Farm Real Estate Values

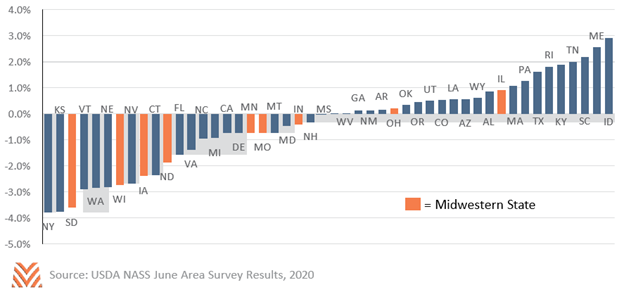

National farm real estate values held firm in 2020, though values varied by state. According to USDA data from the 2020 NASS June Area Survey, the average acre of farm real estate is worth $3,160, unchanged from the 2019 survey. Twenty-three states experienced an inflation-adjusted decline in values during the year, while 22 states experienced increased values. Many of the states experiencing a decrease in the value of farmland are in the Midwest, largely caused by the continued pressure on grain sector profitability (see the figure below). The biggest declines come from Northern Plains states such as South Dakota and North Dakota and Lake States like Wisconsin and Minnesota. The declines are a function of both tighter cropland economics as well as weaker pasture demand. Mountain States like Idaho and Colorado exhibited the most strength, followed by Southern Plains states Texas and Oklahoma. These increases are a result of increased demand for farm and rural properties with 10-year returns catching up to neighboring states.

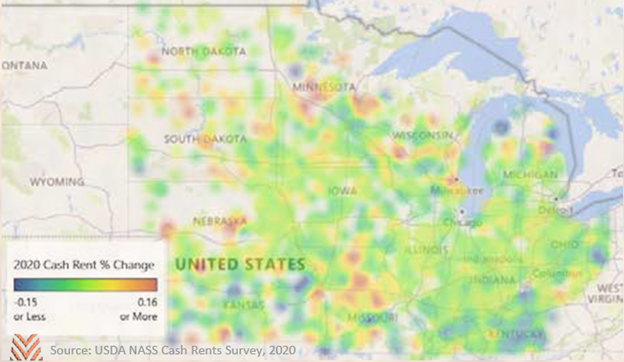

One driver of farm real estate values is the cash flow generated through rental rates. In addition to land value, the USDA surveys landowners and operators about the level of cash rental rates paid for irrigated and non-irrigated farmland. The figure below is a Midwestern heatmap of average rental rate percentage changes from 2019 to 2020. Red indicates warming, or increases, in rental rates, while blue indicates cooling, or decreases, in rental rates. Much of the map is green, indicating no change in rates from 2019. However, there are hot spots in Minnesota and northern Missouri, where rates increased more than 15% annually. There are also cool spots, particularly in the southern parts of Kansas, Missouri, and Kentucky, where rental rates declined significantly from the prior year. Rental rates generally trend with the profitability of the underlying land, but they tend to rise faster than they fall. Like a dividend, the level of rental income influences the value of the underlying asset.

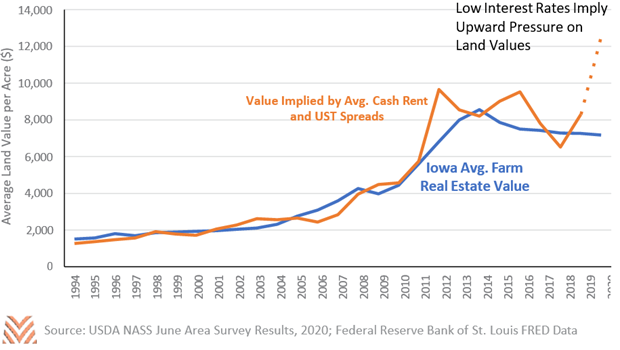

In addition to rental rates, interest rates are another major factor in the level of asset values. The rate paid by the U.S. Treasury on 10-year bonds has traditionally been a good benchmark for long-term assets like farmland. It represents the risk-free rate an investor can choose to get a stable return for an extended period. Farmland owners should expect a higher return (e.g., rental rate) as the asset is not risk-free. Since 1994, the implied required return for farmland owners in Iowa is approximately 3.5% above 10-year U.S. Treasury rates. Using a simple dividend discount model with this required return and the average cash rental growth rate of 3.3% per year, the figure below shows how closely the actual reported average land value per acre in Iowa tracks the implied level of asset values. If cash rents hold firm into 2021, the low-interest-rate environment is likely to put significant upward pressure on land values, particularly in the Midwest, where the land is most similar, and the relationship between cash rents and values are the strongest. Federal Reserve Chair Jerome Powell indicated several times in September that Federal Reserve policy will aim to keep rates low through 2022, and the market-based expectations show 10-year U.S. Treasury rates below 1.0% through September 2022.

While there are many other factors that influence local land value markets, most current economic factors are also supportive of values. The supply of high-quality land remains limited. According to data from Farmers National, Midwestern farm auction activity slowed in the second and third quarters of 2020, likely a result of COVID-related constraints. Demand for metro-adjacent properties is also likely to continue to be supportive of land markets as some migration out of urban areas is expected to continue post-COVID. Water access is likely to be the most significant headwind to value accretion in the near term, particularly in Western states like California, where drought conditions and regulatory requirements decrease the economic viability of some farm acres.