Farmland Value Gains in Context

Every August, a team of economists at the USDA’s National Agricultural Statistics Service releases an annual look at state- level and national average farm real estate values. The analysis is based on a nationwide survey of land operators called the June Area Survey, in which more than 9,000 segments of land are statistically sampled, and the results are carefully tabulated to estimate the average value of different types of farmland across each state. The August 2022 Land Values report showed a 12.4% increase in land values from June 2021 to June 2022, with an average value per acre of $3,800. The annual increase was led by advances in Corn Belt states like Kansas (25.2%), Iowa (21.4%), and Nebraska (21%), but also in Western states like Idaho (10.4%), California (10.1%), and Colorado (9.9%).

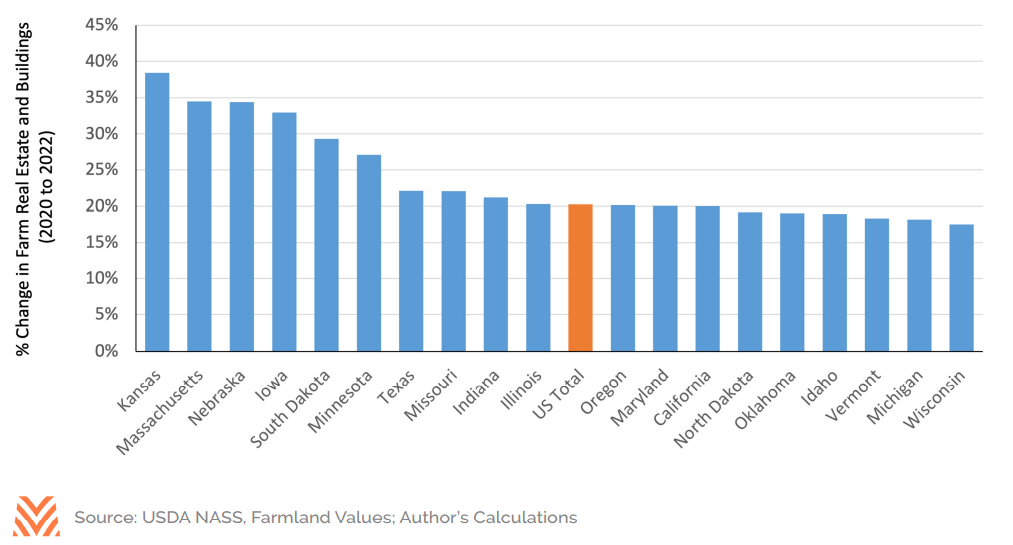

Double-digit gains in many states matched economists’ expectations due to an extended period of low interest rates and higher profits. As discussed in other articles in this issue of The Feed, 2021 and 2022 represented some of the highest nominal and real farm incomes in history. It is understandable, then, that the average value of farm real estate has increased by nearly 40% in Kansas since 2020 (see the figure below). The U.S. average real estate value is up 20% since 2020, and 13 other states have seen 20% or higher two- year gains in values. The strengthening value of farm real estate boosted farm balance sheets and improved lending collateral positions during 2022, but it also raised the cost of buying farm ground and the opportunity cost of owning the asset class.

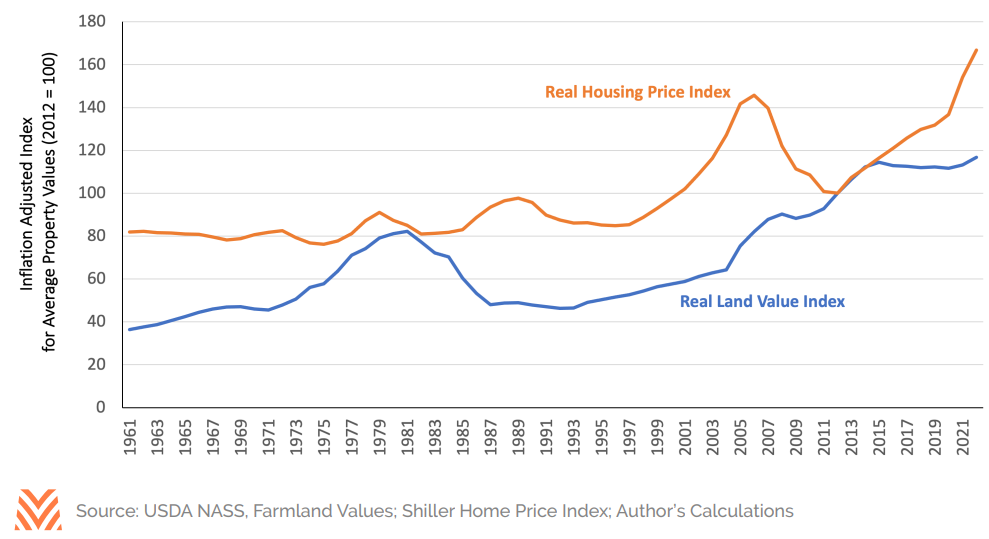

While individual land sales make headlines, and while these two-year growth percentages are a welcome trend for hundreds of thousands of landowners, inflation-adjusted returns to farmland are significantly more modest. If the price of everything increased at a rate of nearly 8% in 2022 (as indicated by most measures of year-over-year inflation), landowners should expect their holdings to increase at least 8%, and they should likely expect a return above inflation to make their investment worthwhile. If land values increase by 12% in 2022, the real return to farmland is then approximately 4%, or the total return less the percent increase in prices. Between June 2021 and June 2022, housing prices averaged an increase of 18% (or roughly 10%, adjusted for inflation). The figure below plots an index of farmland values compared to an index of housing values (both adjusted for inflation, anchoring values at 2012 levels). Since 2012, U.S. house prices have increased more than 60% after adjusting for inflation; farmland values have increased a modest 17% during that same period. While the double-digit gains in farmland values grab lots of attention, real returns to farmland are much less volatile compared to other asset classes like housing, stocks, and bonds.

The distinction between real and total returns is an important one. Simple math shows that the increase in farmland values in 2022 was the ninth largest gain in the last 62 years of available data. However, when adjusted for inflation, 2022 was only the 24th largest gain. It is hard to call recent increases in land values an asset bubble when values have increased more than they have this year 23 different times. Conversely, nominal (i.e., not adjusted for inflation) gains in housing prices ranked first and second in 2021 and 2022, respectively. Adjusted for inflation, 2021 and 2022 ranked first and fourth, respectively. It may be tempting to correlate the volatility in housing prices with land values, but farm real estate markets have been slower to increase in value and are therefore less likely to exhibit volatility in the higher interest rate environment compared to residential housing.