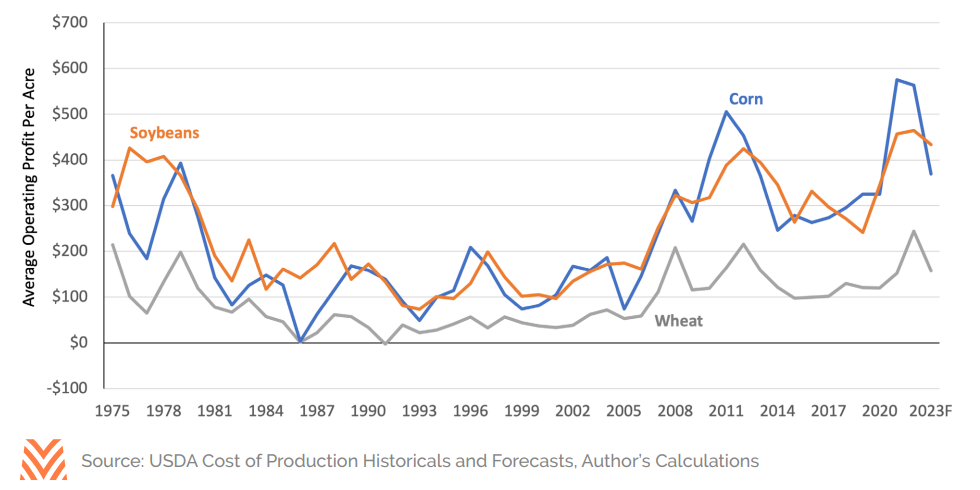

Elevated commodity prices raised farmers’ revenues considerably in 2021 and 2022. While crop yields failed to set records, the higher average price throughout the year allowed farmers to market unsold crops at significantly higher prices. Profits were especially strong in 2021 when the crop was planted with still-low input prices. The run-up in fertilizer prices in late 2021 caused a large increase in the cost of production for most. However, because commodity prices were so high, profit-per-acre remained near historical highs in 2022. The figure below shows the average operating profit per acre (total revenues less variable cash expenses) for each major crop commodity adjusted for inflation back to 1975. The three major cycles shine through this time series, with a spike in profitability in the 1970s, the 2010s, and now in the 2020s. Most notable is the extremely high level of operating profits driven by the 2021 crop, a new nominal and inflation-adjusted level going back 50 years. If realized, the 2022 level would be a new high for wheat producers and a near-high for both corn and soybean producers, behind only 2021.

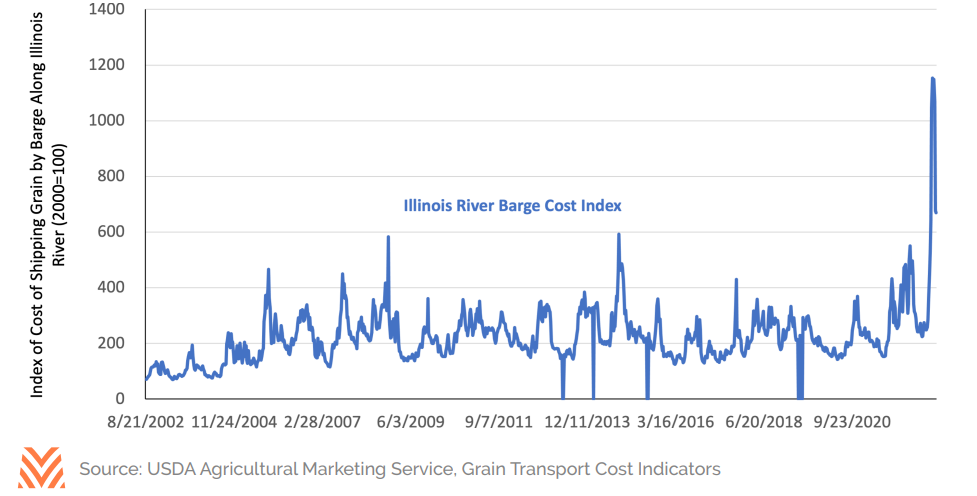

The biggest expected delta heading into 2023 is the cost of production. The USDA forecasts that the cost of growing an acre of corn, soybeans, and wheat will increase 32%, 22%, and 34% between 2021 and 2022, respectively. The cost of fertilizer was the biggest driver of the expected increase, up 65% in 2022. Interest costs are another source of the forecasted increase, although rates have only been elevated for the second half of the growing season. The full impact of higher interest rates is likely to take effect in the 2023 season. Looking ahead, profitability is expected to compress in 2023 on higher production costs and lower commodity prices. However, even compressed profitability levels represent a top-10 historical per-acre operating profit level for corn, soybeans, and wheat growers. Expense areas to watch will be shipping, seed, labor, and interest costs, as those categories have yet to see significant increases compared to 2021 levels. Flash drought conditions along the Mississippi have caused a backup of barge traffic and a runup in the cost of shipping (see the figure below), but prices started to ease in November 2022 and will likely moderate as precipitation recharges the river in the spring. Commodity prices should see support into 2023 if dry conditions persist in most major growing regions and if there is no sudden shock to global demand. There is limited potential for upside if there is any additional disruption to global supplies. Weather will be the biggest source of uncertainty in 2023 as persistent dryness in parts of the Midwest could stress production for many growers. Producer profits could start to experience greater friction in 2024 if supplies rebuild and production costs continue to build momentum.